On-chain and technical analysis indicators suggest that Bitcoin price may have bottomed out. However, some investors are still wary that the BTC price could drop as low as $10,000 in the short term. The crypto market is currently going through a period of high volatility as global economic conditions continue to worsen against the backdrop of rising inflation and interest rates. Events affecting global financial markets erase all traces of the bullish sentiment.

For this reason, many investors are predicting that the Bitcoin price could drop as low as $10,000. They also predict that this decline will continue until a market bottom is found. In fact, most traders ridicule the idea of BTC falling below its 2017 all-time high. However, the recent price drop to $17,600 indicates that this bear market may be different from the previous one. Here is what several analysts have to say about the possibility of Bitcoin falling to $10,000 in the next few weeks.

Historic levels suggest Bitcoin price could drop to $10,000

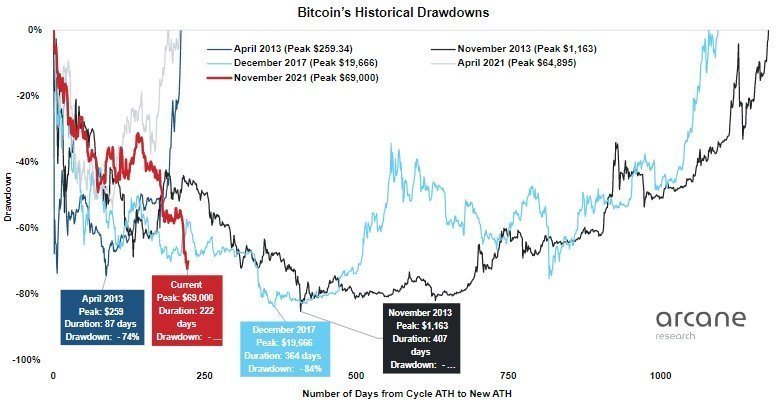

Insight into how BTC might perform in the short term can be gleaned by looking at its performance during the bear market cycles of 2013 and 2017. In 2013, in the fall over a period of 407 days, Bitcoin lost 85% of its value. In the bear market that emerged in 2017, the maximum decrease was 84%. As we reported as Kriptokoin.com, the 2017 bear market lasted 364 days. According to a report from Arcane Research, the current decline has been going on for 229 days. Accordingly, there has been a maximum decrease of 73% so far. The analyst firm also evaluated the price action of BTC:

“It is possible that the price of Bitcoin is following the plan of these cycles. Accordingly, a bottom at $10,350 should occur at the end of the 4th quarter of 2022.”

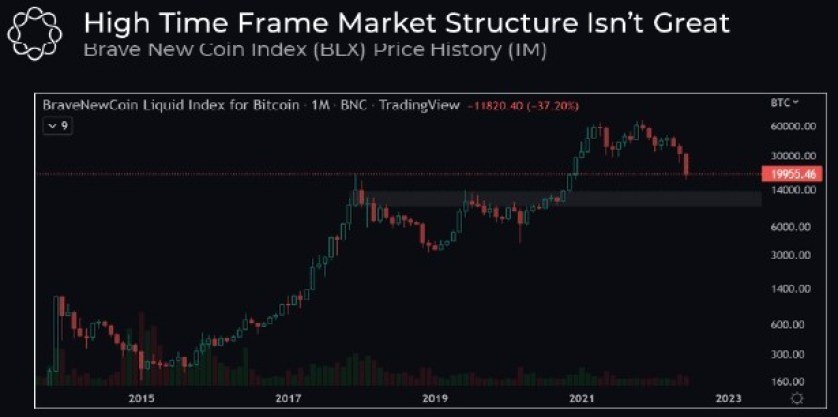

The next BTC level could be $10k

Crypto research firm Delphi Digital has revealed further evidence supporting the possibility of a drop to $10,000. Published a chart. Then, “From the perspective of a high timeframe market structure, the next place we need to look is $10. K– $12,000.” said. According to the chart below, support for the higher timeframe market structure is likely between $9,500 and $13,500. Delphi Digital had this to say for Bitcoin price:

“If BTC experiences an 85% drop from the top to the bottom, this area aligns with the implied low.”

“Bitcoin will not fall to 10 thousand dollars”

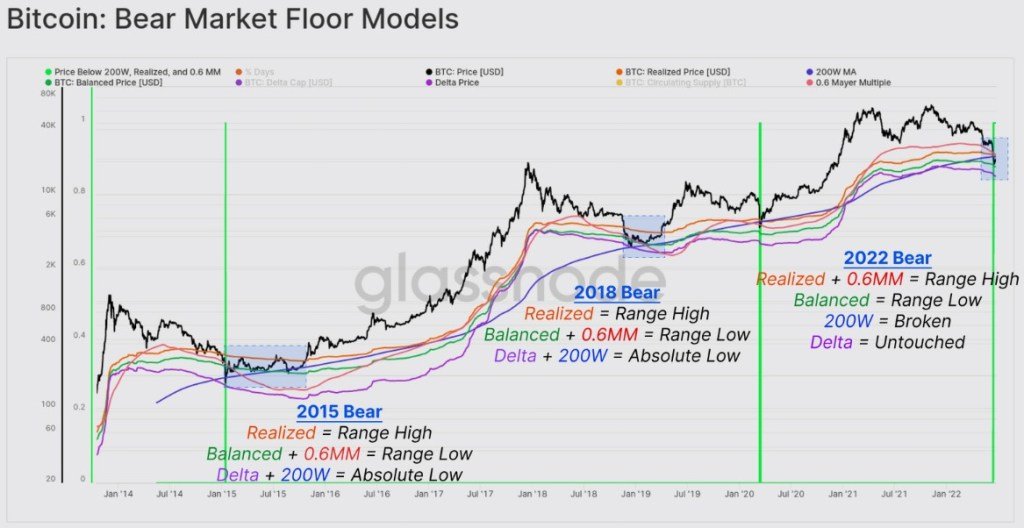

Not every analyst expects a drop to $10,000. Take, for example, Will Clemente of Blockware Solutions. According to Clemente, Bitcoin’s current range reflects a good spot for accumulation. Additional data from Glassnode shows that Bitcoin’s 200-week moving average, equilibrium price, and delta price in the bear market base model are in line with the 0.6 Mayer Multi metric analyzed by Clemente. Glassnode said:

“Only 13 (0.2%) out of 4,360 trading days saw similar conditions. The two previous events occurred in January 2015 and March 2020. These points are marked in green on the graph. Based on the Delta price metric, which is still untouched, the potential low for BTC is $15,750.”

BTC price may have bottomed out

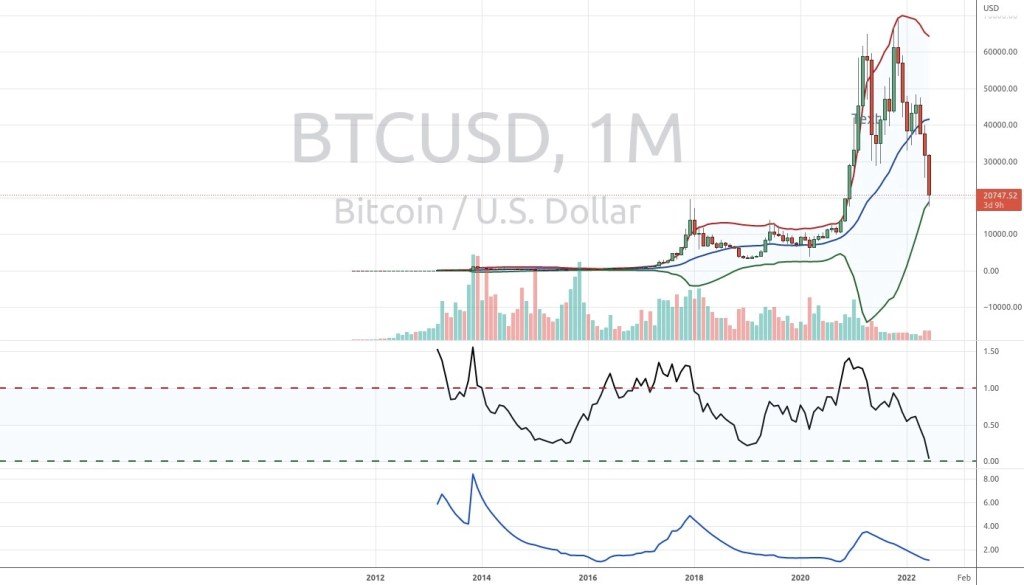

John Bollinger, creator of the popular Bollinger Bands trading indicator, suggested that the Bitcoin price may have bottomed out. According to Bollinger:

“Perfect double (M-type) peak and %b on BTC/USD on the monthly chart confirmed by BandWidth, leading to a label of the lower Bollinger Band. No sign yet, but this is a logical place to hit rock bottom.”