There seem to be divided opinions, as coupled with early signs that all is not well in the BTC price rally. As Kriptokoin.com, we have compiled the effective events of the week for you.

RSI ‘downtrend’ causes alarm

An additional chart of the Binance order book confirmed that the major bid support, known as the ‘offer wall’, had dropped to $23,460, providing room for the spot price to drop further.

Trader and analyst Matthew Hyland acknowledged that it is ‘really difficult’ to tell if Bitcoin can go higher in short time frames. Holding the zone around $22,800 in the event of a pullback and then key breakout, but “won’t surprise me” on the day, he said.

More concerned about the strength of the rally was Venturefounder, a contributor to the on-chain analytics platform CryptoQuant. In a Twitter thread, he warned that external factors such as “macro weakness” could have a sudden bearish effect on the crypto markets.

Venturefounder referred to the Relative Strength Index (RSI) metric, which measures how overbought or oversold an asset is at a given price point. In 2021, the RSI was rising against the BTC price correction and then ended with an all-time high of $69,000 in November of that year.

Eyes on FOMC minutes and US dollars

Time will tell how this ‘weakness’ in the macro markets will take shape. The coming week has far fewer potential macro triggers than the previous one, with a scattering of US data, including personal spending in the form of the Personal Consumption Expenditure Index (PCE).

However, the event on the radar of most crypto experts is the release of the minutes of the Federal Open Market Committee (FOMC) meeting at the Fed in February. This was where Fed Chairman Jerome Powell’s last benchmark rate hike was decided in anticipation of a moratorium on rate-raising policy, albeit theoretically. “We also have FOMC minutes on Wednesday where Powell will explain what a ‘pause’ in rate hike might look like,” Crypto Chase said.

https://twitter.com/mdtrade/status/1627527066689183744

However, not everyone is convinced that the FOMC minutes will be self-evident. Among them is financial market research resource Capital Hungry, which warned this week that “sneaky hawk revisions” could occur.

The reversal of inflationary trends will boost the strength of the US dollar, which spent the last macro trading day of the previous week erasing previous gains. Matthew Dixon, founder and CEO of crypto rating platform Evai, voiced the bearish scenario for the US Dollar Index (DXY) that there will be a bullish headwind for risky assets, including crypto.

200-Week Moving Average

The 200WMA, a classic ‘bear market’ trendline, has been acting as resistance since mid-2022 and BTC/USD remains below the level more than ever. Recovering the level would have marked a remarkable success, but so far all attempts have been met with utter rejection.

“If Bitcoin manages to rise above the increasingly probable 200-week MA cloud, we will see much more TradFi crypto coverage again,” said Caleb Franzen, market analyst at Cubic Analytics. Franzen also showed the aforementioned levels in the short term with the ceiling at $25,200 to break.

https://twitter.com/CalebFranzen/status/1627455479352901633

Bitcoin’s 50 WMA is currently at $24,462, coinciding with the current spot price focus. Additionally, the requests on the exchange order books are stacking around 200WMA, which increases the difficulties in converting it from resistance to support. In his research, published Feb. 18, Franzen described the WMA cloud as one of the ‘two main signals to add more bullish fuel to the fire’ alongside the actual price.

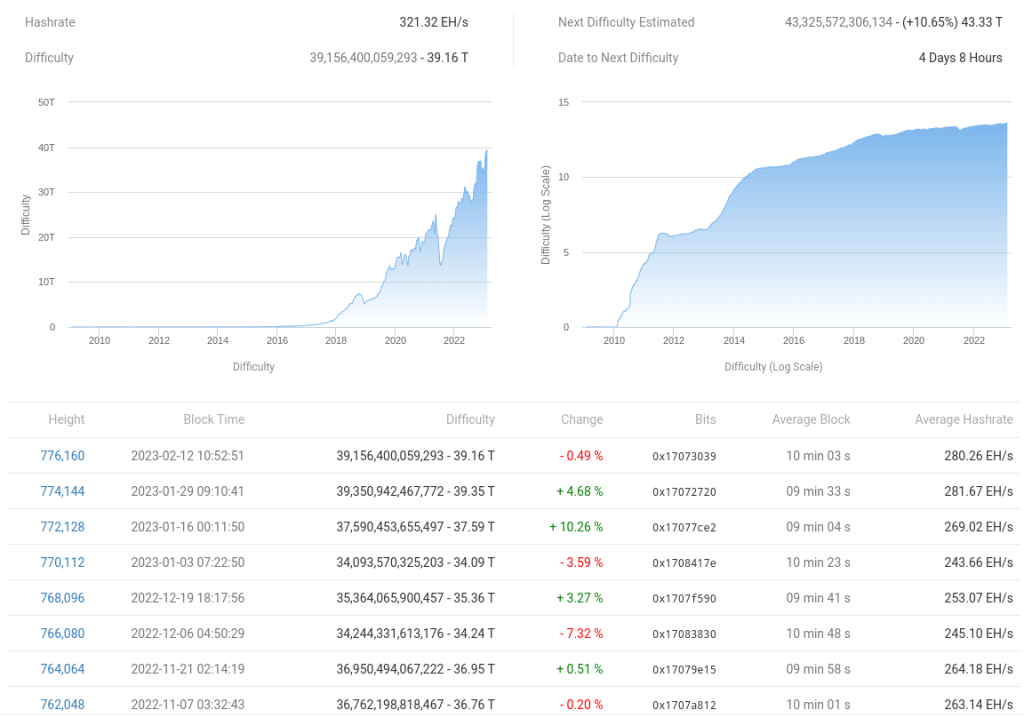

Hash rate hard to rank for new record highs

Bitcoin’s network fundamentals remain solidly bullish as the month draws to a close. The next automatic refactoring will have difficulty adding an estimated 10% to its current tally. This will cancel the modest drop of the previous refactoring to send the difficulty to all-time highs.

This is a very important metric for measuring Bitcoin miner sentiment, as such significant increases indicate corresponding advances in the competition for block subsidies. A clear recovery in miner profitability after months of pressure comes with increased coverage of so-called ‘rank’ fees.

Data from on-chain analytics firm Glassnode confirms this. Miners started holding more BTC than they sold on monthly timeframes, reversing the net selling trend from mid-January. Meanwhile, raw data from MiningPoolStats shows that the Bitcoin network hashrate also remains on an uptrend, staying above 300 exahash per second (EH/s).

Long-time Bitcoin market participants will remember the once-popular ‘price follows hash rate’ phrase, which assumes that a large enough hash rate spike has inevitable bullish implications for BTC price action.

To the top for BTC

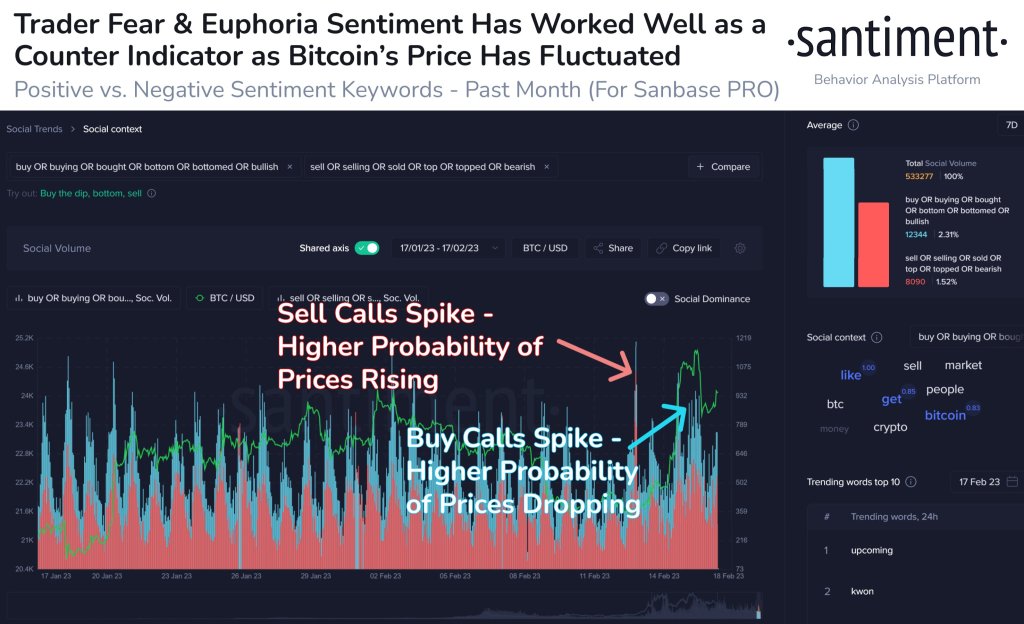

The latest findings from research firm Santiment show that crypto market sentiment has become very greedy around these few month highs. In a chart showing social media activity, he commented, “Bitcoin’s 8-month high yesterday came with a huge amount of enthusiasm.” This phenomenon is also seen in altcoins, and Santiment this month chooses Dogecoin as a prime example. The statement said:

“This pattern of social volume and extremely positive sentiment for Dogecoin perfectly illustrates how enthusiasm drives prices to the top. Whatever your view of DOGE, the exaggeration on this asset in particular has historically heralded market corrections.”

Meanwhile, the ever-popular Crypto Fear and Greed Index shows “greed” as the type of emotion that dominates crypto-wide this week.

The push to highs for Bitcoin coincided with a reading of 62/100 for the Index, marking new highs for BTC/USD hitting $69,000 in November 2021.

Important financial developments

- Monday, February 20: US markets are closed for the Presidents Day holiday.

- Tuesday, February 21 (5:45 PM CET)

- US Manufacturing PMI (Expected: 47.3 Previous: 46.9)

- Wednesday, February 22 (22:00 CEST)

- US Federal Open Market Committee (FOMC) meeting minutes

- Thursday, February 23 (14:00 and 16:30 CEST)

- CMB interest rate decision announcement (Exp. 9.00%, Previous 9.00%)

- US Gross Domestic Product (GDP) disclosures (Expected: 2.9% Previous: 2.9%)

- Statement of US unemployment benefits applications (Expected: 200k Previous: 194k)

- Saturday, February 25

- Unlocking ImmutableX (IMX) coin (worth $19.3M)