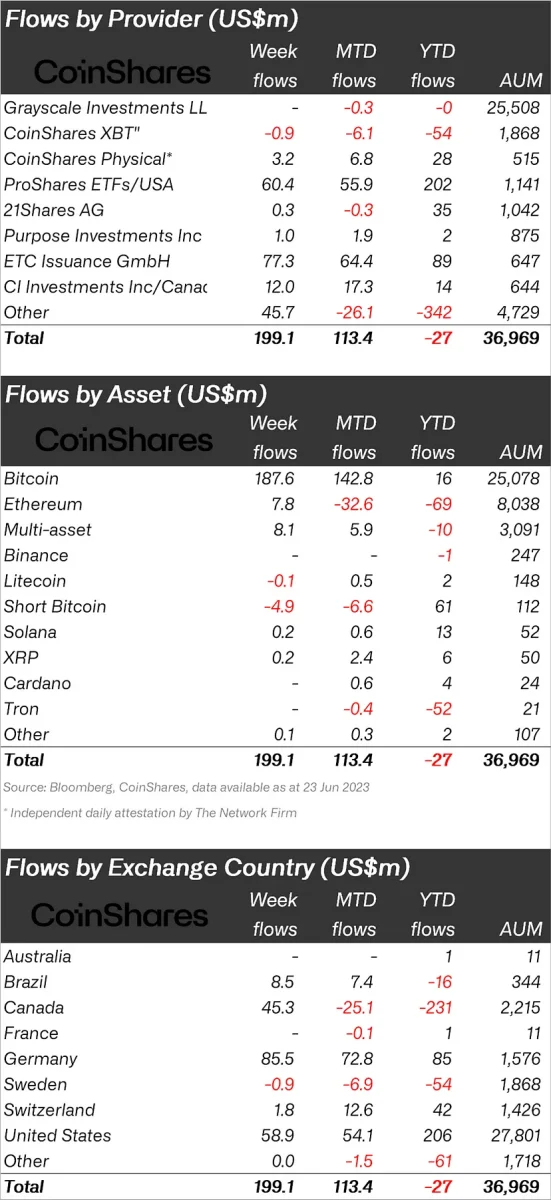

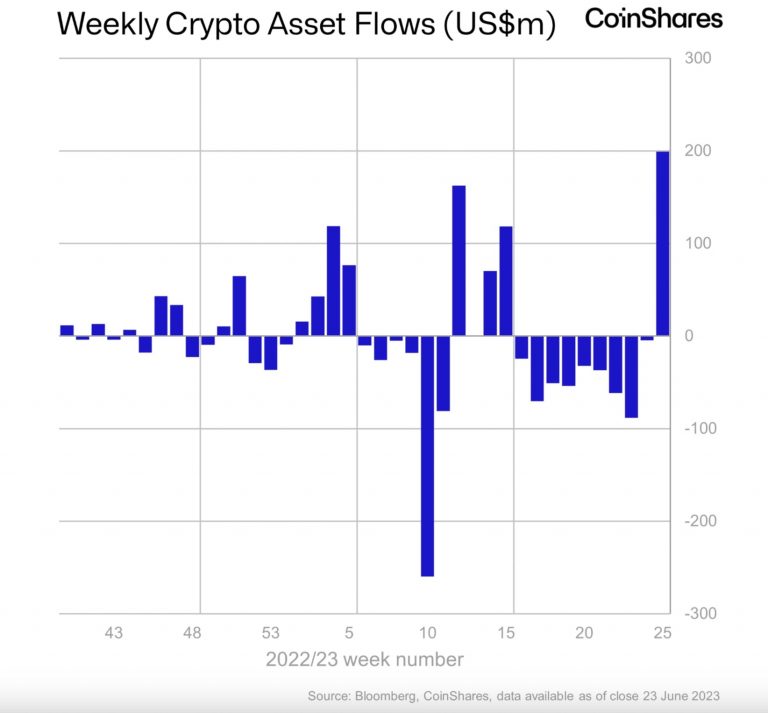

In a major development for the crypto-asset market, investment products have witnessed the largest single-week entry since July 2022, with a total of US$199 million flowing into the industry. This increase marks a correction in almost half of the previous nine-week exits and signals renewed positive sentiment among investors. The Weekly Crypto Asset Fund Flows Report published by CoinShares sheds light on the factors that triggered this shift and their impact on various cryptocurrencies. The report includes data on Litecoin, Ethereum and more. Here are the details…

Litecoin is being sold

Bitcoin has emerged as the primary beneficiary of this surge, taking in $187 million last week. It made up an impressive 94 percent of total streams. By contrast, “short” Bitcoin investments saw $4.9 million outflows for the ninth week in a row. While this surge in sentiment didn’t cover altcoins, as there were only minimal inflows, it encouraged some investors to explore multi-asset investment exchange-traded products (ETPs), resulting in $8 million in inflows over the same period.

The improved market sentiment can be attributed to the recent announcements of high-profile ETP issuers filing applications for physically-backed ETFs with the U.S. Securities and Exchange Commission. These developments garnered a lot of attention and instilled confidence in the crypto-asset market. As a result, total assets under management (AuM) reached US$37 billion, the highest figure since the collapse of 3 Arrows Capital, a major milestone for the industry.

Bitcoin’s dominance in attracting entries is clear, as it accounts for 94% of the total entries. Cryptocurrency’s appeal remains strong and investors flock to tap into its potential. In contrast, short Bitcoin investments continue to face exits, consistent with the trend observed over the past nine weeks. Notably, these outflows account for 60% of the total AuM and mark a significant divergence in investor sentiment regarding Bitcoin. On the other hand, an outflow of 100 thousand dollars is seen in the Litecoin fund.

ETH, XRP and SOL; funded inflow

Ethereum, the second largest cryptocurrency by market capitalization, witnessed $7.8 million in inflows last week. However, these entries represent only 0.1% of the total AuM compared to Bitcoin’s 0.7% entry, showing that investor appetite for Ethereum is currently lagging behind that of Bitcoin. Despite the overall positive trend, altcoins have struggled to attract substantial investment. XRP and Solana, the two leading altcoins, experienced only minor inflows of $0.24 million and $0.17 million respectively. This limited growth in altcoins indicates that market participants continue to focus primarily on Bitcoin due to its potentially entrenched position and perceived stability.

Interestingly, market enthusiasm has encouraged some investors to diversify their portfolios by investing in multi-asset investment ETPs, resulting in inflows of US$8 million last week. This shows that investors are willing to explore alternative digital assets beyond popular options like Bitcoin and Ethereum. Current market dynamics point to a notable shift in sentiment and investment patterns in the crypto-asset space. With the interest in ETF applications in the USA, there has been a significant flow of funds, especially for Bitcoin. However, altcoins are still struggling to replicate the success seen by Bitcoin. This shows that the established leader continues to be preferred.