The famous crypto analyst, who knows the Bitcoin (BTC) collapse in May 2021 and the double top model at $ 69,000, says that the bottom levels for BTC are very close.

Bitcoin tends to bottom

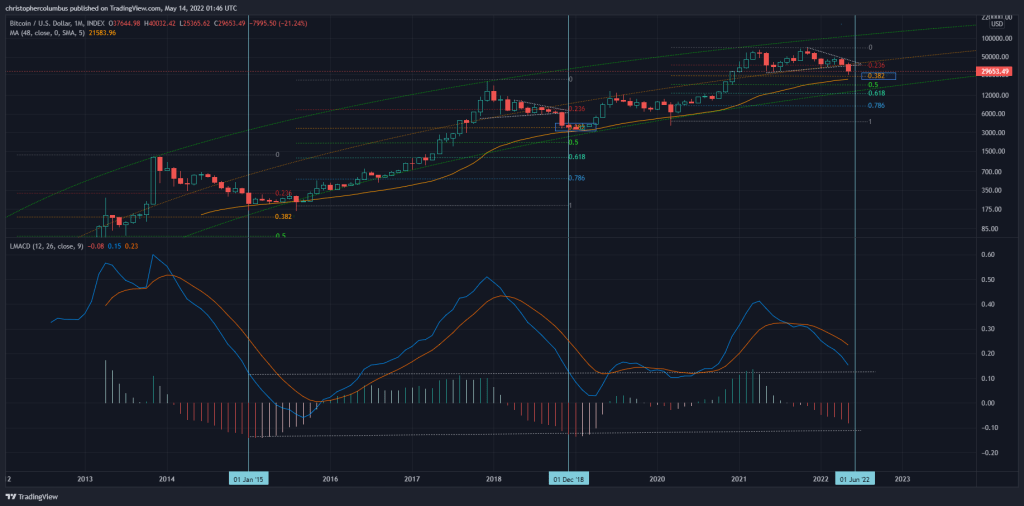

The analyst, known by the alias Dave the Wave, has 99,000 Twitter followers for Bitcoin trading near the 48-month moving average, a point where BTC has historically tended to bottom. He said he predicted. The closely-followed crypto analyst says the Bitcoin base could be established as soon as this month, adding:

Probably, [based on this metric] once again this month, price will re-establish lows. This is what you would expect if it tests.

In October 2021, Bitcoin surpassed the $60k price levels, while Dave the Wave said before BTC finally bounced back and formed a double bottom near the $29k lows. He previously suggested that he would create a double top model for around $65K. The analyst also says that the weekly moving average convergence divergence (MACD), a trend-following indicator, looks like BTC is poised to bottom, adding:

I think this was the first time I mentioned a double top. If there is a double top, why not a double bottom?.. The Bitcoin weekly MACD structure looks promising…

BTC and ETH will outperform stocks

Another analyst famous for his predictions for Bitcoin Mike McGlone, on the other hand, thinks that BTC can provide big returns as stocks continue to fall. As we reported on cryptokoin.com, in a recent interview Mike McGlone says that the Federal Reserve’s interest rate increases are more harmful to the US stock market in the long run than well-established cryptocurrencies such as Bitcoin (BTC) and Ethereum, adding:

Bitcoin and Ethereum, which the Fed wants to decrease to reduce inflation, will also fall, but they will stand out. Overall, the volatility of cryptocurrencies, especially Bitcoin, as a new market, continued to drop against the stock market. That’s what happened when Amazon first came out. Volatility in 2009 was the same as Bitcoin is now.

According to McGlone, cryptocurrencies are on par with Amazon and other industry revolutions and winners of the 2000s and 2010s. On the subject of investors’ transition to crypto, the analyst says:

Do you really want to lose this revolution? Investors look forward to the future. This is exactly what I see. There are some sell offers on the exchange and below on cryptocurrencies like BTC.