We will share with you the details of earning interest from DeFi to learn more about the widely used DeFi Applications, important stablecoins and ways to earn interest.

In recent years, DeFi has been in the spotlight for the many promising blockchain-based applications it promotes. While the blockchain itself is completely decentralized, there are several aspects of DeFi that are completely decentralized. We’re seeing Smart Contracts using different features of DeFi, but still have a few central sides.

Decentralization will become more apparent as we see more innovative methods emerge every day. For now, it would be appropriate to consider the DeFi dApp as an unattended service. Here are some of the most commonly used DeFi Applications:

- CompoundFinance

- DyDx

- Fulcrum

- Dharma

Decentralized finance When you dive into its ocean, you should encounter hard coins at the end. Stable cryptocurrencies are a cryptocurrency that is pegged to a fixed value, like fiat currency.

Reserve assets are more centralized than most cryptocurrencies because they depend on their value. A central party holds the fiat currency in reserves and in return issues a token representing the value of the reserve currency.

Stablecoins also give you the opportunity to earn passive income by earning interest rates through lending. Notable stablecoins used in DeFi include:

- Dai (DAI): Created in MakerDAO by locking Ether as collateral and opening a Collateralized Debt Position (CDP).

- USD Coin (USDC): This is used by the California-based crypto exchange. When you deposit US dollars in your Coinbase wallet, it automatically converts your US dollars to USDC.

- TrueUSD (TUSD): A stablecoin issued by TrustToken. US dollars sent to TrustToken are converted to TUSD.

There are also many stablecoins available for purchase on various platforms.

How Do I Earn Interest by Lending?

Once you’re sure which stablecoin you want to use, just follow these simple steps to get started.

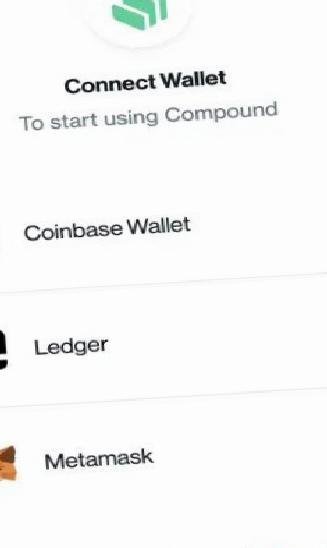

You will need a Wallet to store your crypto assets and connect with the DeFi dApp. For a hassle-free experience, it is better to use a widely used and reliable wallet. Metakask is the most practical and reliable. It helps you interact with the Ethereum Blockchain and manages your private keys for your Ethereum wallet within the browser.

After installing Metamask, you will receive a public Ethereum address. You can access a public address only if you have the private key. Public address is like username and private key is like password. You can share your username, but never your password. Transfer your shares to this address.

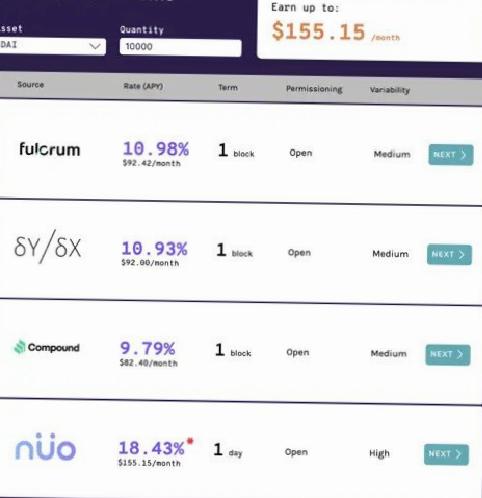

Now choose a DeFi platform, it’s best to go with those that offer and maintain high interest rates.

After choosing a DeFi platform, you need to connect Metamask to dApp.

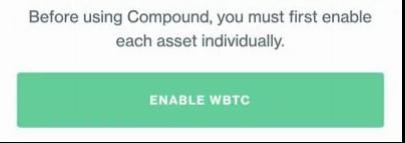

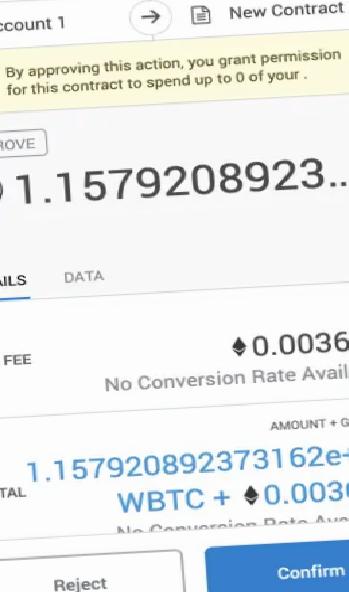

Before your first use, you must approve the DeFi smart contract that allows it to operate the asset. Click Enable and Metamask will open your transaction details.

Also note that there is a gas fee in Ether (ETH) every time you interact with a smart contract.

Expensive gas fees can be a big drop, but Ethereum 2.0’s launch Its release is only a matter of time, and this will likely result in a significant reduction in gas fees.

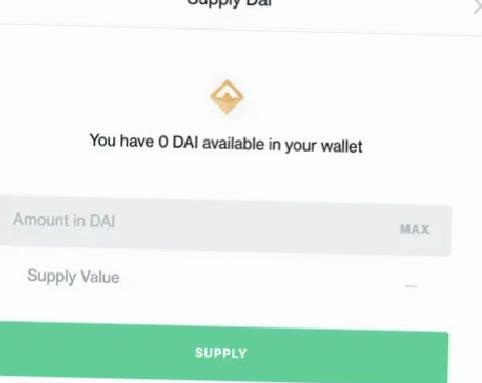

After pressing Activate, you can now procure your stablecoin to start earning profits. Select the amount you want to provide to the protocol. Metamask will open again and you will have to confirm the transaction with the corresponding gas fee.

You are now part of an open financial revolution. Now instead of a third party computer code manages your funds. You will start earning interest in real time as your funds are borrowed, it will continue to be updated as each blockchain block is mined.

If at any point you wish to stop lending, you can withdraw your funds using the withdrawal function. In the DeFi ecosystem, you are in complete control of your funds.

Risks and Considerations

DeFi may seem like the perfect solution to all the shortcomings of the traditional financial system. However, it is best to fully understand the technology behind it beforehand and carefully consider the risks that come with it.

1. Bugs and Vulnerabilities

It is important to understand that codes are always prone to bugs and errors. The good news is that such risks can be handled by third-party security firms.

The high-value DeFi market tends to attract many cyberattacks.

2. Interest Rate Fluctuations

There is great variation in interest rate when interacting with smart contracts. The 20% APR rate may not be valid for long and can immediately drop to as low as 5%. Always be on the alert and don’t let your high expectations get you down.

3. Liquidation Risks

Low liquidity assets used as collateral by borrowers have the potential to experience rapid decline. The Ethereum network is not the most efficient at handling large numbers of simultaneous transactions, and this can result in outstanding loans that are not covered by the forced sale.

However, these issues have often been resolved by improved risk management measures.

4. Stablecoin Hiccups

Stablecoins are fiat-backed cryptocurrencies that share the same value as fiat money. However, problems with the banking partner of stablecoin issuer Tether caused the value of 1 USDT to drop to as low as $0.90 for a short period of time.

While stablecoins come as a good solution to the volatility of the crypto market, it is best to be aware of the factors that govern the centralized crypto asset.

DeFi Has Much to Cover

The DeFi ecosystem is still in its early stages. New investment opportunities are increasing with DeFi, but there are still many uncertainties. It’s best to stay up to date with the latest market trends and do extensive research before investing. You can never be sure when new innovations lead us down less challenging paths.