Bitcoin (BTC) and altcoin investors are not feeling as fearful as they were in June, but some metrics suggest that the market is still at support levels.

What is happening in the bitcoin and altcoin markets?

As we reported on cryptokoin.com, the total crypto market capitalization has fluctuated in the range of 17 percent over the past 28 days in the $840 billion to $980 billion region. Price action is relatively tight, given the extreme uncertainty surrounding recent market sell-off catalysts and the controversy surrounding Three Arrows Capital. From July 4-11, Bitcoin (BTC) gained a modest 1.8 percent, while the price of Ethereum (ETH) remained stable. More importantly, the overall crypto market has dropped 50 percent in just three months. This means investors are giving higher odds for the descending triangle formation that falls below the $840 billion support.

Regulatory uncertainties continue to dampen investor sentiment after the European Central Bank (ECB) published a report concluding that the lack of regulatory oversight added to the recent decline of algorithmic stablecoins. As a result, the ECB recommended supervisory and regulatory measures to contain the potential impact of stablecoins on the financial systems of European countries. On July 5, Jon Cunliffe, vice-president of financial stability at the Bank of England (BoE), proposed a set of regulations to tackle the risks of the cryptocurrency ecosystem. Cunliffe called for a regulatory framework similar to traditional finance to protect investors from irreversible losses.

Few Altcoins rebound and sentiment slightly improved

The bearish sentiment at the end of June dissipated, according to the Fear and Greed Index, a data-driven sentiment indicator. The indicator hit a record low of 6/100 on June 19, but spiked to 22/100 on July 11 as investors began to build confidence at the bottom of the market cycle. Note that although the overall market cap increased by 2 percent, a few altcoins increased by 13 percent or more. Aave (AAVE) gained 20 percent as the lending protocol announced plans to launch an algorithmic stablecoin, a proposal subject to the decentralized autonomous organization of the community. Polygon (MATIC) rallied 18 percent after projects run in the ecosystem, formerly Terra (LUNA) and now Terra Classic (LUNC), started to migrate to Polygon.

The OKX Tether (USDT) premium measures the difference between China-based peer-to-peer transactions and the official US dollar currency. Excessive retail demand for cryptocurrency pushes the indicator above 100 percent of fair value. On the other hand, bearish markets are likely to fill the market bid of Tether (USDT), resulting in a 4 percent or higher discount. Tether has been trading at a 1 percent or higher discount on Asian peer-to-peer markets since July 4.

Futures markets

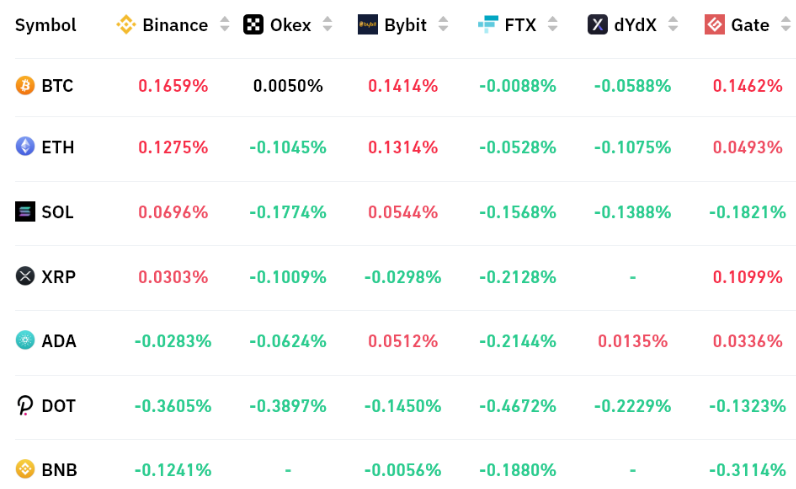

It is necessary to analyze the futures markets to confirm whether the lack of excitement is limited to the influx of stablecoins. Perpetual contracts, also known as reverse swaps, have an embedded rate that is typically charged every eight hours. Exchanges use this fee to avoid currency risk imbalances. A positive funding rate indicates that long-term (buyers) demand more leverage. However, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

Perpetual contracts reflected a neutral sentiment, as Bitcoin, Ethereum, and Ripple (XRP) showed mixed funding rates. Some exchanges have offered a somewhat negative (bearish) funding rate, but this is far from punishing. The only exception was Polkadot’s (DOT) negative rate of 0.35 percent per week (equivalent to 1.5 percent per month), but this is not particularly alarming for most traders. Given the lack of buying appetite and leveraged futures demand from Asian-based retail markets, investors may conclude that the market is not comfortable betting that the $840 billion total market cap support level will hold.