CoinShares’ latest weekly fund flow report shows that Bitcoin is outpacing its altcoin rivals by a large margin. After January 16-22 the previous week with the recovery, the institutional money chose to play Bitcoin this time.

While the altcoin market is raising a decent amount of funds, Bitcoin widened the gap

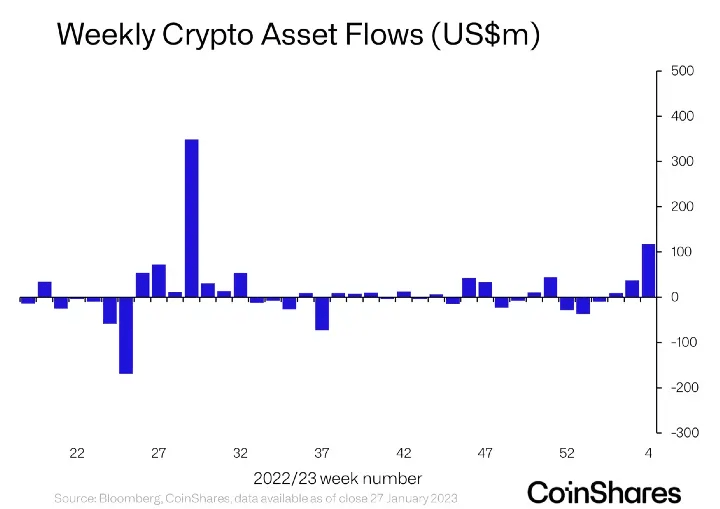

Cryptocurrency investment products saw $117 million in the week of January 23-29, the biggest inflow since July 2022. Investment product volumes improved, trading $1.3 billion weekly, up 17% from the previous year average, while the cryptocurrency market collected an average of 11% weekly volume. Investment products remained only 1.4% of total volumes on trusted exchanges.

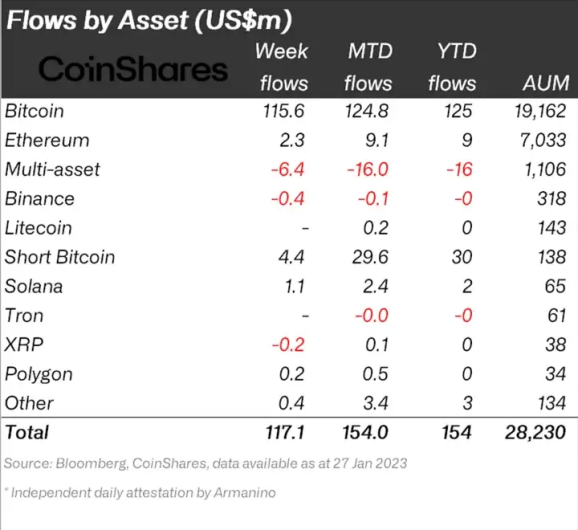

In particular (BTC) was a favorite of institutional investors, with $117 million in inflows last week. The focus was almost entirely on Bitcoin, which saw an inflow of $116 million last week, but there were also small inflows of $4.4 million in Short Bitcoin products. This shows that opinions continue to be polarized.

Altcoin projects favored by institutional money

On the altcoin side, fund flows have been consistent over the past weeks. Multi-asset investment products saw a total outflow of $6.4 million for the 9th consecutive week, indicating that investors prefer certain investments. In the overall chart, Ethereum, Solana, Cardano, and Polygon are the cryptocurrencies that are seeing inflows of funds for the week. Here are the weights and the change over the past week and month:

- Ethereum (ETH): $2.3 million

- Solana (LEFT): $1.1 million

- Polygon (MATIC): $0.2 million

- Cardano (ADA): $0.2 million

- Litecoin (LTC) remains stable

- Tron (TRX) remained stable

Altcoin projects losing funds

On the red side, Bitcoin Cash, Stellar, and Uniswap have all had minor breakouts. Binance experienced the biggest loss of funds with $0.4 million, while XRP (XRP) was the other product that broke out with $0.2 million.

Fund flow by country

Germany was the focus this week, seeing 40% of all entries ($46 million), followed by Canada, the United States and Switzerland with 30 million, 26 million and 23 million respectively. As you follow on Kriptokoin.com, Germany has been providing more funds in recent weeks compared to other countries.

Meanwhile, Blockchain stocks also saw inflows totaling $2.4 million. But looking at providers, sentiment seems to continue to polarize. Blockchain stocks are owned by Riot Platforms, Inc. Block Inc. Coinbase Global, Inc. Marathon Digital Holdings, etc. includes companies such as