A survey conducted by BDC Consulting and published last week covered the bankruptcy of FTX. As a result of the survey, the price of Bitcoin is expected to decline from $ 16,387 on Sunday to about $ 11 thousand. As Kriptokoin.com, we convey the expectations of the participants participating in the survey to you.

Is Bitcoin price heading towards these levels?

Only one participant thinks that the BTC price will rise above $17,000 in the near term. However, there are also those who think that it will lose its value completely. About 21 percent of investors said the price would drop to $12,000. FTX was one of the centralized cryptocurrency exchanges.

Sponsored the Miami Heat arena in Florida. Collaborated with Larry David on the 2021 TV commercials that aired at NFL games. It is also stated that he is one of the second biggest supporters of Democrats in the last mid-term cycle.

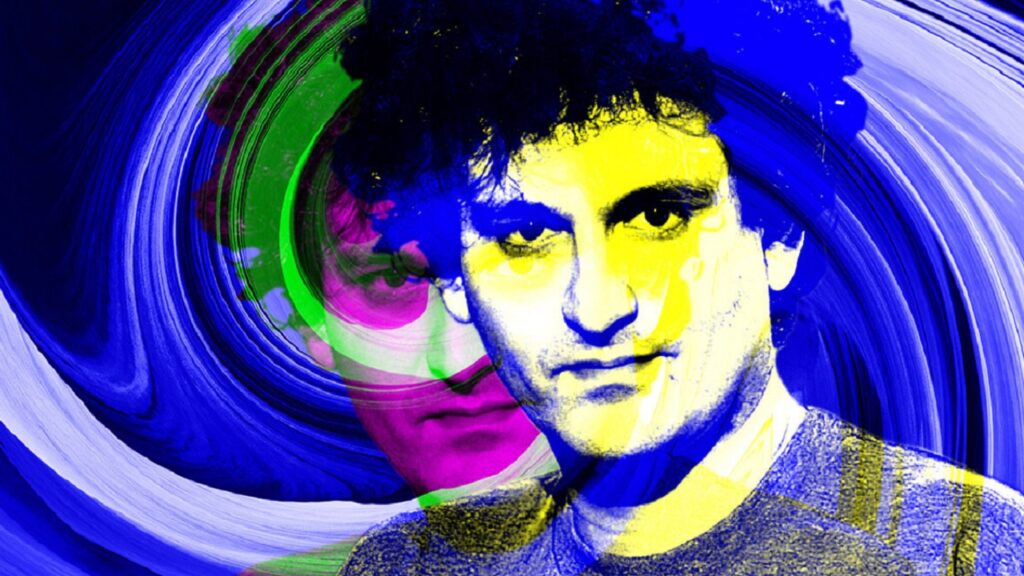

FTX has lost billions of dollars in funds from crypto investors. He then filed for bankruptcy protection on November 11. The well-connected former CEO SBF was once named the JP Morgan of his generation by CNBC star host Jim Cramer. With all of this, his net worth is listed as $17.2 billion as of September 27. Now he owes investors billions of dollars.

These names were fired after the resignation of SBF

Gary Wan, co-founder and chief technology officer of Bitcoin exchange FTX, Nishad Singh, FTX engineering director, and Caroline Ellison, who heads Alameda Research, were fired after Bankman-Fried resigned. John J. Ray, who oversaw the bankruptcy and liquidation of the politically connected energy investor Enron, will oversee the bankruptcy and liquidation of the companies.

The FTX crisis has been a warning to retail investors to keep their Bitcoins and other cryptocurrencies on exchanges. Cold wallets like Ledger Nano or Trezor reminded investors to check their cryptocurrencies.

Jim Cramer, former CEO of Bitcoin exchange FTX, spoke about SBF

Sam Bankman-Fried was known as the JP Morgan of his generation. However, CNBC star Jim Cramer once shared that he failed. In addition, a cold wallet is a physical device that stores cryptocurrencies that investors hold offline. Cold wallets are not connected to the internet. That’s why it protects cryptocurrencies from bankruptcy and hacking like FTX.

Many investors like to keep their cryptocurrencies on the exchange to make transactions easier. However, as seen in the past weeks, these can have serious consequences. After the FTX incident, the price of Bitcoin and the prices of other cryptocurrencies dropped significantly.

Although the exact number is unknown, investors who have an account or have a connection with FTX are victims. Simply put, the FTX crash was the equivalent of the Nasdaq going bankrupt. However, Apple investors traded on the Nasdaq will lose all their shares.

Nikita Zuborev, principal analyst at Russia-based internet service BestChange.com, said:

None of the seasoned crypto traders hold cryptocurrencies on exchanges longer than the situation warrants. Usually trading. Today, experienced investors withdraw their money and put it in a cold wallet, preferably more than one. This guarantees protection against any sanctions against your assets and stock market bankruptcies.

Investors will continue to trade on the stock markets

More than half of the crypto fund managers surveyed said they plan to increase their savings in the coming months. In addition, according to the information conveyed, no one states that they are selling it. A chart shows that DeFi has the safest market state. NFTs have not yet achieved this.

The BDC Consulting survey showed where crypto fund managers are most interested in investing right now. About 66 percent of respondents say they will expand their crypto portfolios next month. In addition, about a third said that they will not take any active transactions due to FTX:

Everything looks bad. Investors who bought cryptocurrencies this year are throwing the money away.

When will the Bitcoin price rise again?

Bitcoin has dropped more than 65 percent since the start of 2022. Blockchain, metaverse and NFTs altcoins suffered serious losses. Axie Infinity, once a favorite of the blockchain game investor, has quickly become worthless. It has dropped 93 percent since January. Solana, on the other hand, took a serious hit after FTX and fell by about 92 percent.

Gotbit CEO Alex Andryunin has this to say about altcoins:

Attention should be paid to altcoins such as Curve, 1inch, Uniswap, DAO Maker and Chainlink. The products of these projects provide an obvious benefit to the user. The collapse of FTX could be an excellent opportunity to invest at very low prices. However, close monitoring is required.

Despite the general panic, the BDC survey shows investors are long-term optimistic. For some long-term investors, the experience creates buying opportunities that BDC respondents say they will take advantage of in the coming months.

Are cryptocurrencies useless?

Robert Sharratt, a former investment banker and private equity investor, says crypto was “useless” before he created Fluid Finance, a global finance app that connects to a Web3 wallet for crypto storage. He tells crypto investors never to overlook the appeal of “user-controlled finance” of Bitcoin and blockchains:

Users can never directly control their funds in traditional finance and have no idea what happens to their funds once deposited. FTX was like a wolf in sheep’s clothing. They did allow crypto trading, but were nothing more than a black box database with no user control. Bitcoin is user-controlled. If at all, major failures like FTX should be positive for Bitcoin adoption.