We can say that this week will be calmer after the heavy data flow from the USA last week. While the US CPI data, one of the most important indicators used by the US Federal Reserve (Fed) to monitor inflation, came in line with expectations, the International Monetary Fund (IMF) lowered its global growth forecast.

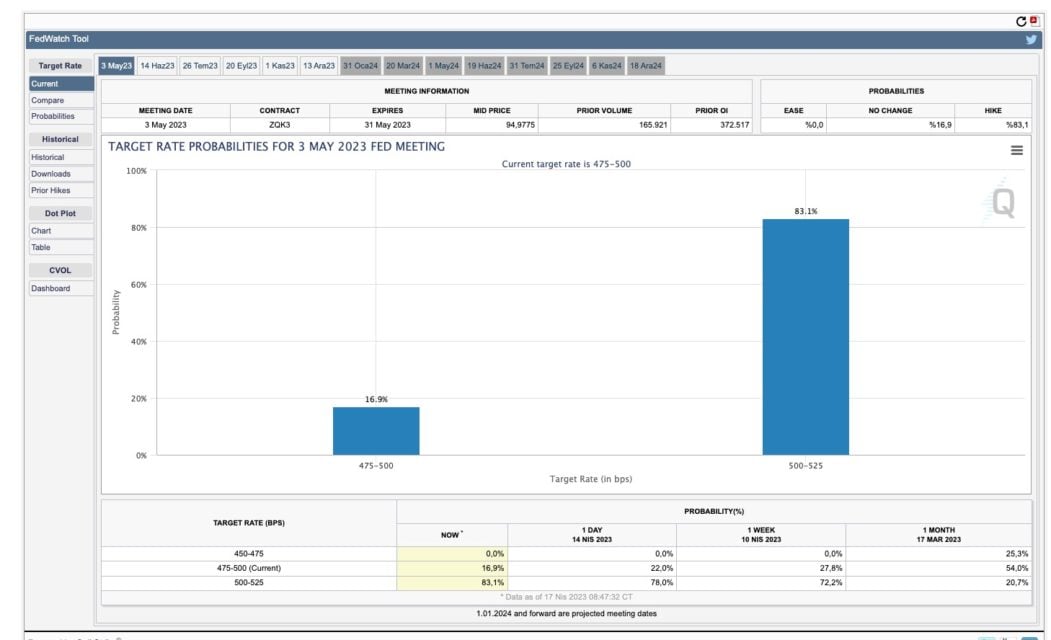

In the minutes of the March meeting of the US Federal Reserve, we saw that after the banking crisis, the risk of recession increased in 2023. According to CME data, the probability of a 25 basis point hike in the Fed’s meeting in the first week of May is above 83%. This week, the speeches of Fed officials will be followed with the data stream.

March inflation data will be released by the UK on Wednesday. A higher-than-expected inflation data may enable the UK to raise interest rates by another 25 basis points at the next meeting.

Eurozone, US and UK will release PMI (purchasing managers index) data on Friday, and investors will be able to see the positive or negative impact of banking crises on economic growth.

Economic Calendar

Tuesday, April 18, 2023

- China – Gross Domestic Product (GDP) (YoY) Expectation: 4.0% Previous: 2.9% – 05.00

Wednesday, April 19, 2023

- UK – Consumer Price Index (CPI) (Annual) Expectation: 9.8% Previous: 10.4% – 09.00

- Euro Zone – Consumer Price Index (CPI) (Annual) Expectation: 6.9% Previous: 6.9% – 12.00

- USA – Beige Book – 21.00

Thursday, April 20, 2023

- USA – Applications for Unemployment Benefit Expectation: 240k Previous: 239k – 15.30

Friday, April 21, 2023

- UK – Composite Purchasing Managers Index (PMI) Expected: 52.6 Previous: 52.2 – 11.30

Bitcoin Technical Analysis

Last week, there was a week where the risk appetite increased in the crypto money markets. On the daily chart, Bitcoin hit the $31,000 level. Currently, Bitcoin remains in the supply. Although the $32,000 levels are a strong resistance zone, the price will want to go up unless it breaks the $27,200 level I indicated with the key zone. We will follow daily candle closes at $32,000 for a fresh uptrend.

Global In / Out Of The Money

GIOM aggregates the locations of all addresses into clusters based on the number (or volume) of addresses previously purchased in a given price range. The larger these clusters, the more support/resistance to be expected around these price levels.

Large currency clusters, on the other hand, represent key price ranges (cost to acquire) on the chain where large volumes of addresses (or volumes) were bought previously and would now profit if they were sold today (because the price is higher than theirs).

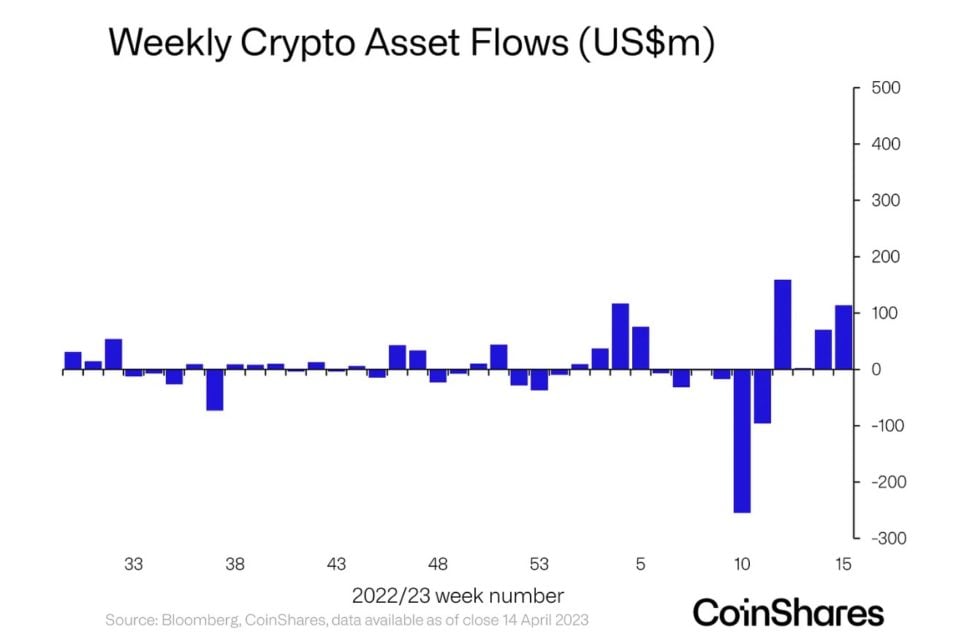

According to the weekly report by CoinShares, crypto assets saw a total of $114 million inflows last week, with a total of $345 million in four weeks of inflows. This shows that cryptocurrencies may have regained the interest of investors.

Last Week’s Top Rising Cryptocurrencies

- Injective (INJ) 72.1%

- Radix (XRD) 59.6%

- WOO Network (WOO) 57.2%

- Baby Doge Coin (BABYDOGE) 52.1%

- Arbitrum (ARB) 46.3%

Last Week’s Featured Crypto News

SEC Contacts Justin Sun for Information About Tronix

The SEC issued a summons to Sun, Mahone, and Soulja Boy, asking them to respond within 21 days. It was announced that if there was no response, a decision would be made against them by default “for the compensation claimed in the complaint”.

Bitrue Hacked for $23 Million

Bitrue administrators pledged to fully compensate the funds of all identified users affected by the hack. The exchange underlined that there was a loss of $ 23 million after the hot wallet attack by hackers. Announcing the attack on April 14, Bitrue said it had to temporarily suspend all withdrawals due to short-term abuse of its hot wallet.

Twitter Partners With eToro

Twitter will allow its users to access stocks, cryptocurrencies and other financial assets through its partnership with eToro.

Available from Thursday, this new feature will allow users to view market charts, trade stocks and other assets from eToro, and view market data on more financial instruments.

Argentine Regulator Approves Bitcoin Futures

Argentina’s securities regulator has approved a Bitcoin-based futures index to be launched on the Matba Rofex exchange.

The Bitcoin futures contract is expected to start trading in May. The Bitcoin futures contract will be based on the BTC price provided by various organizations in the country offering BTC/ARS trading pairs. All transactions will take place in the national fiat currency, and investors will have to deposit Argentine pesos via bank transfer, according to the statements.

US House Committee Releases Draft Stablecoin Act

The US House Committee has released a preliminary version of the Stablecoin Bill. This bill includes a moratorium on stable currencies backed by other cryptocurrencies. Additionally, it contains important regulations regarding stablecoins, including a request to review a central bank digital currency (CBDC).