Bitcoin starts the first week of December at a three-week high. Trading at $17,294, BTC price rose amid the battle of the bulls and bears. Last week, it closed a week at just over $17,000. After that, the cryptocurrency started to make the most of the relief in equities and the weakening US dollar. This week, the US will release inflation data for November. Keep your eyes on the dollar as the wounds of the FTX collapse continue to heal.

Will Bitcoin experience a “Santa Claus rally”?

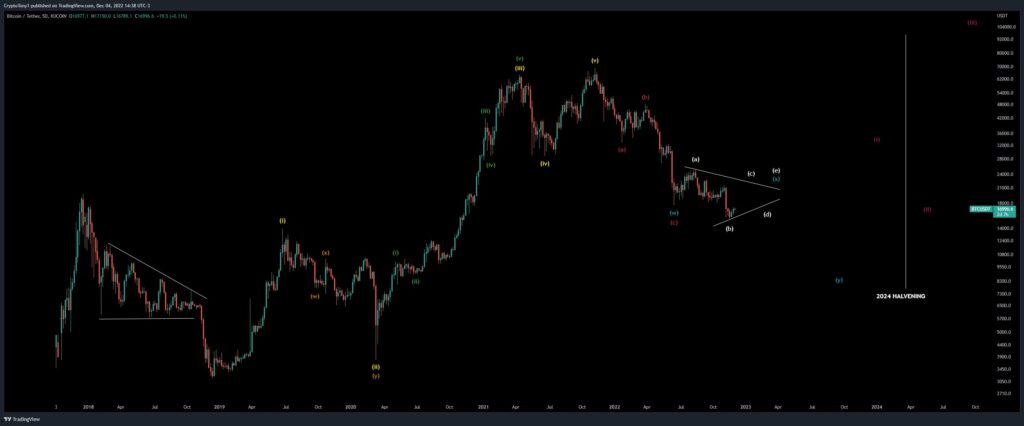

A slight relief for Bitcoin bulls this week comes in the form of a solid weekly close followed by a rise to several-week highs. Investors have several reasons to believe that BTC will approach $20,000. For example, Credible Crypto says that BTC has created a tight and nice consolidation. He then claims that the uptrend will continue even if a drop to $16,000 is possible. He is also supported by his friend Dave the Wave, who is a trader. The trader is expecting a “Santa Claus rally” for the cryptocurrency. According to others, the BTC bottom is extremely close.

However, not everyone is that optimistic. For the Crypto Kingpin, Bitcoin will rise to $18,000 before it starts to “fall”. He didn’t mention exact down targets but described the weekly close as “contradictory”. Another popular trader, Bluntz said, “The ongoing bullishness in BTC right now is part of an abc w4. According to him, the leading cryptocurrency will make a new drop below $ 15 thousand in the first quarter of 2023. Finally, Korinek_Trades predicted a relief rally for BTC and altcoins. However, he added that any drop would pull BTC to $12,000.

Beware of stocks

On December 13, the US Consumer Price Index (CPI) data, which is very important for November, will come. Meanwhile, the US Producer Price Index (PPI) and unemployment data later in the week are also important. The uncertainty of this data is keeping the crypto and stock markets tense for now. However, stocks that were calm after the FTX crash also have a bearish forecast in their correlation with BTC. Accordingly, Bitcoin may be avoiding on-chain effects. The most prominent prediction for equities came from Michael A. Gayed, author of The Lead-Lag Report. Gayed warned that a stock market crash was coming.

Bitcoin miners surrender in November

FTX bankruptcy is starting to show itself increasingly in the struggles of Bitcoin miners. Recent data showed a 30-day change in the amount held in miner wallets. Accordingly, the amount of BTC held by miners is at the most negative level since the beginning of 2021. Figures from on-chain analytics firm Glassnode come in the form of the Miner Net Position Change metric. As of December 3, miners lost a total of 17,721 BTC in 30 days.

According to additional data, the overall balance of miners declines even more sharply at the beginning of December. Miner balances fell from 1,828,630 BTC on November 30 to 1,818,303 BTC on December 3. This is a figure not seen since September 2021. The leading cryptocurrency lost 17% in November. “November was a terrible time for BTC miners,” said popular analyst Satoshi Stacker. He then added, “We are now in the midst of a huge miner capitulation.”

Bitcoin miner difficulty could see 17-month high

With Bitcoin miners under stress, network fundamentals are starting to reflect changes in activity. According to data from BTC.com, during the automatic realignment on December 6, mining difficulty will drop by an estimated 7.8%. The weeks following the FTX meltdown produced interesting changes in network engagement. Thus, analysts have suggested several reasons as to why fundamentals diverge from price action. According to one theory, Russia added a significant amount of hash power, even though miner profitability dropped significantly. This took a huge dip at the end of November following the FTX and BTC crash.

Sensitivity hovers above ‘extreme fear’ zone

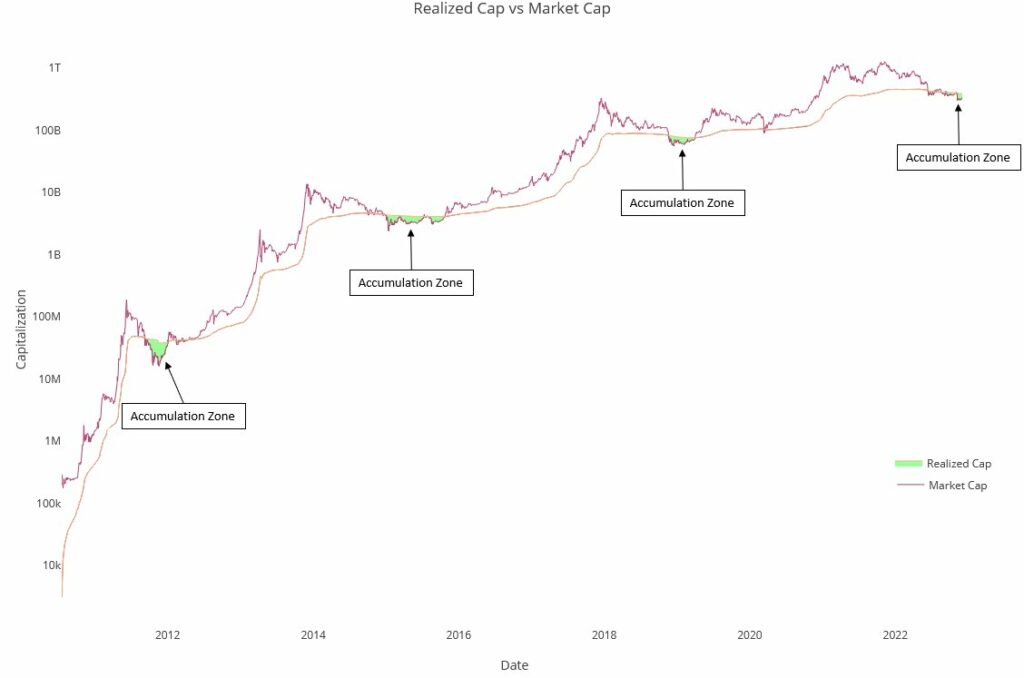

Bitcoin price action fends off further macro dips, while sentiment avoids volatility. The Crypto Fear and Greed Index remains slightly above the “extreme fear” zone. Falling in line with price following FTX, the index continues to recover modestly despite the general impression that new lows are coming. The realized and unrealized losses for BTC supply are reaching unprecedented levels, and the supply as a whole is in net loss according to the market-to-value (MVRV) metric.

Former FTX CEO Sam Bankman-Fried will attend several interviews

Bankman-Fried, the founder and CEO of the FTX exchange, which collapsed in early November, continues his round of apology. Bankman-Fried, who remained CEO until the collapse, will participate in several interviews this week. As we reported on cryptokoin.com, the FTX founder continues to claim to know nothing about mismanagement. He also continues to apologize for the bankruptcy of the company he runs on every show he attends. Right now, many investors want to see Bankman-Fried in court, and that could happen on December 13.

Effects of BlockFi bankruptcy continue, layoffs increase

Crypto lending platform BlockFi has filed for “Chapter 11” bankruptcy protection. According to his petition, more than 100,000 creditors, including Ankura Trust, FTX and the SEC, have both assets and liabilities between $1 billion and $10 billion. The first meeting for Chapter 11 took place on November 30. The next hearing will be on January 9, 2023. However, the wave of FTX and BlockFi continues to affect the market. Crypto exchange Bybit announced on Sunday that it has decided to cut its workforce as a result of the “deepening bear market”. Kraken and Metaplex have followed similar steps to Bybit.

Developments unfold in the Terra case in South Korea

Last week, the Seoul Southern District Court rescinded prosecutors’ orders for the arrest of several prominent Terraform Labs figures, including Chai Corp.’s CEO Daniel Shin. That doesn’t mean they’ve gotten away with it. They will not only be detained during the trial. Authorities are investigating how Terra’s collapse in May wiped out $50 billion from the ecosystem. They are also trying to figure out who is responsible for this. Meanwhile, the location of Terra’s other founder, Do Kwon, remains a mystery.

Follow us on Twitter, Facebook and Instagram and join our Telegram and YouTube channel to stay up to date with the latest news!