While the tremor in the cryptocurrency market continues, crypto organizations continue on their way. Coinbase, one of the world’s leading cryptocurrency exchanges, expands the list of custody services. In this context, Coinbase Custody supports 20 more altcoin projects.

Crypto custodian Coinbase expands support for Custody

Coinbase Custody balances the protection of private keys with easy online customer access to customers. In this way, it allows customers to both securely and actively participate in crypto networks. Custody services include depositing and withdrawing supported crypto assets into a custodian account. In addition, staking is also included in the scope of services.

As reported by Kriptokoin.com, Coinbase Custody has announced that it has added support for 20 more altcoin projects.

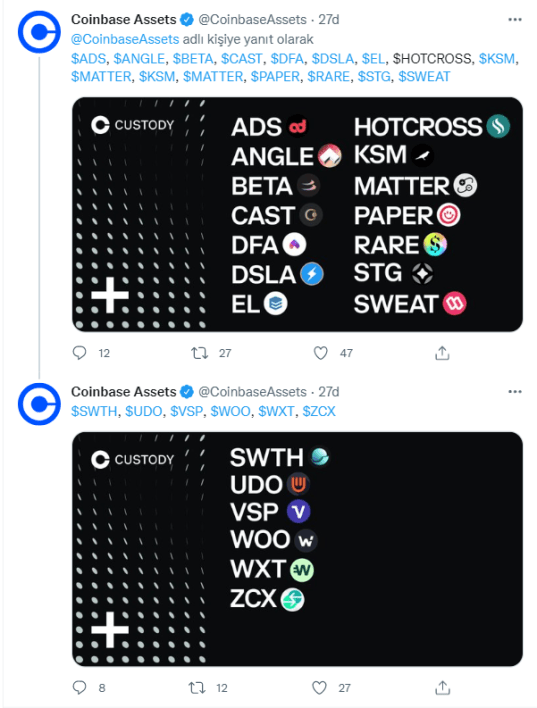

The altcoin in the announcement of Coinbase Custody is listed as follows. ADS, ANGLE, BETA, CAST, DFA, DSLA, EL, HOTCROSS, KSM, MATTER, PAPER, RARE, STG, SWEAT, SWTH, UDO, VSP, WOO, WXT, ZCX.

What exactly does this mean?

The developers designed Coinbase Custody to provide financial controls for institutions and companies that want to trade digital currencies like Bitcoin and Ethereum. The crypto exchange designed it to provide private custody services to institutions, in line with proposals following the emergence of multiple hedge funds targeting the cryptocurrency space.

Basically, Coinbase Custody aims to provide institutions with a secure way to store digital assets such as cryptocurrencies, with access to audit trails, withdrawal limits, and support for multiple signers. The platform provides phone support to institutions that want to confirm fund transfers and other account changes.

Why is Coinbase Custody important?

So far, Coinbase’s most notable forays have been aimed at traditional consumers and early-stage venture capital. With Coinbase Custody, the platform has financial institutions and hedge funds in sight. If you’re wondering how institutional it is, Coinbase Custody requires a minimum balance of 10 million USD. It charges a $100,000 setup fee in addition to a monthly fee of 10 basis points.

The service opens a secure door for institutional investors and hedge funds to operate in the crypto space. Therefore, it is important for the adoption of the cryptocurrency market. Multi-signature wallets and even hardware wallets appeal to hardcore investors. Besides, thanks to the new platform, companies, large enterprises and other financial players are creating their own cryptocurrency offerings. They also get a secure and stable service to keep them safe.