It seems that the recent crypto crises are not affecting the market as negatively as before, is this an indication that the crypto investor is getting used to the fear?

When we consider the past times of the crypto ecosystem, we see that the news effects are very different compared to today. The fact that the market was so dependent on the news in the previous period also greatly affected the price of Bitcoin (BTC). When we compare this situation with today’s market, the differences are striking. In the last week, Binance’s systemic problems and the lawsuit against Binance CEO CZ have been on the agenda. Surprised that the leader of crypto exchanges has suffered such a loss, the market has priced this situation to a minimum.

The effects of past crises were fully reflected in many crypto data. Negative effects continue to be observed today. However, there is a market independence compared to previous processes. Especially after the Binance-sided crises, the recent peak value of BTC was an indication of this.

Effects of Past Crises on the Market

Many crises have been observed in the history of cryptocurrencies. Each crisis has left different marks on the industry, the market and the crypto investor. Investor psychology, which is one of the cornerstones of the crypto industry, has taken the leading role in all crises. There were many cases such as BTC and sector-side negative discourses of authorized names, sanctions by regulators, banning crypto mining, closing crypto exchanges. Each crisis had a different effect in itself. One of the most important common points of the crises experienced was the “collapse of BTC price”. In particular, the collapse of FTX, one of the most powerful cryptocurrency exchanges of the time, had one of the biggest declines in crypto history.

FTX’s Bankruptcy Announcement

One of the biggest news-based BTC price changes occurred after the FTX exchange announced its bankruptcy. The market went into a bearish trend when problems broke out in FTX. Increasingly popular for that time, signing sponsorship deals and gaining a large community base, FTX had created a billion-dollar pool of finance. Many factors such as increasing liquidity problems and systemic problems in FTX frightened crypto investors.

Not long after the events, the bankruptcy declaration from FTX plunged the crypto market into collapse. The 28 percent depreciation experienced with the BTC price coming from $ 21,470 to $ 15,560 was one of the biggest drops in crypto history.

The Fear Level of FTX Bankruptcy

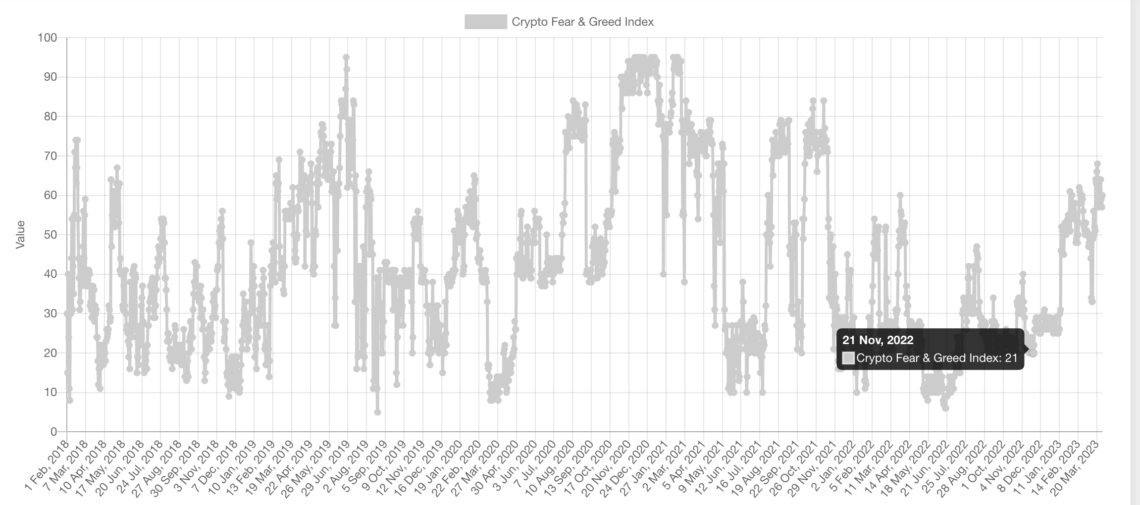

Investor psychology, one of the main criteria of financial markets, played a major role after these crises. Let’s examine the “Fear and Greed Index” applicable to the crypto market. Fear and Greed Index; An indicator that analyzes a number of different trends and market indicators to determine whether investors are feeling greedy or scared, reporting results as 0 points of extreme fear and 100 points of extreme greed.

With the effect of the FTX crisis, the “Fear and Green Index” level reached 21. This event, which seriously frightened the market, caused crypto investors to stay away from the market for a while.

SEC Suing Kraken

Another major drop in crypto history was when the Securities and Exchange Commission (SEC) sued cryptocurrency exchange Kraken for offering unregistered securities. The SEC had informed that Kraken should shut down its services and pay a fine to the authority on charges of offering unregistered securities.

With the chain of chaos, the great decline on the BTC side started. Falling from $ 23,400 to $ 21,230, BTC fell by 9.27 percent in a very short time. This drop, driven by the SEC-Kraken tension, has ranked as one of the biggest in crypto history.

The Fear Level of the SEC-Kraken War

The crypto market, which has been on the rise for a while, started to decline with the SEC’s move to Kraken. The fall of the Fear and Greed Index from the 65’s to the 48’s was clearly showing the panic and fear atmosphere in the investors.

Terra’s (LUNA) Collapse: BTC Drops 56 Percent!

LUNA, once one of the top emerging ecosystems, collapsed after its stablecoin, UST, became depeg. Showing how important the stablecoin issue is to the industry, LUNA has hit not only crypto but different financial markets as well. The LUNA crisis deeply shook BTC and altcoins, creating serious fear in the crypto ecosystem.

With the loss of stability of the UST, the panic atmosphere in the ecosystem, the indifferent attitudes of the LUNA officials, the crypto market started to collapse. Falling from approximately $ 40,000 to $ 17,550, BTC fell by 56.13 percent and was included in the dusty pages of crypto history. The LUNA crisis has deeply injured not just community-based issues, but stablecoins and various ecosystems.

Effects of Current Crises on the Market

BTC started a major uptrend after testing the $15,600 level. Fud news during this uptrend did not shake up the crypto market as much as in previous periods. The fact that voracious buyers have been pushing the BTC price up in recent weeks, ignoring the Fud news, is a sign of a change in the market structure.

If we look at the recent crises, Binance’s technical problems and CZ being sued by the CTFC come up. BTC’s drop of only 5.18 percent over the two-day period is one of the clearest evidence that crypto investors are “used to fear.”

In line with the striking developments on the side of Binance, BTC, which experienced a decrease of 5.18 percent, rose very quickly and achieved an increase of 9.55 percent. In the past, the effects of the Fud news continued, causing deeper declines. Looking at today, these declines were short-lived, followed by big rises.

Binance biased negative news led to a slight drop in the “Fear and Greed Index”. If we evaluate this data in the general table, it only dropped to 64 levels in the two-day crisis range and then moved upwards, showing that crypto investors are now used to some situations and these situations do not affect crypto trading as much as before.