Crypto analyst Nicholas Merten gave serious warnings about the largest altcoin project in the market. He said it could lose more than 70% of its value from its current price.

Nicholas Merten expects crash in DeFi altcoin market

In his latest Youtube post, the crypto analyst laid out a scenario where Ethereum will depreciate 75% from its current price. Merten says that Ethereum, which is currently trying to hold on to the $ 1,200 region, will shrink to triple-digit prices. In his new “Imminent Ethereum Crash” headline new video, he details the reasons for his expectations:

Our target range for Ethereum is between $300 and $500. I don’t think it’s going to live there for long, but it has to do with the fact that there’s a huge bombshell in DeFi with over $1.5 billion in cumulative liquidations that could potentially happen.

Merten details his analysis with a chart showing the purge levels of Ethereum-based DeFi protocols. According to his predictions, these protocols will trigger a massive sell-off if Ethereum continues to drop. In his own words:

If we start moving towards around $750 to $550, you will start to see the cascading effect of sell-side pressure in the Ethereum market… If you want to look at it from an ETH perspective, here is a million plus ETH, pulling us down and additional sell-side pressure is 750 and 550 for the price of ETH. It risks causing a rapid decline from $300 to $300.

Retail investors are skeptical about the future of Ethereum

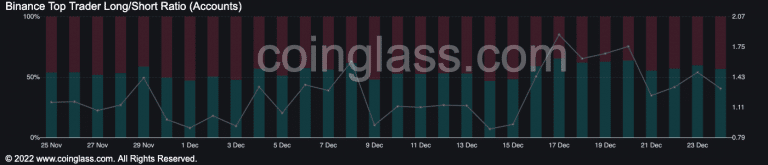

While whales are showing interest in Ethereum, individual investors’ interest in Ethereum is waning. Also, the percentage of long positions held by top traders has dropped from 65.25% to 56.67% over the past few days, according to data from Coinglass.

One of the reasons for this could be declining activity on the Ethereum network. According to data provided by Santiment, daily active addresses on the Ethereum network have dropped from 1.42 million to 408.8k over the past two weeks. In addition, Ethereum’s speed has also dropped significantly in the last month. In his scenario, supported by all this data, Merten says that we could see moves similar to the 2028 bear market when the ETH price drops to $300:

If we repeat history, just repeat history without taking into account the macro environment, which would get us down to $300.

Meanwhile, concerns about the centralization of the Ethereum network are back on the agenda with new tweets from Willy Woo. As we quoted as Kriptokoin.com, Woo says that the Ethereum network is under US control.

Ethereum is currently trading around $1,220. Its price was fixed in the last 24 hours. It stays green around 2.6% compared to last week. Meanwhile, the price of Bitcoin was also spending time under $ 17,000.