Cryptoasset investment products continue their winning streak, with significant inflows totaling $176 million last week, according to CoinShares data. This marks the eighth consecutive week of positive momentum, bringing year-to-date inflows to $1.32 billion. In particular, investors seem to focus on coins such as Solana (SOL) and XRP. Here are the details…

CoinShares explained: Money is flowing into ETPs

The dominance of Exchange Traded Products (ETPs) in the crypto market is increasing, with their share of total crypto volumes reaching an average of 11%. This is a significant increase compared to the long-term historical average of 3.4% and exceeds the averages observed during the 2020/21 bull market. The growing interest in ETPs is also highlighted by the fact that trading volumes have doubled this year, reaching an average of US$3 billion per week, compared to the 2022 average of US$1.5 billion.

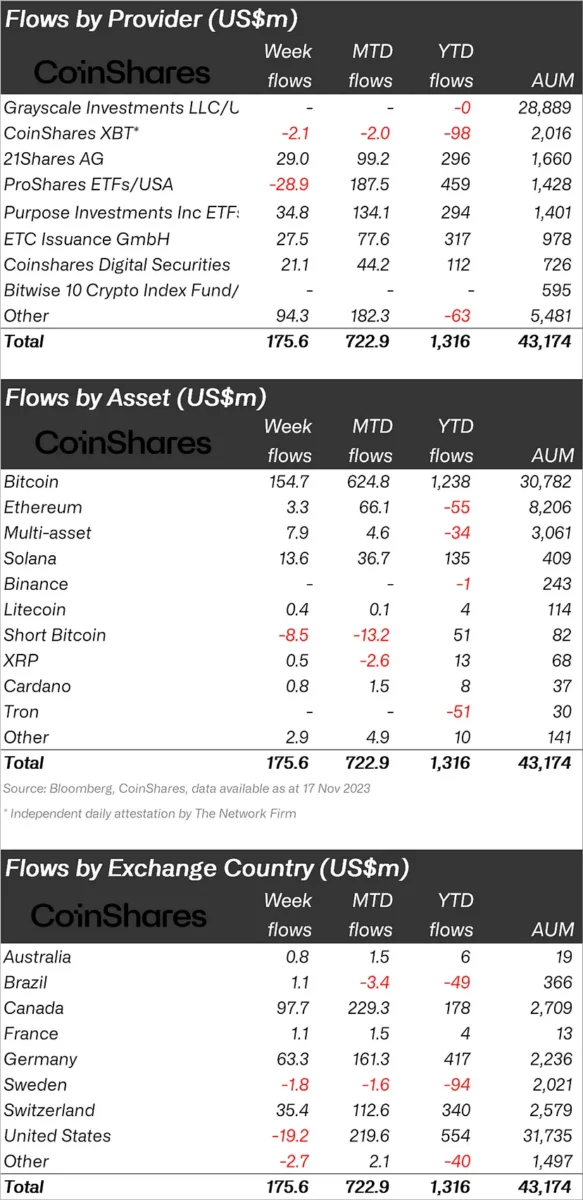

Bitcoin continues to be the focus of investors’ attention, generating inflows of US$ 155 million last week. Cumulative inflows over the last eight weeks currently represent 3.4% of total assets under management (AuM). Despite seeing an outflow of $8.5 million in short-bitcoin, the overall positive sentiment continues, driven by the expectation that a spot-based Bitcoin ETF will soon be approved in the United States, a development we have previously examined in detail.

SOL and these altcoins attracted attention

Regionally, Canada, Germany and Switzerland made significant contributions to the positive trend, recording inflows of $98 million, $63 million and $35 million respectively. On the other hand, the United States experienced a total outflow of 19 million dollars from futures-based products. Various altcoins also witnessed significant inflows. Solana (SOL), Ethereum, and Avalanche stood out with inflows of $13.6 million, $3.3 million, and $1.8 million, respectively. XRP and Cardano also exhibited inflows of $500 and $800 thousand respectively. However, Uniswap and Polygon saw minor outflows of $0.55 million and $0.86 million respectively.

While current inflows are significant, they fall short of the remarkable figures seen in 2021 and 2020, which witnessed inflows of $10.7 billion and $6.6 billion respectively. Despite this, the steady positive trend and the increasing dominance of ETPs in the overall crypto market points to a solid and improving investment environment. Investors continue to navigate the dynamic crypto market, balancing traditional favorites like Bitcoin with growing interest in alternative crypto assets. As the market eagerly awaits the potential approval of a spot-based Bitcoin ETF in the US, the coming weeks promise to be pivotal in shaping the trajectory of crypto investment trends.