Famous crypto analyst Benjamin Cowen aroused curiosity about the near future prospects of Ethereum (ETH) based on his analysis of historical data. According to Cowen, Ethereum’s average monthly return on investment (ROI) suggests that the summer months, especially the third quarter (Q3), may not be the best time for investors to accumulate or hold ETH. Instead, he points to the end of Q4 or the beginning of Q1 as more historically appropriate periods. Here are the details…

Cowen’s Ethereum analysis drew attention

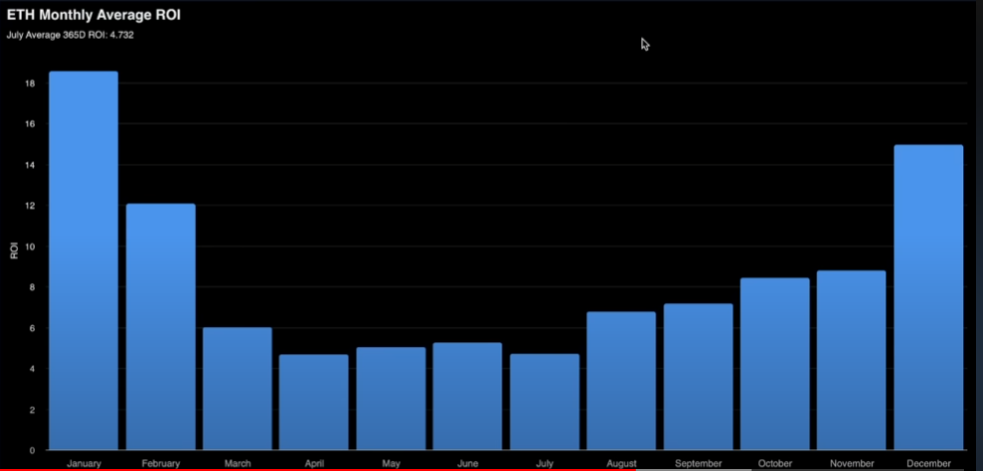

As Cryptokoin.com also reported, there are new analyzes about the leading altcoin, ETH. In a recent video update, Cowen examines Ethereum’s historical performance, highlighting the seasonality associated with the cryptocurrency. Their findings show that investors who bought ETH in the months of December and January have historically achieved optimal returns. “When you look at a one-year time frame, December and January have historically been the best periods,” Cowen explains. Noting that the worst performing month was July, Cowen states that the current price of ETH is not significantly different from July of the previous year. This is in line with the notion that there was a stagnation in ROI in the April-July period and ROI tends to increase as the market enters Q4.

Extending his analysis to two-year ROI, Cowen observes the same pattern where June and July are the least favorable months, while January and December continue to stand out as the best periods to accumulate Ethereum. Despite Ethereum’s current importance in the cryptocurrency market, Cowen warns that historical data points to a clear seasonality associated with its performance. Investors who want to maximize their ETH returns should carefully consider the timing of their investments, focusing on the end of the year and the start of the next year.

Leading altcoin moves cautiously

At the time of this writing, Ethereum is trading at $1,833 and is showing a stable but cautious trend. Investors are advised to consider the historical patterns revealed by Cowen’s analysis when making their decisions. While Cowen’s views provide valuable historical context, it’s important to remember that the cryptocurrency market is inherently volatile and influenced by a multitude of factors. Market sentiment, regulatory changes, technological advances, and macroeconomic trends can all play an important role in shaping the future performance of cryptocurrencies. As the crypto space continues to evolve, analysts and investors must remain vigilant and open to adapting their strategies to real-time developments. While historical data can provide valuable guidance, it should not be the sole determinant of investment decisions.

Prudent investors are advised to do extensive research and consult with financial experts before making any major moves in the volatile world of cryptocurrencies. As a result, Ethereum’s journey to prominence has been marked by a clear seasonality in ROI, as analyzed by Benjamin Cowen. Historical data shows that investors who accumulate ETH at the end of the year and early January have historically had better returns. However, the cryptocurrency market remains unpredictable and investors should exercise caution and prudence when navigating this dynamic environment.