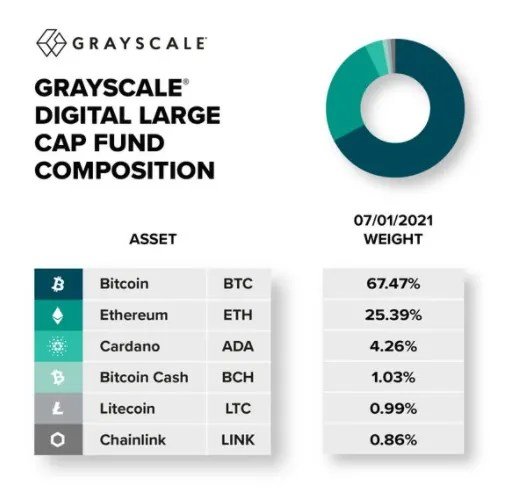

Grayscale, the world’s largest crypto asset manager, is raising the weight of an altcoin project on its backdrop, which includes smart contracts like Solana and Ethereum. This is an important trump card to attract the attention of institutional investors in the future.

Smart money is preparing to buy this altcoin project

Grayscale launched new Cardano (ADA) products last year due to strong demand from investors. Interestingly, it made Cardano its third largest product. Earlier this year, Grayscale launched its smart contracts fund, with ADA taking the largest share. Cardano has successfully maintained its position of holding the largest weight in the Grayscale smart contracts fund to date.

ADA’s weight in the fund has increased by 4% since its launch. It alone occupies 28.25% of the entire fund. It also has 6% more weight in the Grayscale smart contracts fund compared to the next competitor Solana.

Why is Grayscale important to Cardano?

Grayscale is the world’s largest crypto asset manager. As such, being on top of the smart contracts fund gives Cardano (ADA) much more visibility among large institutional investors. As a result, it could bring a greater capital inflow to Cardano in the future. A Twitter user, ThisCorrosion, says this is one of Cardano’s biggest trump cards:

We will likely see large corporate and personal investment capital flow through these funds in the next or 2 years. Uncertainty in regulation is probably the biggest factor holding it back right now.

ThisCorrosion expects giants like Vanguard and iShares to join these funds.

Some concerns and solutions

However, there are some concerns that Grayscale stores all ADA purchases in its Coinbase cold wallet. In this case, Coinbase has a lot of control over the ADA management. Also, these institutions are missing out on sufficient returns with their staked assets on Coinabase versus what they would gain with share pool operators (SPOs).

Twitter user ThisCorrosion adds that institutional players should recognize the unique benefits that cryptocurrencies offer over commodities:

I hope institutional investment firms understand that Cardano is a unique investment and requires different approaches than commodities like gold.

While the user’s concerns are valid, the Cardano network is experiencing a fix in the Voltaire phase of its roadmap. This stage mainly focuses on governance. It also allows the network to work with Input Out Global management. Cardano’s Voltaire phase will begin in 2023.

The fix for the ADA management issue comes with Cardano Improvement Proposal #50 (CIP-50). A research fellow at the University of Tennessee, Dr. Michael Liesenfelt said:

While the CIP50 will require some commitment, it will benefit these corporate stakeholders. These institutions may also choose to follow the example of Cardano_CF by transferring 675 million to dozens of international pool operators rather than centralizing shares in private pools.

Cardano’s ADA underwent a major correction in the crypto winter 2022. However, any positive development could cause the ADA price to rise even higher. As you follow on Kriptokoin.com, ADA is currently trading at $0.38996.