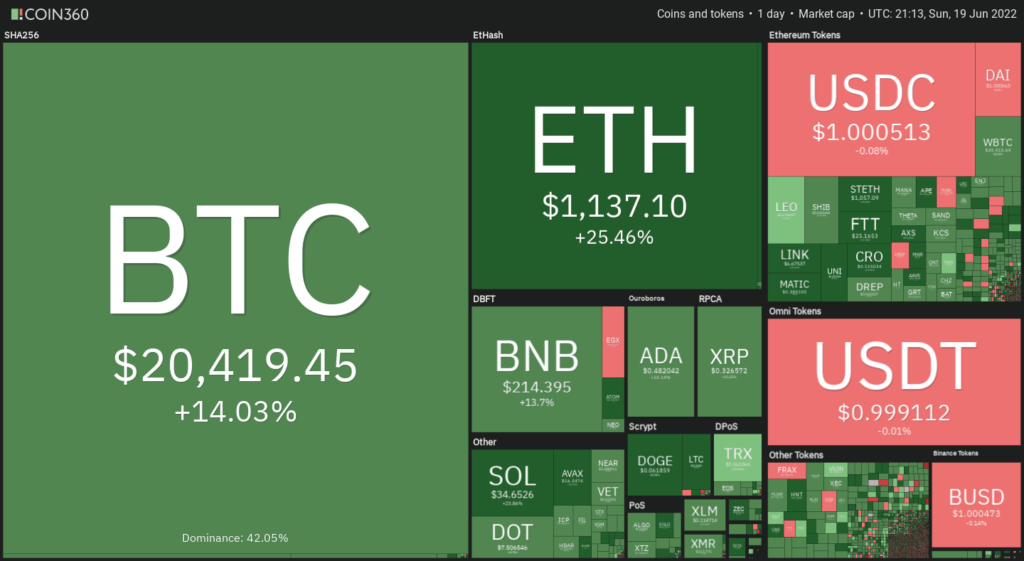

Bitcoin (BTC) dropped to $17,622 on June 18. This marks the first time in the history of Bitcoin and altcoin projects that they have dropped below the previous high cycle level. The Fed’s aggressive monetary tightening, a crisis at crypto lending platform Celsius, and liquidity problems at the Three Arrows Capital mutual fund are creating a sense of panic among traders.

How is the Bitcoin price?

Market commentator Holger Zschaepitz said that Bitcoin has fallen more than 80% four times in history. That puts about 74% of the current decline within historical standards. The previous bear markets ended just below the 200-week moving average, according to market analyst Rekt Capital. If history repeats itself, it is unlikely that Bitcoin will remain at current depressed levels for long. Coinglass data shows that Bitcoin’s 39% loss in June of this year is the worst since 2013. In fact, few investors expected Bitcoin to bottom out soon. However, crypto critic Peter Schiff said that the sell-off could continue and drop to $3,000. Can the bulls stop the decline in BTC in the short term? If that happens, let’s examine the top 5 altcoin projects that could outperform other cryptocurrencies.

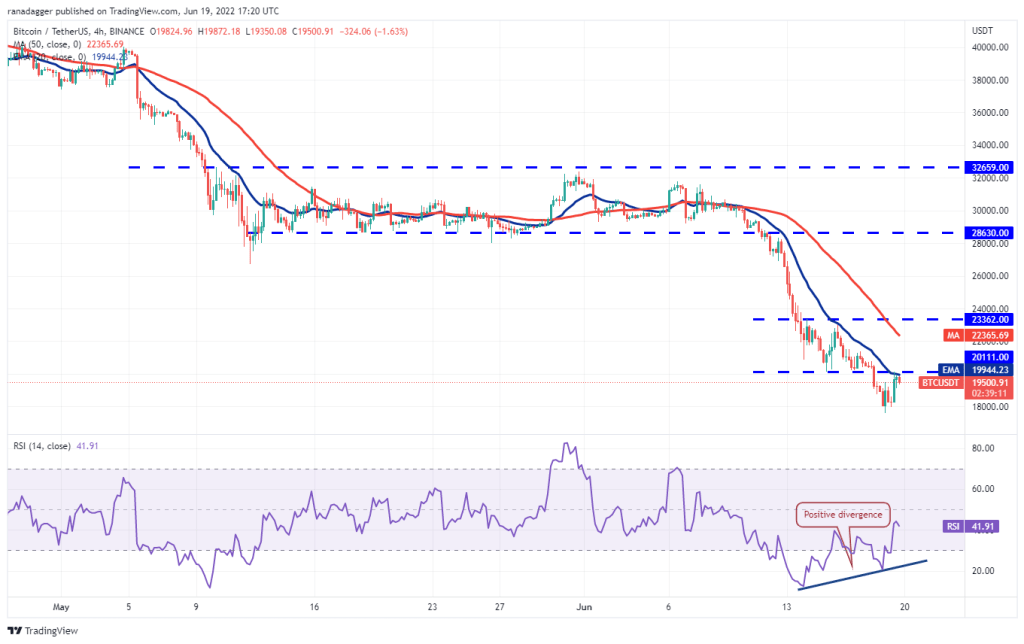

Bitcoin (BTC)

Bitcoin dropped below the critical support of $20.111 on June 18. Thus, it showed the resumption of the downtrend. The bulls buying bearish showed up on the daily chart as minor positivity. Buyers are trying to push the price above the $20.111 breakout level. If they do, it will suggest the June 18 drop to $17,622 could be a bear trap. It is possible for the BTC/Tether pair to rally to $23,362 in the future, where the bears could form strong resistance again.

The relative strength index (RSI) has been trading in the oversold territory for the past few days, indicating a relief rally in the near term. This positive view is likely to be invalidated if BTC price drops from $20.111. Additionally, it shows that the bears have turned the level into resistance, increasing the probability of a break below $17,622. The next support on the downside will be found at $16,000 and will trigger a drop in the altcoin markets. A positive divergence in the RSI indicates that the bears may be losing control.

The 4-hour chart shows the price returning to the 20 exponential moving average (EMA). This is an important level to watch out for for the bears as a break and close above it will push the pair into the overhead resistance zone between the 50-simple moving average (SMA) and $23,362. Conversely, if Bitcoin price fails to continue above the 20 EMA, it will indicate that the bears are active at higher levels. Sellers will then try to push the pair back to $17,622.

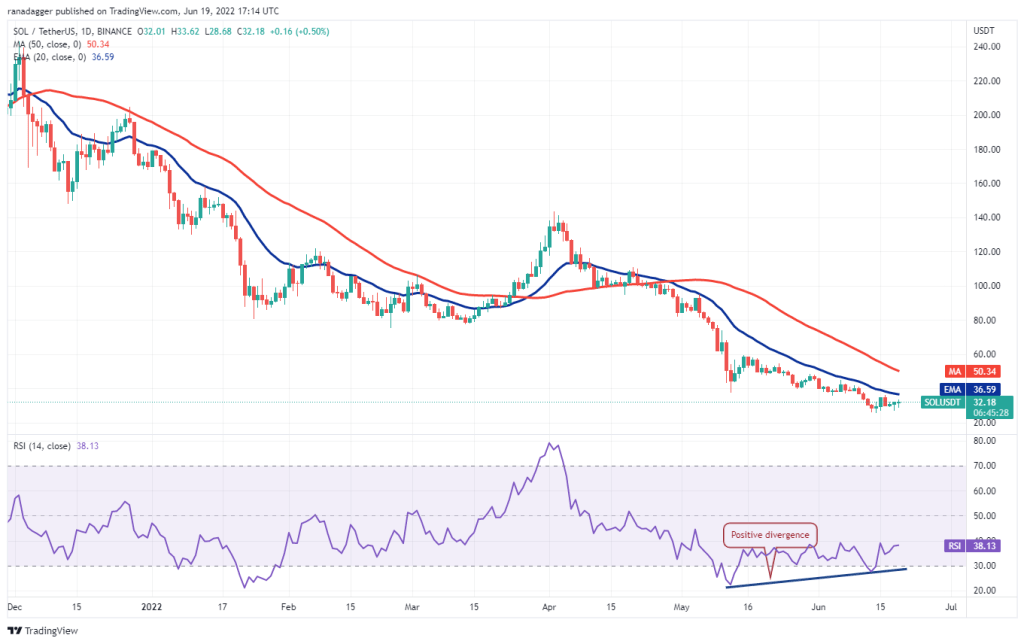

Altcoin Solana (LEFT)

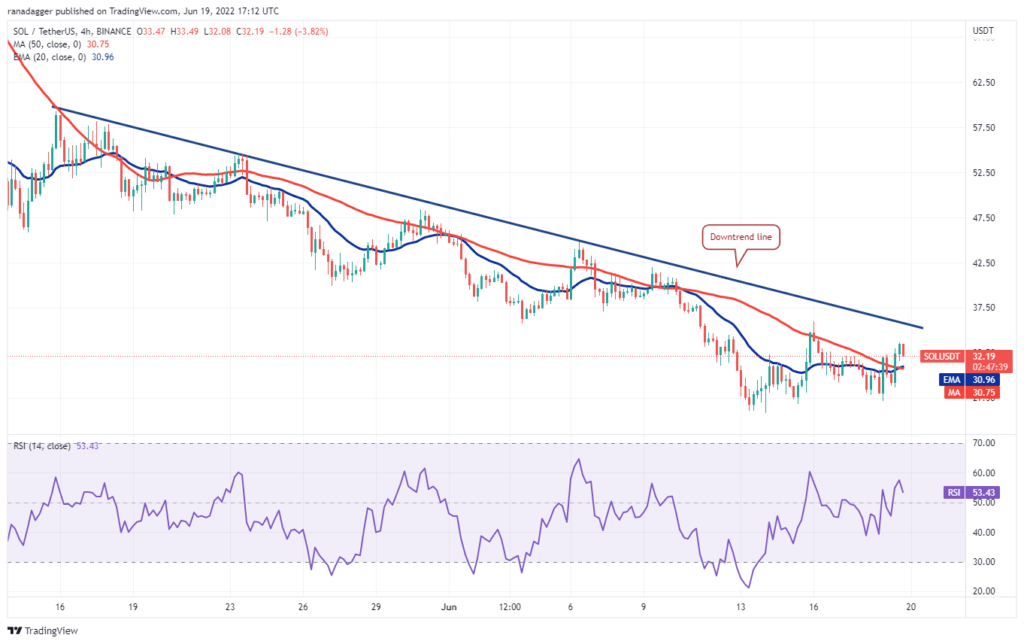

Altcoin Solana (SOL) is moving in a strong downtrend. However, the positive divergence in the RSI indicates that the bearish momentum may weaken. The bulls will try to push the price above the $36 20-day EMA. If this happens, it will indicate that the bulls are in a reversal. The SOL/USDT pair will then rise to the 50-day SMA at $50, where the bears will again form a strong defense. On the contrary, if the price drops from the 20-day EMA, it will indicate that the bears are not in a mood to give up their dominance. Sellers will then try to bring the price back below $25. Also this will start the next leg of the downtrend.

The bulls pushed the price above the moving averages on the 4-hour chart. Therefore, it will attempt to break through the general hurdle on the downtrend line. If they do, it will indicate that the downtrend may have ended in the short term. Buyers will then try to push the price to $42.50 and then to $45. Conversely, if the SOL breaks from the current level or below the downtrend line and breaks below the moving averages, it will reveal that the bears are aggressively defending the overall resistance. This will push the altcoin price to $27.50 and then to $25.

Litecoin (LTC)

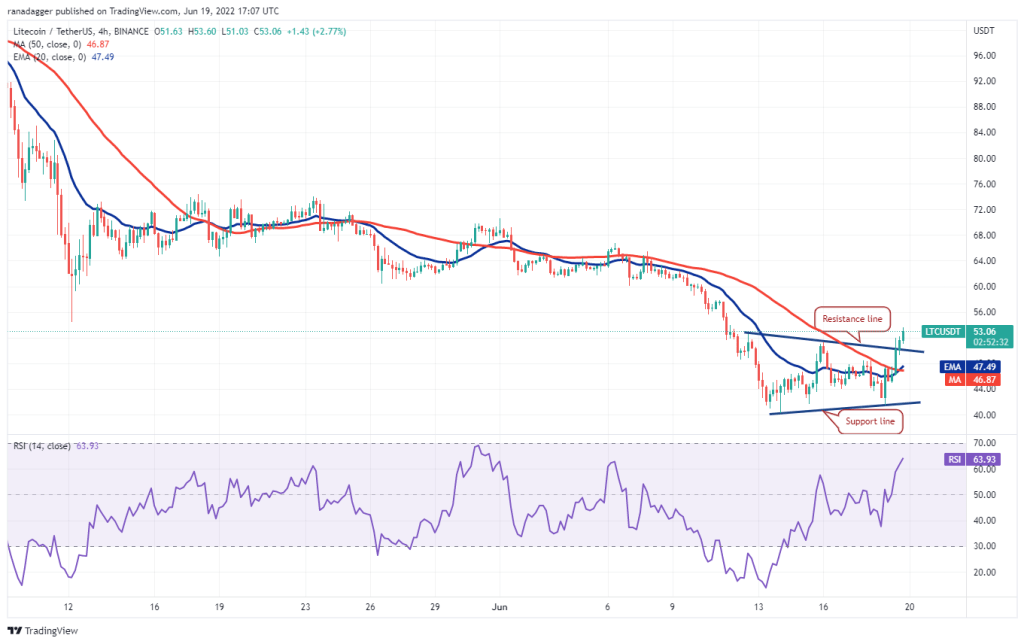

The bears tried to push Litecoin below the strong support at $40 on June 18. However, the long tail on the candlestick of the day shows that the bulls are defending the level aggressively. The recovery rally has reached the 20-day EMA ($55). This is an important level to consider. This is because a break and close above the level will suggest a potential change in trend. Accordingly, the LTC/USDT pair has the potential to rise to the 50-day SMA of $68.

Contrary to this assumption, if the price drops from the 20-day EMA, it will indicate that the trend remains negative and traders are selling on rallies. The bears will then start another attempt to push the pair below $40 and resume the downtrend. The price broke out of the symmetrical triangle shape on the 4-hour chart. This setup often acts as a continuation pattern. But sometimes it also indicates a possible reversal. The moving averages completed the bullish crossover, offering buyers an advantage. If buyers sustain the price above the triangle, the altcoin is likely to bounce back to the $62 pattern target. This positive view may become invalid in the short term if the price goes down and re-enters the triangle. Such a move would suggest that a break above the triangle could be a bull trap.

Altcoin Chainlink (LINK)

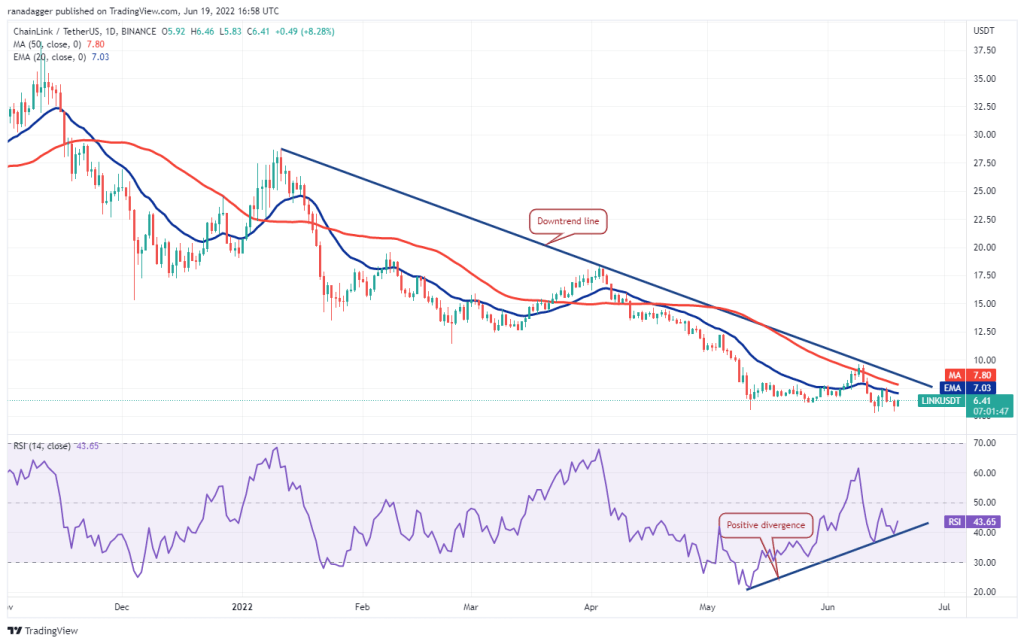

Chainlink (LINK) moves in a downtrend. However, the altcoin is attempting to bottom around $5.50. The bears pushed the price below this level on June 13, June 14 and June 18. However, they were unable to sustain lower levels. This indicates that the bulls are buying on the dips. The positive divergence in the RSI indicates that the bearish momentum may weaken. Buyers will try to push LINK towards the bearish line, which is likely to act as a stiff resistance. If the price turns down from the bearish line, the bears will again attempt to push the LINK/USDT pair below the $5.50 support. If this happens, it will strengthen the chances of a downtrend resumption.

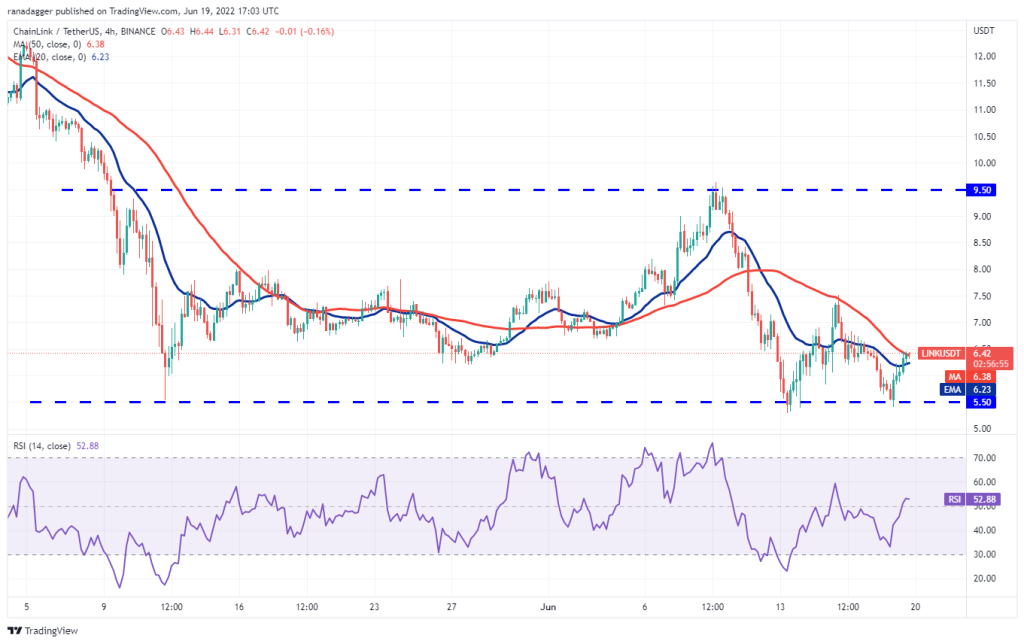

Alternatively, it is possible for buyers to push the price above the downtrend line. If this happens, it will suggest a potential trend change. Thus, the altcoin will have the opportunity to rise to $ 10 in the future and then to $ 12. The rebound in the pair reached the 50-SMA, which could act as a minor resistance. However, the 20-EMA is flattening and the RSI is near the midpoint. Thus, the possibility of bears losing control is getting stronger. If buyers push the Chainlink above the 50-SMA, the pair will rally to $7.51. A break and close above this resistance will complete the double bottom pattern in the short term. However, the model in question has a die target of $9.50. The bears will try to invalidate this bullish view. However, for such a trend flip, the bears would need to push the price below the strong support at $5.50 and hold it there.

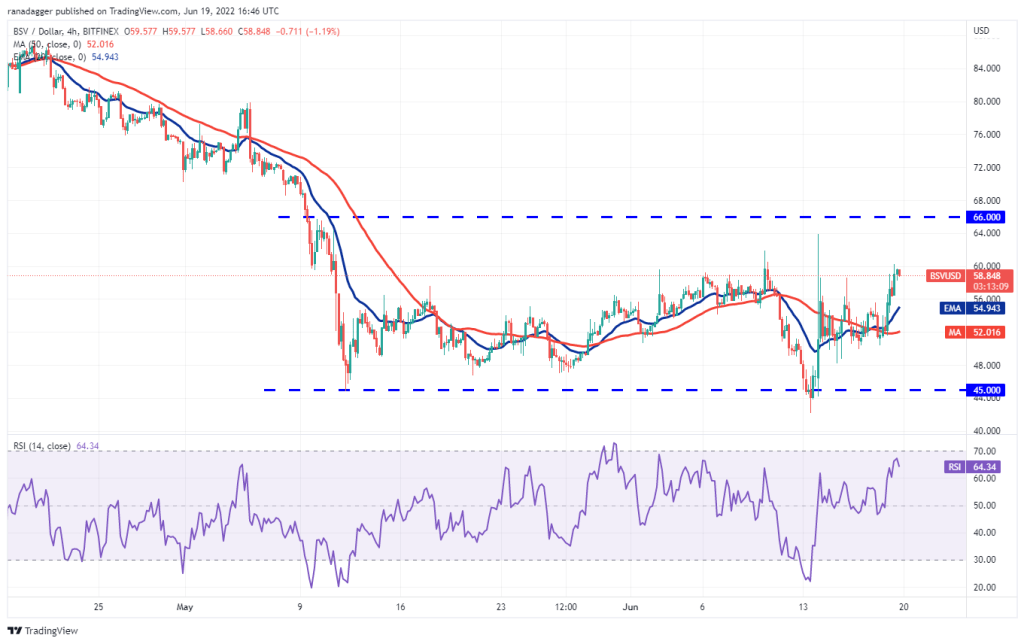

Bitcoin SV (BSV)

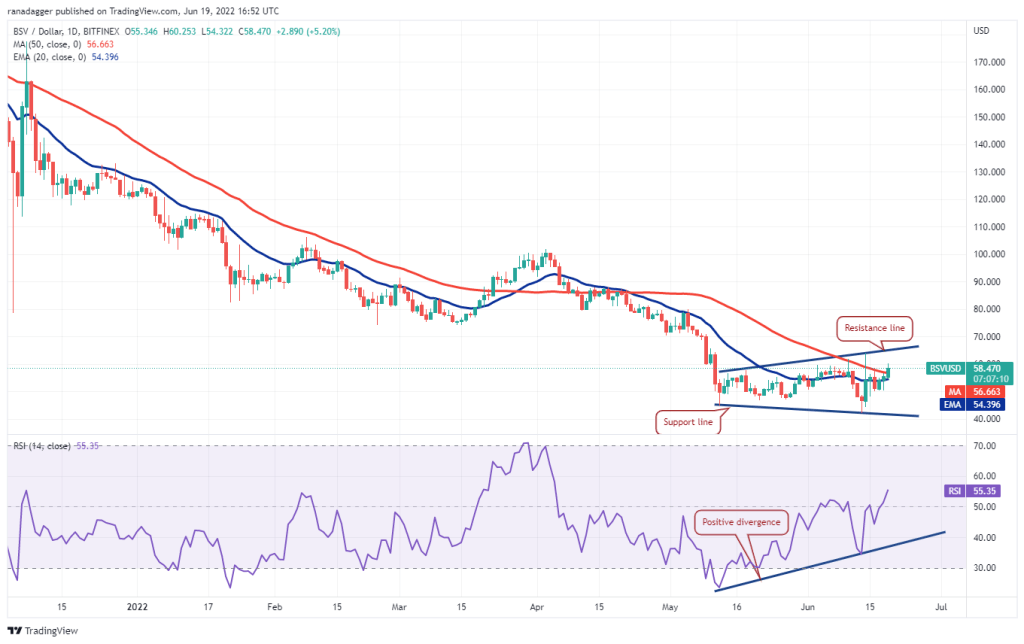

Bitcoin SV (BSV) has created an expanding pattern. Accordingly, buyers are trying to push the price above the resistance of the setup. The RSI is showing a positive divergence, indicating that the bearish momentum is weakening. The BSV/USD pair could rally towards the resistance line where the bears might try to stop the recovery. If this happens, it will indicate that the bears continue to sell in the rallies. Thus, it will allow to keep the pair inside the expanding formation for a while. Conversely, if the bulls push the price above the resistance line, it suggests that the pair may have bottomed out. The altcoin price will then have the potential to push the pair to $80 and then to $87. Thus, it will be able to initiate a new upward movement.

The 4-hour chart shows the pair trading in a wide range between $45 and $66. As we have reported on Kriptokoin.com, the bears’ attempt to push the altcoin price below the range has failed. Therefore, the bulls will try to push the price above the resistance. If the bulls are successful, it is possible for the altcoin to start a new bullish move. This setup will bring the price up to $87. However, another possibility is for the price to drop from $66. If this happens, it will suggest that the pair may remain range-bound for a while.