Depending on who you ask, the $16,000 level for Bitcoin price is a ‘buy bottom’ opportunity or a bear market capitulation waiting to happen.

How low can the Bitcoin price really drop?

The leading crypto hit an all-time high of $69,000 in November 2021. It has remained in a downtrend for over a year since then. BTC price performance resulted in losses of up to 77% for investors. But how low can BTC really drop?

Bitcoin traders and analysts agree that 2022 is BTC’s newest bear market year. As you follow on Kriptokoin.com, BTC started the year at about $ 46,000. He saw little relief for about 1 year. It has since returned to levels not seen since November 2020. This has placed BTC in the historical bear market subzone. With a maximum loss of around 77% since the most recent peak, Bitcoin may have little room to drop. However, this time could be different. Some of the most popular crypto analysts are giving their opinions on where Bitcoin will bottom out.

Near $16,000 “comfortable buy” zone for CryptoBullet

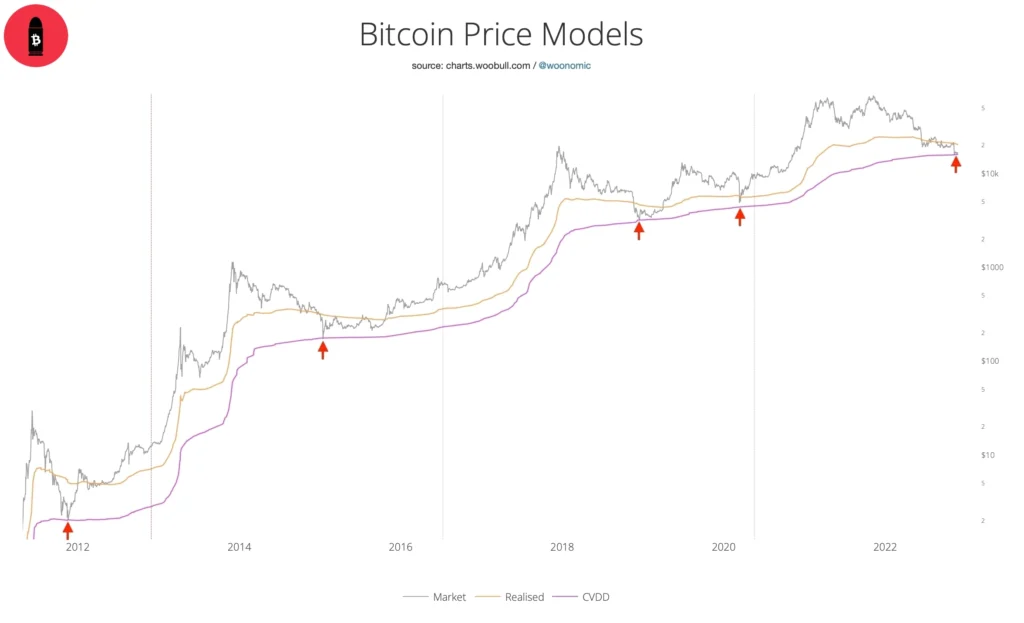

A prominent social media personality adheres to a theory from early 2022. It’s about a specific on-chain metric. Days of Destroyed Cumulative Value (CVDD) for CryptoBullet still provides an important insight into macro Bitcoin bottoms. CVDD essentially counts how long a coin is ‘held’ when it is moved to a new wallet. It’s expressed by dividing the ratio by the overall age of the market by 6 million, which analytics source Woobull explains is a ‘calibration factor’.

In retrospect, CVDD has acted as an important line in the sand. If this time is no different, probably BTC is already giving buyers the best possible profit opportunity. According to Woobll, CVDD is currently around $15,900. CryptoBullet shared the following to his Twitter followers on November 26:

Here at CVDD I feel comfortable buying Bitcoin. Can it go any lower? Of course it’s possible. If another crypto company goes bankrupt or something like that, BTC will fall below CVDD. But not too much. Most of the downtrend is over.

CVDD annotated graphic / Source: CryptoBullet/ Twitter

CVDD annotated graphic / Source: CryptoBullet/ TwitterFilbfilb’s worst case scenario for BTC: $6,500

The crypto analyst is constantly reevaluating how badly the bears have bitten this time. Filbfilb, co-founder of trading group Decentrader, says that if macro conditions worsen, BTC could likely hit $10,000 around the new year.

But that was before the FTX debacle. The resulting fuel added to the bear market fire caused him to rethink. Filbfilb outlines areas of strong bid support as potential bottoms. “But these things change. A large bid ‘ladder’ is just below the spot price. It focuses on $12,000-14,000. At the same time, it is possible that the eventual support will drop as low as $6,000.”

Filbfilb also notes that a black swan event, such as more crypto bankruptcies, could trigger a spike in the upper support area, with the potential to hit $10,000 or lower in the next step. However, he says a trip to the $6,000 region is ‘unlikely’ under current conditions.

BTC 1-week candlestick chart with liquidity heatmap data / Source: TradingView

BTC 1-week candlestick chart with liquidity heatmap data / Source: TradingViewEyes on $14,000 reward for Bitcoin price

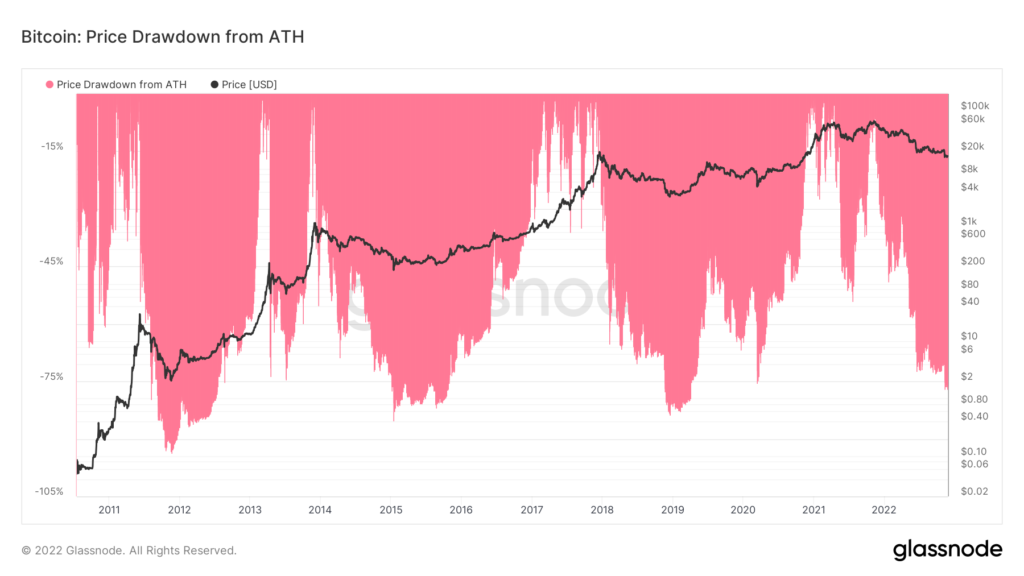

The upper band of the bid support on Filbfilb’s exchange order books is a popular target for a growing number of commentators. For most traders, $14,000 is a key spot on the radar right now. That’s why they’re already planning the entrances from here. This area will also align BTC losses with previous bear markets against all-time highs.

BTC drop and all-time highs chart / Source: Glassnode

BTC drop and all-time highs chart / Source: GlassnodeAnalyst Rekt Capital, on the other hand, says that on the weekly timeframes, $13,900 forms an important support line. It also states that this has not been tested since the second half of 2020.

BTC explanatory chart / Source: Rekt Capital/ Twitter

BTC explanatory chart / Source: Rekt Capital/ Twitter