Less than five years after US sanctions nearly neutralized Huawei, the Chinese tech giant has become China’s most important weapon in the war on semiconductors that is poised to shape the world economy for decades to come. According to a new report from Bloomberg, Huawei’s role in China’s chip industry is far beyond what was previously reported. You can read all the information in detail in the rest of the article.

Less than five years after US sanctions nearly neutralized Huawei, the Chinese tech giant has become China’s most important weapon in the war on semiconductors that is poised to shape the world economy for decades to come. According to a new report from Bloomberg, Huawei’s role in China’s chip industry is far beyond what was previously reported. You can read all the information in detail in the rest of the article.Huawei miracle

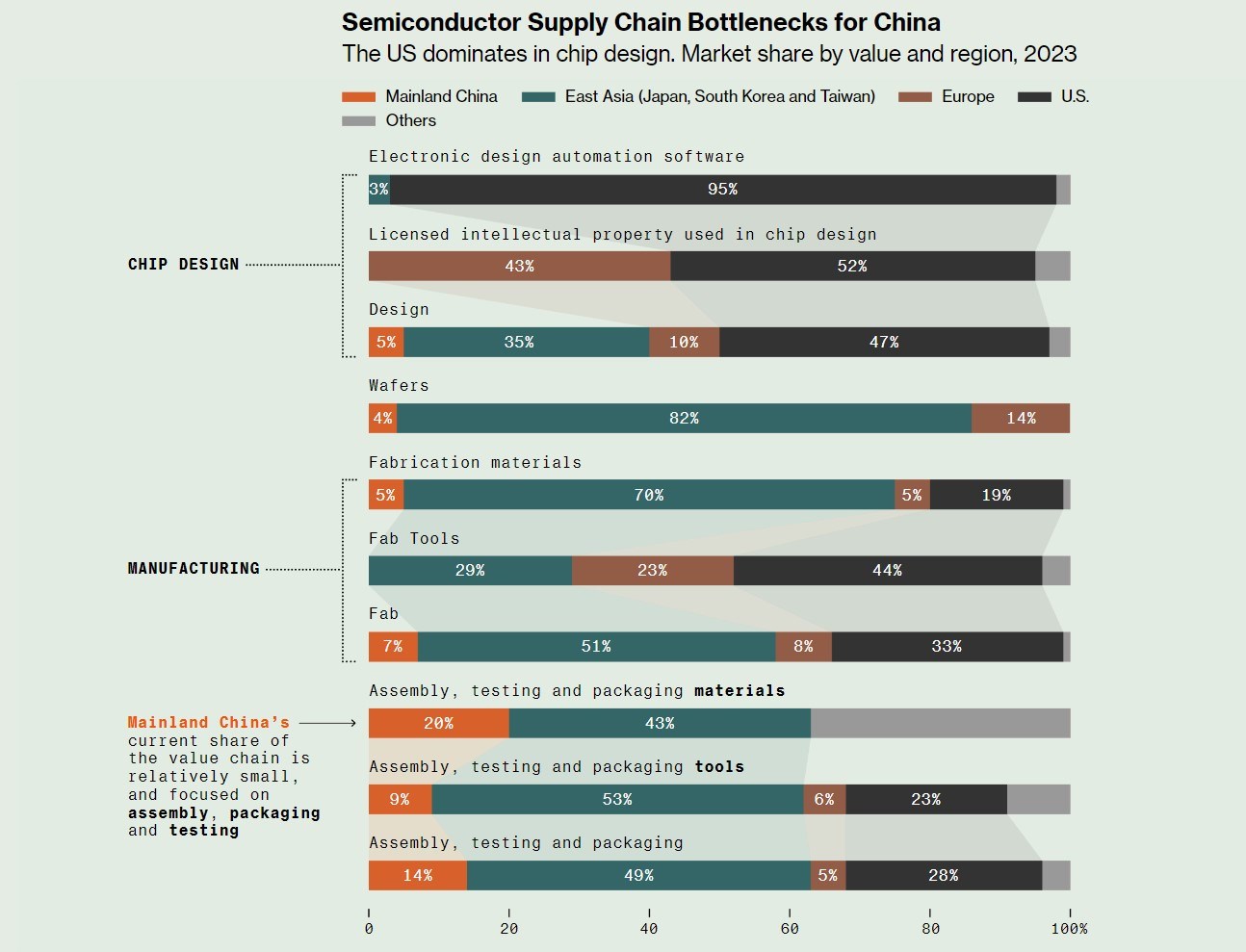

The number of companies that can survive the sanctions and embargoes against Huawei can be counted on the fingers of one hand. However, Huawei is giving a strong comeback signal by achieving the difficult task. In addition to being a top customer for chip manufacturers and the country’s leading chip designer, the firm is increasingly providing engineering expertise and financial support to smaller companies in strategic areas of the chip supply chain.

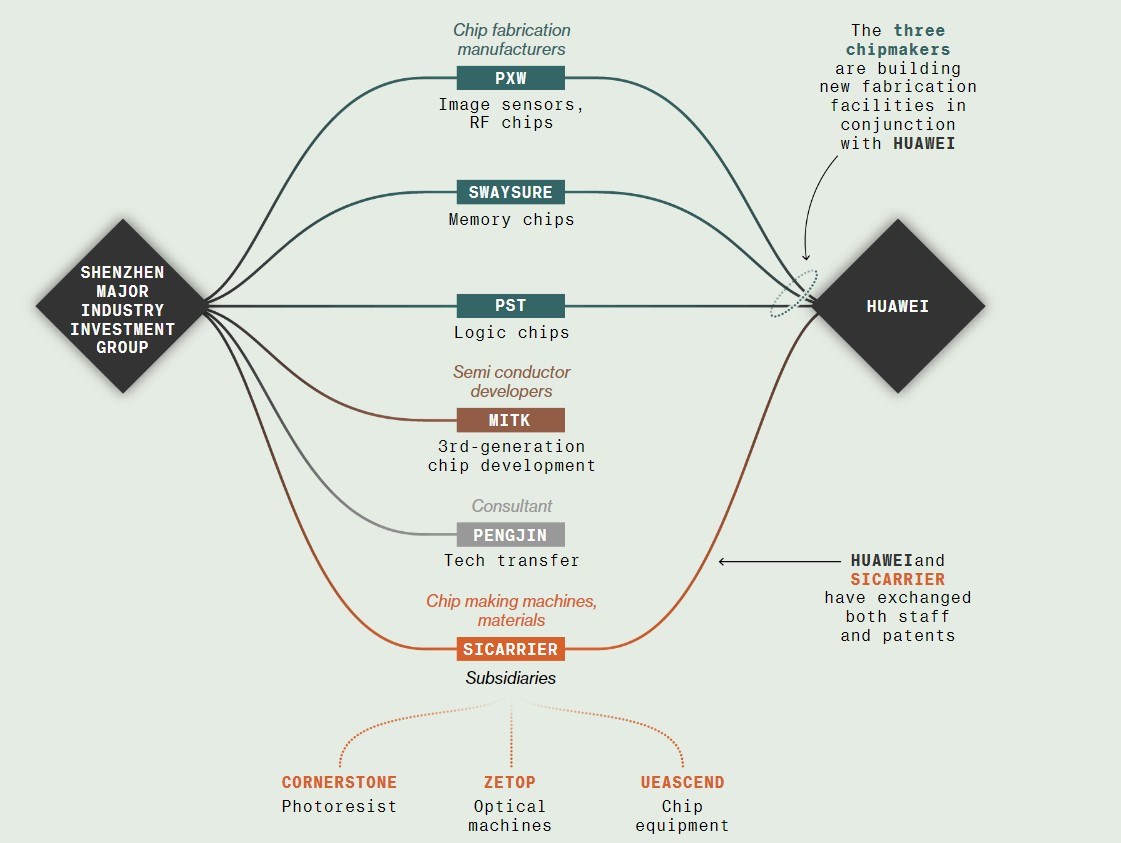

On the other hand, government support for the company has reached unprecedented levels. A new report mentions a startup network backed by the Shenzhen city government investment fund that focuses on helping Huawei build a self-sufficient chip network. This group includes optics experts, chip equipment developers and chemical manufacturers. This support is independent of the $30 billion government support provided to Huawei.

On the other hand, government support for the company has reached unprecedented levels. A new report mentions a startup network backed by the Shenzhen city government investment fund that focuses on helping Huawei build a self-sufficient chip network. This group includes optics experts, chip equipment developers and chemical manufacturers. This support is independent of the $30 billion government support provided to Huawei.Kendra Schaefer, a partner at Beijing-based consultancy firm Trivium China, states that Huawei is positioned at the center for China and that US export controls bring the state and industry together in an unprecedented way.

Huawei, on the other hand, denied the allegations that the government supported it to develop semiconductor technologies. “This is pure speculation and an assumption based on information on the internet,” Huawei said in a statement.

Ren Zhengfei

There is actually a name behind Huawei’s failure to collapse: Ren Zhengfei. More than a decade ago, when business was starting to grow, Ren, the company’s founder, told engineers that the only way to eliminate a deadly threat to the company was to continue investing in semiconductor research.

In a fight to survive after the U.S. blacklisting in 2019, Ren moved some 10,000 developers to 24-hour shifts in a race to redesign circuit boards and software to work without American technology. During peak times, some staff did not step out of the Shenzhen campus for days, living on instant noodles and sleeping on chairs.

This all-out effort kept the company afloat. Around this time, the Chinese state began to increase its support and today’s “symbiotic” relationship emerged.

The importance of Mata 60 Pro

The clearest indicator of this relationship is probably the launch of the Mate 60 Pro smartphone in August. In fact, the launch of the phone coincided with US Commerce Secretary Gina Raimondo’s visit to China. This may be a coincidence, but Huawei did not notify any press sources in advance or even held an event or promotion when launching the Mate 60 Pro.

The clearest indicator of this relationship is probably the launch of the Mate 60 Pro smartphone in August. In fact, the launch of the phone coincided with US Commerce Secretary Gina Raimondo’s visit to China. This may be a coincidence, but Huawei did not notify any press sources in advance or even held an event or promotion when launching the Mate 60 Pro.The importance of Mata 60 Pro is highlighted by Semiconductor Manufacturing International Corp. in the country. It contained highly advanced Chinese components, especially the Kirin 9000s processor produced by (SMIC) in the 7 nanometer process. Huawei and China’s semiconductor success have sparked debate within the United States about whether efforts to slow China’s technological advancement are inadequate.

The concern in the US is that the advanced semiconductors that power Huawei’s smartphones could also be used for military applications, such as AI-controlled drones or supercomputers for code-breaking and surveillance.

Shenzhen-based investment fund and SiCarrier

At the center of the network of state enterprises assisting Huawei is an investment fund run by the municipal government of Shenzhen, where Huawei is headquartered. Shenzhen Major Industry Investment Group Co. is emerging as an investment fund that provides support for Huawei’s chip production. This fund, established with state capital in 2019, is stated to specifically aim to accelerate China’s chip efforts and support Huawei.

This fund has invested in a number of companies in Huawei’s supply chain. SiCarrier Technology Ltd., which stands out among these companies, makes significant contributions to chip production by working in a symbiotic relationship with Huawei. SiCarrier has a particularly close relationship with Huawei’s internal research arm, known as 2012 Labs (the name was chosen by Ren Zhengfei, inspired by the movie 2012).

SiCarrier employs select engineers for Huawei’s projects and inherits various technologies from Huawei through patent transfers. However, Huawei denies that it has a deep partnership with SiCarrier and refuses to cooperate on chip technologies.

SiCarrier employs select engineers for Huawei’s projects and inherits various technologies from Huawei through patent transfers. However, Huawei denies that it has a deep partnership with SiCarrier and refuses to cooperate on chip technologies.However, according to patent transfer information published by the National Intellectual Property Administration of China, Huawei appears to have transferred various patents to SiCarrier, including chip technologies as well as soundproof technologies for electronic machines and data center designs.

SiCarrier, which has an office in an industrial park affiliated with the Chinese Academy of Sciences, also operates in a six-story building in an industrial park in the eastern suburbs of Shenzhen. It is stated here that various components for semiconductor manufacturing equipment are produced. It is stated that SiCarrier is not only a manufacturer for Huawei, but also a connection point between Huawei and other components of the supply chain. For example, SiCarrier, optical machinery manufacturer Zetop Technologies Co. is the largest shareholder of the company. Zetop Technologies produces transistor layers bonded to silicon wafers, which play a critical role in microchip production.

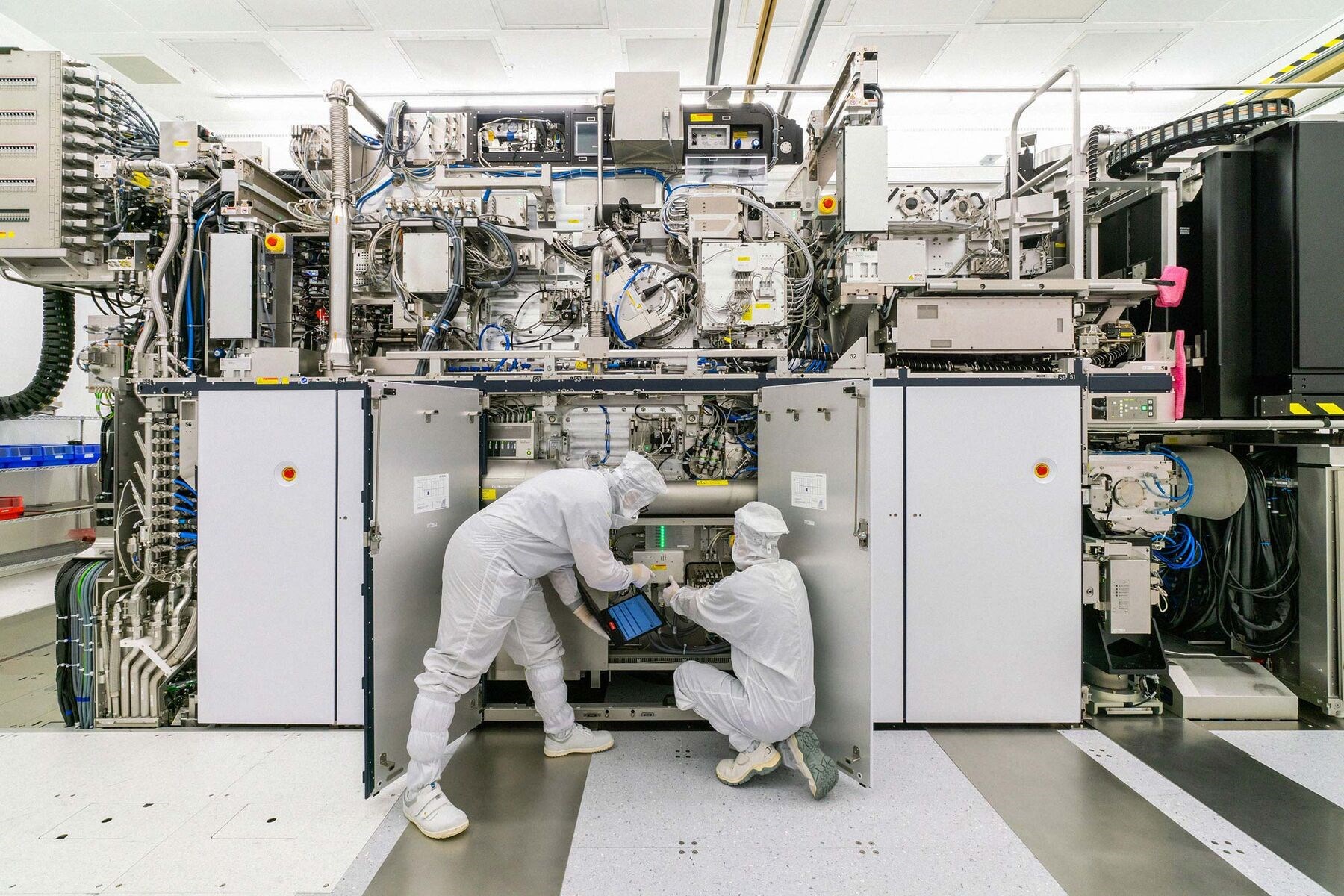

This relationship of SiCarrier is of critical importance, especially in the lithography process. The fact that Dutch ASML Holding NV, the leading company in this field, has a monopoly on extreme ultraviolet lithography (EUV) equipment, causes China to experience difficulties in chip production. It is stated that Huawei hired former ASML employees after the company was blacklisted, to solve the problems with the machines it could not receive from ASML. These employees contribute to the development of the equipment necessary for chip production.

This relationship of SiCarrier is of critical importance, especially in the lithography process. The fact that Dutch ASML Holding NV, the leading company in this field, has a monopoly on extreme ultraviolet lithography (EUV) equipment, causes China to experience difficulties in chip production. It is stated that Huawei hired former ASML employees after the company was blacklisted, to solve the problems with the machines it could not receive from ASML. These employees contribute to the development of the equipment necessary for chip production.SiCarrier’s deep relationship with Huawei demonstrates China’s advancement in chip technologies, with the launch of the Mate 60 smartphone in particular seen as a culmination of this effort. Huawei never disclosed the technical details, but it was determined that the Kirin 9000s is powered by SMIC’s advanced 7 nanometer processor. This shows that China is about five years behind the current state-of-the-art technology.

Analysts expect China to continue pouring billions into the chip race, as the consequences of falling behind could be devastating to its ambitions in fast-growing fields such as artificial intelligence.