Research by analysts of cryptocurrency data provider Kaiko has come to interesting conclusions about metaverse coins that could stand out in the coming months.

Kaiko analysts, in 2023 these metaverse coins are also moving

Analysis surrounding gaming platform Axie Infinity (AXS) has detected a surge of more than 100% after the “token unlock” period, which saw 1.8% of the total token supply flow into the market. On the other hand, Sandbox’s native token SAND is on track for 12% token unlock in three weeks. Unlocks are typically downside catalysts for a token’s price, so Kaiko’s research team is focusing on what’s going to happen, with a special focus on investor behavior around the three main unlocks.

https://twitter.com/ConorRyder/status/1618958406953603073

Sandbox (SAND) and Axie Infinity (ASX) analysis

AXS and SAND have gained 50% and 46% respectively against ETH since the beginning of the year. Kaiko analysts prefer to prioritize price movements against ETH rather than the dollar to understand the relative market performance of each token during an overall bullish rally. AXS, in particular, rose 40% in the hours before its release on the 23rd.

This performance runs counter to the trend in 2022, when tokens facing unlocks were underperforming the market. Even more interesting is that AXS and SAND are also victims of this trend during the 2022 unlocks.

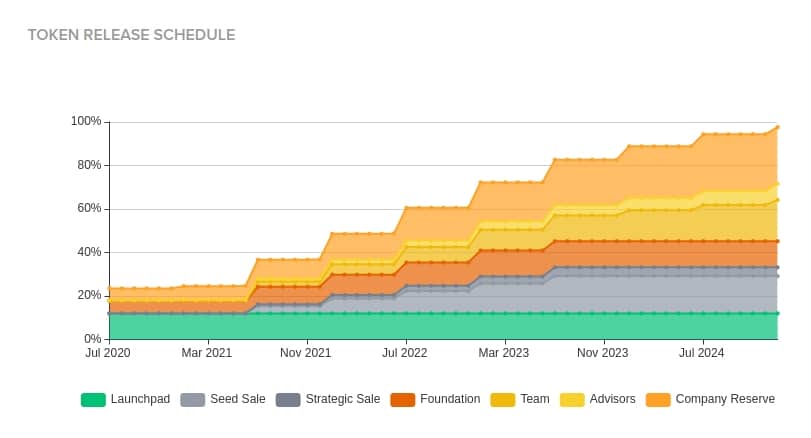

Before forming a reasonable hypothesis about what might happen, the analyst examines factors such as token allocation, investor behavior after unlocking, and market dynamics in the spot markets. Therefore, after the liquidity is released at the time of unlocking, it can be seen how different allocations continue to affect the selling pressure on the token.

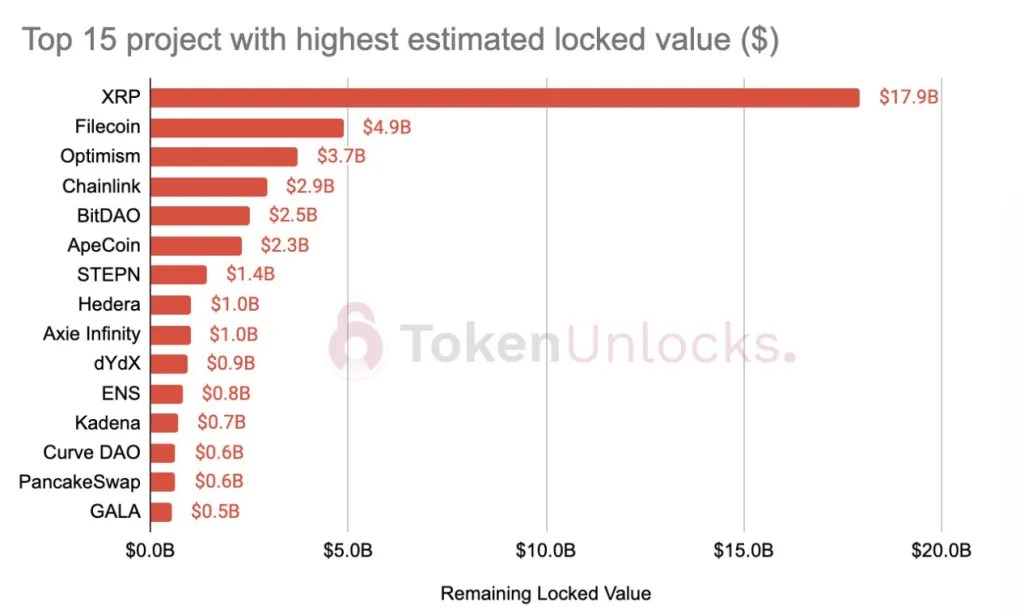

Here are the metaverse coins and dates that will unlock a massive amount of tokens

SAND serves as a management token for the Sandbox DAO as well as acting as a unit of exchange in the Sandbox metaverse. Unfortunately for SAND holders, the token is at the disposal of a major unlocking program with more than 44% of the supply yet to be unlocked.

12% of the supply will be opened on February 14 this year, similar to August last year. The number of tokens to be opened on this date remains the same as last year’s distribution percentage. About 50% of unlocking is allocated to investors and advisors.

In August, we saw that these investors made wholesale sales as soon as they had the opportunity. This event put a lot of selling pressure on SAND, which was performing 20% below ETH that month. Also, the day after it was published on August 14, about 75% of all major transactions were sell orders, where investors were trying to cash out SAND. This selling pressure continued in the days following its launch as sell orders dominated purchases.

How might the SAND price react?

The allocation of SAND unlocks is towards investors and as a result, token performance drops during unlocks. As the token allocation is the same for the February 14 unlock, similar poor performance can be expected as selling pressure builds up.

The same unblocking plan is scheduled every 6 months until 2025 with the same allocation for investors, so it looks like SAND investors will face serious headwinds by then. As Kriptokoin.com, we have included SAND-like projects that will unlock a large amount of tokens this year.