Bitcoin and the crypto market may head towards another sideways trend move until the coming weeks. The next Fed meeting will frame how the crypto market will move in 2023. Here are the dates and details…

Next Fed meeting will set the stage for the cryptocurrency market

Singapore-based Asia’s leading trading firm, QCP Capital, has released a new market analysis on the current macroeconomic environment. Firm analysts are of the opinion that the next FOMC meeting of the US Federal Reserve will be held on March 22, and this is the most decisive development of the whole year.

As QCP Capital analysts explained, this week has been quiet in terms of key macro data releases. The next key economic data point will be the ADP National Employment report, a monthly report of economic data reflecting the state of US non-farm private employment.

But more importantly, what the Fed has been missing in recent speeches. Fed officials have repeatedly talked about a prolonged rate hike, with some even commenting on the difficulty of achieving a soft landing.

So, according to the QCP, the March 22 meeting will be the trendsetter for the full year as market participants will see where the Fed places the final interest rate in 2023 and whether the Fed plans to cut rates in 2024.

March 22 will shed light on Fed’s 2024 rate plans

QCP Capital thinks that the FOMC meeting on March 22 will give clues about how the Fed will implement monetary policy in 2024. According to the statements in the report:

We believe this month’s FOMC (March 22) will lay the groundwork for the rest of the year as market participants can see where the Fed sees the final interest rate in 2023 and whether the Fed will cut rates in 2024.

4/ We believe this month's FOMC (22 Mar) will set the stage for the rest of the year as market participants will be able to see where the Fed sees the terminal rate in 2023, and if the Fed sees cuts in 2024.

— QCP (@QCPgroup) March 3, 2023

Officially called the Policy Path Chart, this tool is published by the Fed four times a year, in March, June, September, and December, following the 16-member FOMC meetings. It will show to what level and how far the Fed’s “higher for longer” strategy can take.

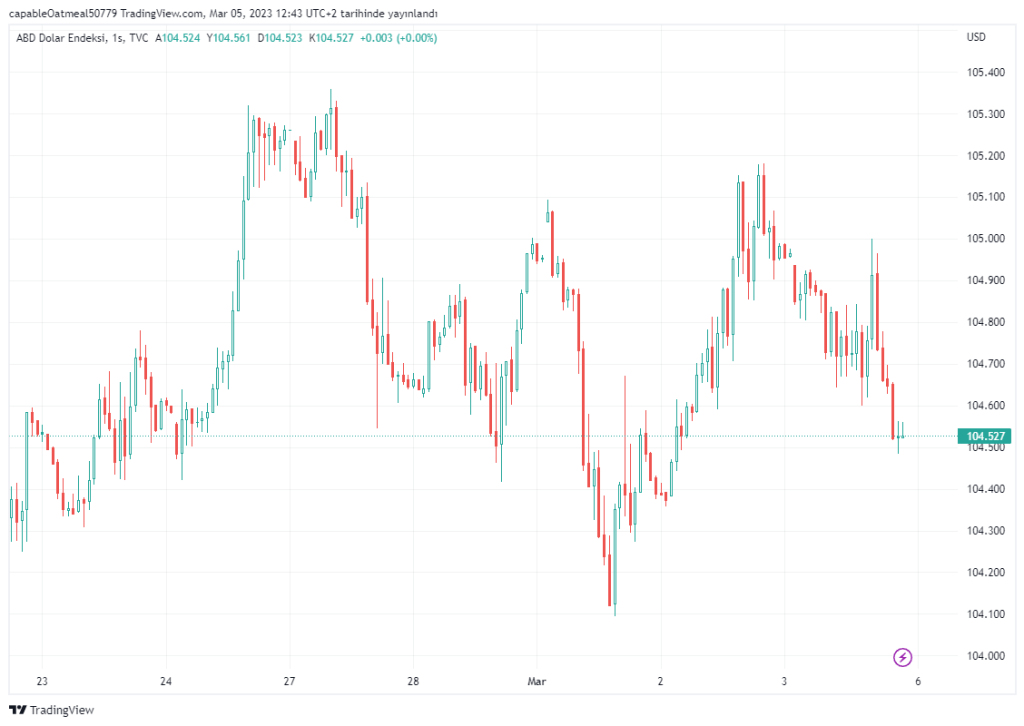

DXY will be the main indicator of the cryptocurrency market

According to analysts, the dollar index (DXY) will continue to dominate the Bitcoin and crypto market. The dollar’s weakness earlier this week was driven by China’s manufacturing purchasing managers index, which reached 52.6 points. “With this, the narrative of China reopening has been reawakened,” causing Bitcoin prices to soar.

However, in the long run, QCP expects DXY to rise, which should put pressure on the prices of risky assets like Bitcoin due to the inverse correlation. According to Trade firm, there are three reasons for this:

First, yield curves get higher as markets are consistently priced at a higher terminal for longer. Second, global liquidity is shrinking again as the PBoC and BOJ reduce liquidity injections and will continue to decline as central banks continue to fight inflation.

The third reason is that the price-to-earnings (P/E) ratio of the S&P 500 is slowly rising despite increasing real returns. “If these two measures continue to diverge, it’s a serious correction,” QCP Capital says.

Meeting can bring volatility

Therefore, DXY and S&P 500 will probably be the biggest arguments for the return of the bear market alongside the crypto-intrinsic risks with Silvergate bank. In terms of its volatility curve, QCP observes that it is much more flat than previous sales at the moment, indicating that the market expects a flat trading environment in the medium term. According to analysts:

At these volume levels, we are positioning the long vega in anticipation of some volatility as we head towards the FOMC at the end of the month.

According to cryptokoin.com data, BTC is trading at $ 22,400 at the time of writing. The failure of Silvergate bank to submit an annual report to the SEC in March, negatively affected the market, as was the case with BTC.