Bitcoin price volatility over the past week has meant buying for institutional investors, according to a new CoinShares report. According to James Butterfill, head of research at CoinShares, massive amounts of money flowed into Bitcoin funds during the extreme market volatility. Meanwhile, other altcoin projects were also popular with institutions. Here are the details…

Institutions’ eyes on these altcoin projects

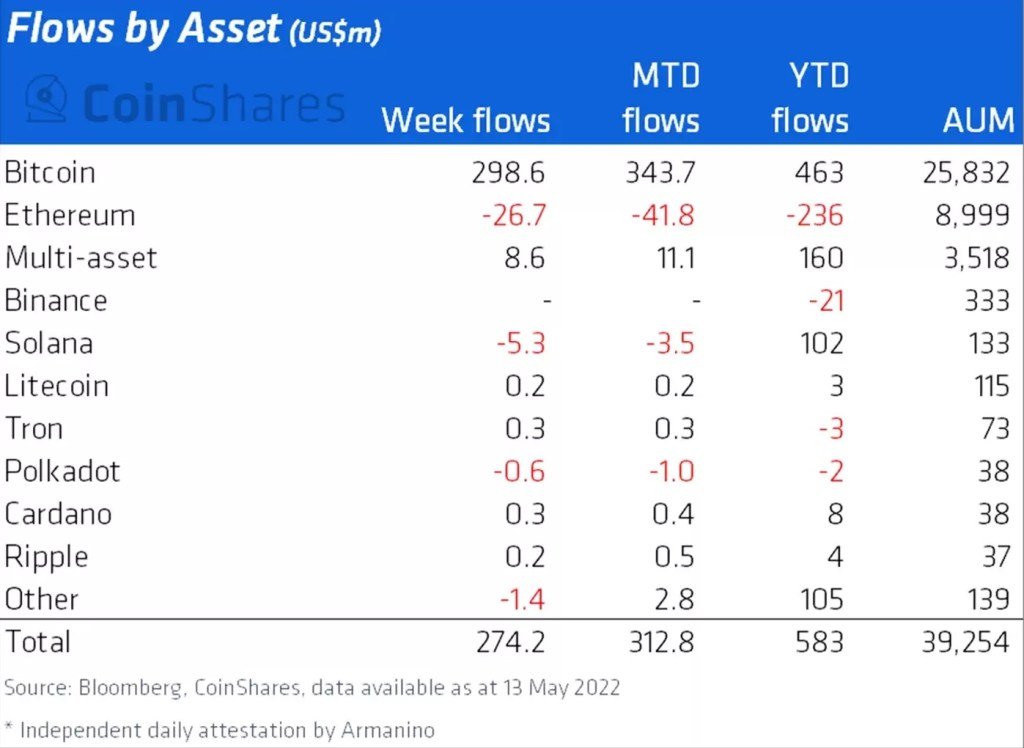

While institutions were transferring money to various altcoin funds, some of them drew attention. Funds that debuted included funds based on Ethereum, Solana, and Polkadot. The CoinShares report noted an outflow of $27 million from exchange-traded Ethereum funds last week, bringing the total outflow for 2022 to $236 million. Butterfill wrote in the report that Ethereum-based funds account for 2.6 percent of assets managed.

On the other hand, Solana saw a net outflow of $5.3M last week, but still looks to be up $103M for the year. Polkadot (DOT), on the other hand, experienced $ 600,000 breakout. Looking at the entered altcoins, Litecoin (LTC) with $ 200,000, Tron (TRX) with $ 300,000, Cardano (ADA) with $ 300,000 and finally Ripple (XRP) with $ 200,000 stand out.

$300,000 entry seen for Bitcoin

As we have reported on Cryptokoin.com, Bitcoin fell below $35,000 for the first time since July 2021, hitting $26,350 levels in the midst of the bearish sentiment. Meanwhile, the TerraUSD (UST) algorithmic stablecoin has lost its pegged to the US dollar, and trust in this ecosystem in particular has collapsed. Back in October, Bitcoin’s price was on a steady rally, ending with an all-time high of $68,789.63 on November 10, with its market cap nearing $1.3 trillion.

Since then, Bitcoin’s market cap has halved: it hit $560 billion. Its price is at $30,463 at the time of writing. BTC funds listed in North America saw $312 million in inflows, while European funds saw $32 million out. Of all the exchange-traded crypto funds CoinShares tracks, Grayscale still remains the largest provider.