As of 2024, technology giant Intel saw the lowest level of the last 13 years in data center processor sales. It is stated that the company’s market share in this field is affected by factors such as increasing the competitiveness of AMD, transition to models with high number of cores, and orientation to artificial intelligence -oriented server architecture.

As of 2024, technology giant Intel saw the lowest level of the last 13 years in data center processor sales. It is stated that the company’s market share in this field is affected by factors such as increasing the competitiveness of AMD, transition to models with high number of cores, and orientation to artificial intelligence -oriented server architecture.The decline in the data center continues

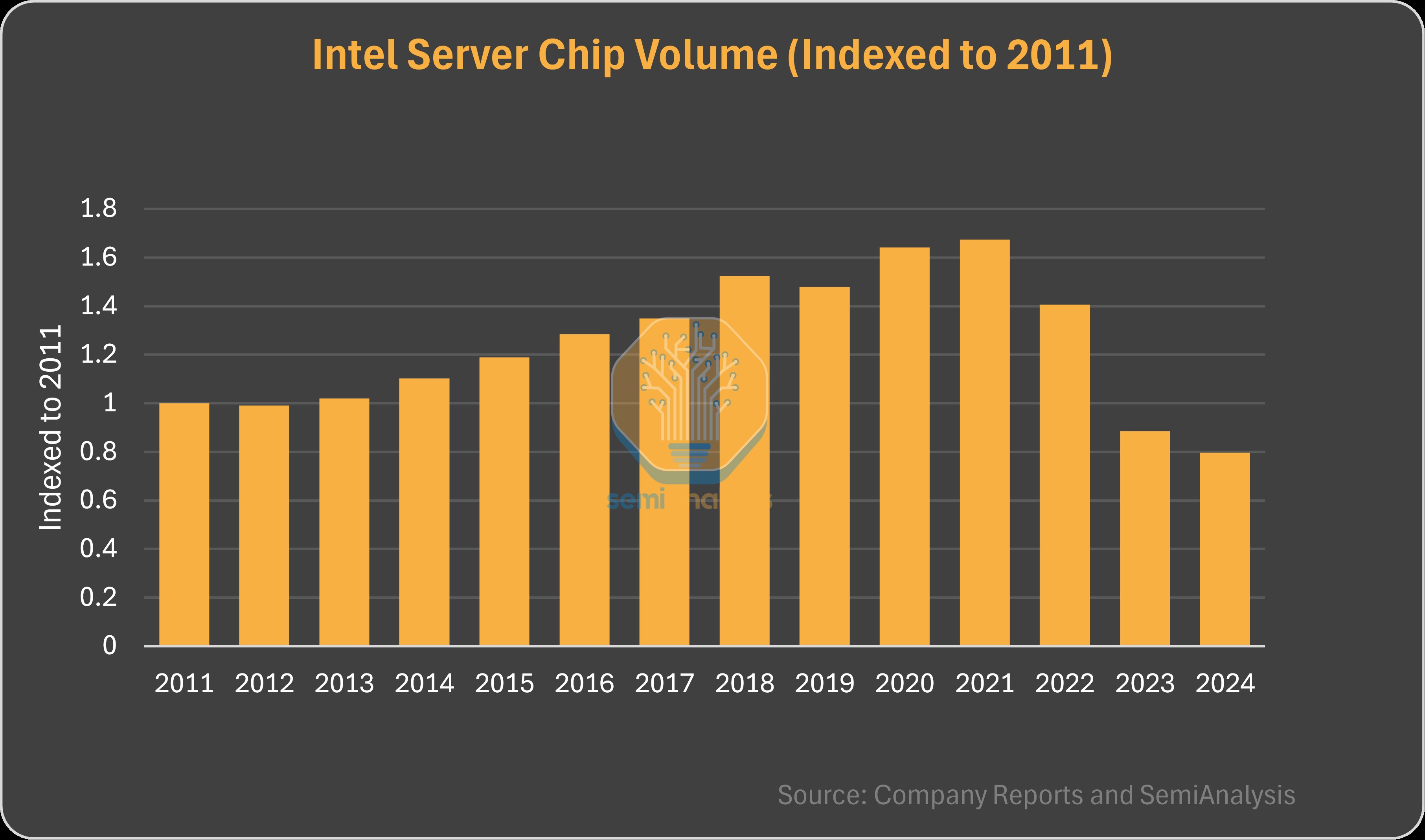

Market analysts, Intel’s data center processor unit sales decreased by 20 percent compared to 2011 and 80 percent compared to 2021. Intel, however, experienced an increase of $ 182 million in its revenue in the server segment last year. This increase is due to the price increases caused by the preference of processors with a higher number of cores. The company’s financial report, server processor prices increased by 12 percent compared to 2023, but the volume of the processor decreased by 10 percent.

The decline in Intel’s data center processor sales reveals the general transformation process of the market. In the mid -2010s, with the rise of cloud computing, Intel was in an unrivaled position and was able to sell high -number processors with a low number of nuclei. However, the fact that AMD has increased competition since 2019 and launching the 4th generation EPYC processors with 96 core in 2022 shook Intel’s position in the market.

The decline in Intel’s data center processor sales reveals the general transformation process of the market. In the mid -2010s, with the rise of cloud computing, Intel was in an unrivaled position and was able to sell high -number processors with a low number of nuclei. However, the fact that AMD has increased competition since 2019 and launching the 4th generation EPYC processors with 96 core in 2022 shook Intel’s position in the market.On the other hand, the increasing cloud computing need during the COVID-19 epidemic increased Intel’s sales in 2020 and 2021. However, as of 2022, the decrease in general -purpose server demand and the prominence of artificial intelligence -supported systems caused new difficulties for Intel. In 2023, sales fell to a great extent and this trend continued in 2024.

Intel’s future is uncertain

In 2024, Intel launched Xeon 6 series processors to offer 128 high -performance or 144 energy efficient core options. However, this step could not prevent the decrease in total sales. Although Customers turn to fewer but stronger processors, Intel’s income increases, but the loss of market share continues.

In artificial intelligence -oriented data centers, systems that work with less CPU instead of high CPU pieces are preferred and with up to eight GPUs. This new structuring shows that the data center market in which Intel is historically strong is also experiencing a radical change. In short, Intel has not caught the change while the market is changing.