CoinShares’ latest weekly cryptocurrency fund flow report shows that 2022 is the weakest year since 2018, with just $433 million in inflows. While the institutional currency buys XRP and Polygon (MATIC), it prefers to move away from altcoin giants like Ethereum.

Altcoin market hits lowest flow of funds since 2018

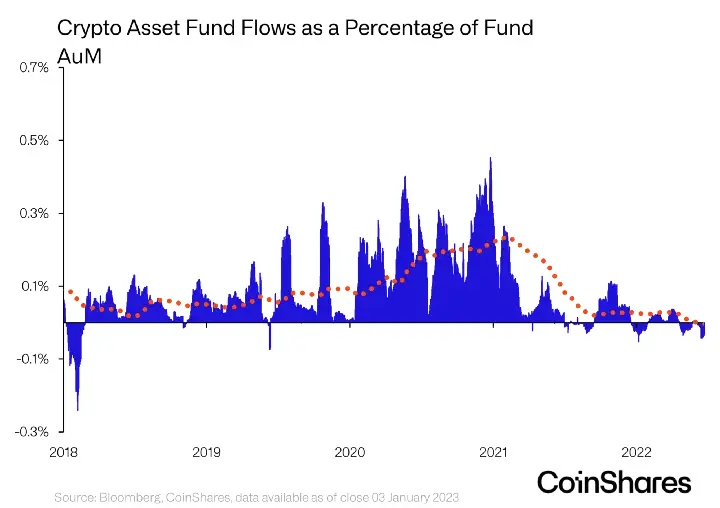

According to the report by CoinShares, the cryptocurrency market recorded a total of $433 million in entries for the full year 2022. This is the lowest level since 2018, when there was only $233 million in inflows. At the time of the historical bottom, the Bitcoin price has lost more than 60% year-on-year. Still, in an environment dominated by a clear bear market triggered by irrational flooding and an over-hawkish FED, it was good news to see that, overall, investors were still choosing to invest.

In a nutshell, 2022 saw the emergence of short-term investment products that saw inflows of $108 million, these remain a niche asset representing only 1.1% of the total Bitcoin AuM.

In a comparison of the two years, 2018’s fund outflows were much more aggressive than in 2022. During this period, weekly total outflows reached 1.8% of total assets managed at one point. In contrast, exits in 2022 reached a weekly peak representing only 0.7% of AuM. Also, inflows were significantly lower than in 2021 and 2020, when there were $9.1 billion and $6.6 billion respectively.

Institutional money’s preferences

In the framework of 2022; Ethereum, BNB Coin, and Tron were altcoin projects that were out of funds. Litecoin, XRP, Solana and Polygon are closing the year with a positive fund flow, albeit on a decline compared to previous years. Year-to-year fund flows and decision/loss ratios are as follows:

In general, in the table, Bitcoin and multi-asset investment products were the products that raised the most funds, with inflows of $287 million and $209 million, respectively. Ethereum has had a turbulent year amid investors’ concerns about a successful transition to PoS and ongoing issues with staking unlocks expected in Q2 2023.

2022 saw the emergence of short-term investment products seeing $108 million in inflows, these remain a niche asset representing only 1.1% of the total Bitcoin AuM. Meanwhile, the previous week’s reports indicated that Solana would experience more inflows of funds in the short term. As we reported as Kriptokoin.com, Solana suffered one of the biggest losses in the past months.