Crypto analytics firm CoinShares recently published an interesting report on the state of the cryptocurrency market. While Bitcoin has been under selling pressure for weeks, institutional money is flowing into 5 altcoin projects.

Majority of the investors are walking away from the market

While the cryptocurrency market continues to fluctuate, the general sentiment of the investors has turned to a bearish trend, causing them to lose confidence. James Butterfield, head of research at ChoinShares, writes:

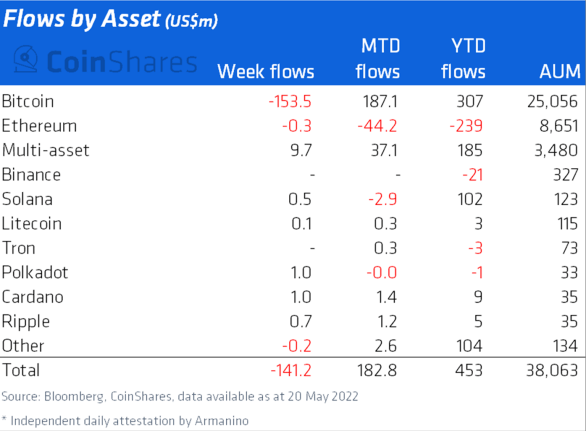

There was a total of $154 million in outflows in the Americas, compared with a total of $12.4 million in Europe.

In addition, total assets under management fell to $38 billion, the lowest level since July 2021. After strong entries in the previous week, Bitcoin funds failed to sustain the momentum. Last week, Bitcoin funds recorded a total outflow of $154 million. Similarly, Bitcoin saw a net outflow of $1.1 million last week.

Institutional money flows into these 5 altcoin projects

Investors preferred multiple crypto investment products last week instead of choosing a single crypto-focused product. It also sees investors’ multi-asset investment products as a safer alternative during times of extreme volatility. Meanwhile, there have also been some minor entries in the altcoin category. Altcoins like Cardano and Polkadot have seen inflows of $1 million each. According to data provided by CoinShares, the 5 altcoins that saw money inflows this week were:

- Solana (SOL)

- Litecoin (LTC)

- Polkadot (DOT)

- Cardano (ADA)

- Ripple (XRP)

As we have mentioned in Cryptokoin.com news, Cryptocurrency investments fluctuated throughout May as the market showed extreme volatility following the collapse of the Terra ecosystem. Furthermore, sales in the US equity market have put additional selling pressure on the crypto space as investors move funds into hedged assets during these times of uncertainty. According to a detail CoinShares included in the report, blockchain equity investment products saw a total outflow of $20 million, which has been troubled by the broad sell-off in equities.