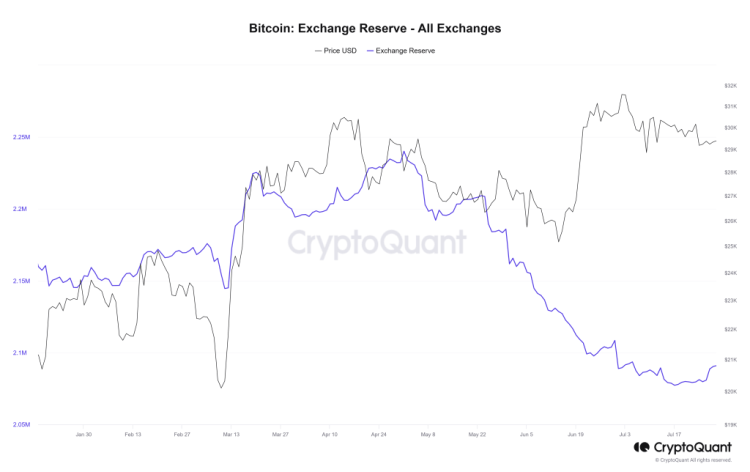

There is new data from CryptoQuant on September 20. Accordingly, it focuses on the amount of Bitcoin (BTC) held on cryptocurrency exchanges such as Coinbase, Binance and Kraken. It also reveals a significant decrease. These reserves are now at their lowest levels in nearly six years.

Bitcoin and market stability amid losses

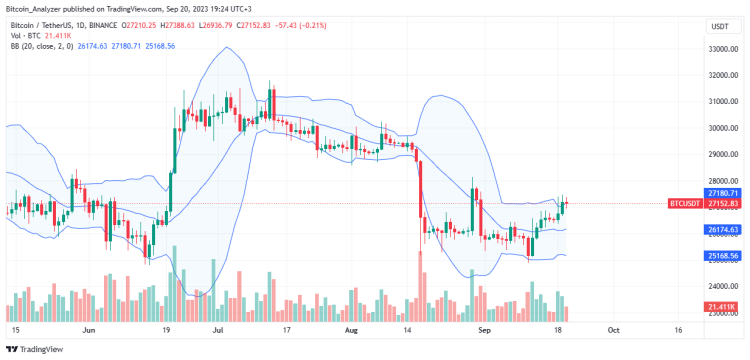

This decline in Bitcoin reserves in exchanges has a meaning. Accordingly, it coincides with a period when the broader cryptocurrency market has stabilized. Bitcoin is in calm waters, having suffered sharp losses throughout most of August and the first half of September. Accordingly, as of September 20, it is still below the $ 30,000 level. But it continues to consolidate.

As of now, cryptocurrency exchanges collectively hold approximately 2.09 million Bitcoins. However, it is important to remember that the total Bitcoin supply is limited to 21 million tokens. Currently, there are major corporate players such as Tesla and MicroStrategy. More than 19.7 million Bitcoins are in circulation, with Bitcoin actively accumulated. Individuals and organizations keep their Bitcoins in non-custodial wallets. Or it can be stored on exchanges such as Binance and Coinbase.

Exchange custodial wallets and market impacts

Exchanges provide custodial wallets where users can store their cryptocurrencies for trading or long-term holding (HODLing). There are repercussions for holding Bitcoin and others on exchanges. It allows users to easily exchange them for other cryptocurrencies or stablecoins such as USDT. While the decrease in coins held on exchanges may seem bullish on the surface, it does not guarantee that prices will recover immediately.

Historically, coin outflows from exchanges generally indicate a strengthening market and the expectation of price growth. However, given the current regulatory environment, traders and Bitcoin holders are increasingly inclined to retain control of their assets amid growing concerns. In contrast, more Bitcoin holders are attracting attention. He also stores his cryptocurrencies in non-custodial wallets as a precautionary measure. This behavior likely explains the dwindling Bitcoin exchange reserves.

SEC and regulatory pressure

The decline in Bitcoin reserves held by exchanges began in 2022. But it accelerated in late 2022. During this period, FTX, a leading crypto exchange, was on the agenda. It faced a crisis that resulted in the freezing of billions of dollars in customers’ funds. Outflows slowed in the first quarter of 2023 following the collapse of some US regional banks. However, this trend continued. Among the major factors contributing to this trend is the ongoing bear market. On the other hand, there is intense regulatory scrutiny, especially by the United States Securities and Exchange Commission (SEC), targeting exchanges such as Binance and Coinbase for alleged non-compliance.

In June, the SEC filed lawsuits against Bitcoin exchanges Binance and Coinbase for alleged unregistered securities issuance, with examples including Cardano (ADA). As a result of this regulatory pressure, Binance US has experienced significant disruptions, including staff departures, layoffs, and a significant decline in trading volume of over 95%. As Kriptokoin.com, the evolving regulatory environment continues to shape the dynamics of the cryptocurrency market, especially regarding the storage and trading of digital assets.