Cryptocurrency markets have been hit over the past month, both in terms of price and events in the ecosystem. For example, the collapse in the Terra ecosystem has deeply affected the overall market. Now, a liquidity crisis has emerged in Celsius, an altcoin project. Here are the details…

Altcoin project Celsius may have a liquidity crisis

Cryptocurrency lending and lending platform Celsius is dealing with a liquidity crisis when it bought $247 million worth of Wrapped Bitcoin from Aave and sent it to the FTX exchange it could be. Celsius Networks recently said it is pausing all withdrawals on the platform. He said it was in the interest of the community. Celsius users have criticized the platform for believing that the project mismanaged its funds following the collapse of the Anchor Protocol on the now-named Terra Classic Blockchain. The project may be addressing these concerns with recent moves to stabilize liquidity.

Some think that if Celsius fails, it will sell a significant amount of staked ETH (stETH), causing it to move further away from ETH. As we have also reported on Kriptokoin.com, stETH is a token provided by the Lido DeFi lending platform that is given as proof that a user has staked ETH. The unusual token movements occurred when Celsius began removing WBTC from the Aave staking and lending platform it uses to earn interest on its deposits.

9,500 WBTC used

So far, 9,500 WBTC tokens worth approximately $247 million from Aave have been used. After a series of transactions, all these tokens were sent to the FTX exchange for an unknown reason. In addition to WBTC, it appears that 54,749 ETH worth about $74.5 million was sent to FTX.

This kind of activity is for the transparency of Celsius until we explain the movements While very weak, the firm may be trying to keep its liquidity stable by replacing most of the floating funds it draws from Aave, such as WBTC and ETH, with stablecoins. Since June 12, Celsius has staked 204 million USDC stablecoin on Aave. It has also invested 10 million USDC and approximately 8.2 million DAI stablecoins in Compound, another DeFi staking and lending platform.

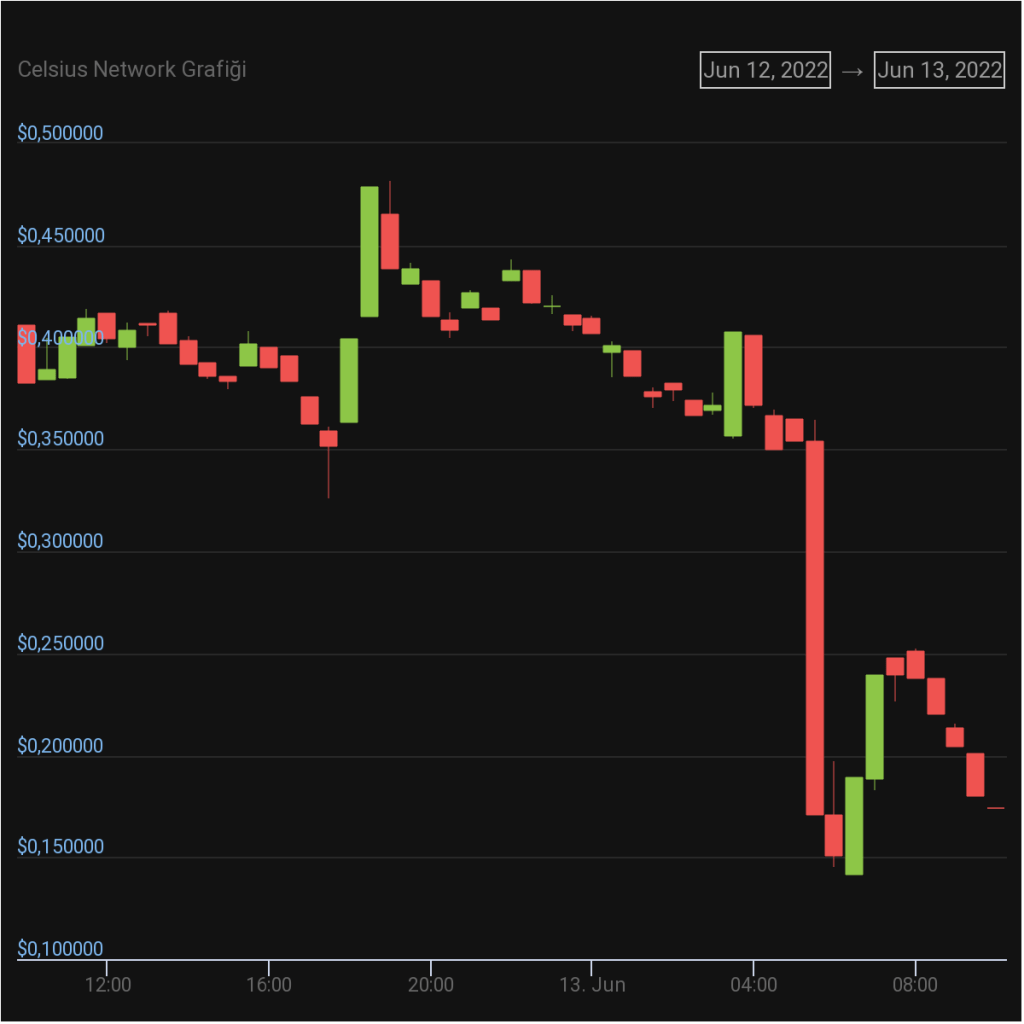

CEL price drops

A total of 222 million stablecoins re-stake by Celsius is almost equal to the value of the WBTC tokens it removed, but still does not come close to matching the combined value of WBTC and ETH. The plans of the Celsius team regarding the ported cryptos are still unclear. There is a real possibility that he could sell the assets he sent to FTX. However, another possible option is that they intend to stake the tokens they send to the exchange to generate returns.

Celsius Network’s CEL token has dropped by nearly 57 percent due to these developments. While the coin was trading at $ 0.48 during the day, it fell to $ 0.14. Currently, it changes hands at $0.17.