Reporting a vulnerability in V2 pools on August 22, Balancer (BAL) addressed AVAX LST Liquidity Providers in a new announcement.

All LST liquidity providers on Avalanche (AVAX) are advised to withdraw their liquidity

Balancer recommended that all LST liquidity providers in Avalanche (AVAX) upgrade their liquidity, taking into account the recently discovered vulnerabilities. These include the BENQI, Yield Yak and GoGoPool protocols. Users need to upgrade to the new version as soon as possible. According to the Balancer team, the old version is currently insecure and contains security vulnerabilities. According to the details in the official announcement:

Regarding the recent vulnerability, all pools that have been increased to mitigate risks have been paused and will remain so. These pools have been discontinued and are SAFE. These will remain paused, however, and users are advised to switch as soon as possible. The Balancer UI will notify all users with step-by-step withdrawal instructions whether they have liquidity in the affected LPs.

https://twitter.com/Balancer/status/1694364098497253390

Balancer users have withdrawn $100 million in crypto since the warning

As we reported as Kriptokoin.com, the Balancer (BAL) team reported that it detected a security vulnerability in V2 pools in an emergency announcement yesterday. Balancer had to urgently tackle the critical vulnerability that could put tens of millions of dollars at risk. In their first move, the team advised some of their users to withdraw their funds from the protocol. In the period until the AVAX announcement, $ 100 million worth of crypto money was exited from the protocol.

Balancer’s latest estimate shows that 1.4% (about $10 million) of the total value locked is at risk. Balancer currently recommends that all LST liquidity providers on Avalanche withdraw their liquidity.

https://twitter.com/Balancer/status/1694014645378724280

What does the critical decision mean for AVAX?

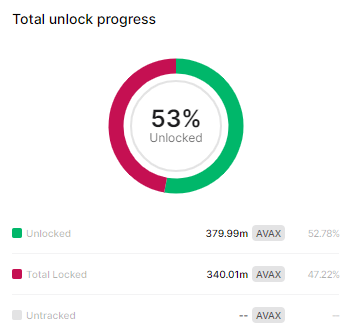

LST liquidity providers in Avalanche (AVAX) are currently busy withdrawing funds from Balancer. Meanwhile, AVAX price is preparing for the $100 million token unlock on August 26. According to TokenUnlocksApp, Avalanche last performed a similarly sized token unlock on May 28, 2023. Then, the Avalanche price fell 27% in just two weeks, from $15 on May 27 to $11 on June 12.

The price drop was further deepened by the FUD effect surrounding the SEC’s lawsuit against Binance and Coinbase. However, on-chain data shows that the August 26 AVAX token unlock could trigger a similar AVAX price downtrend.

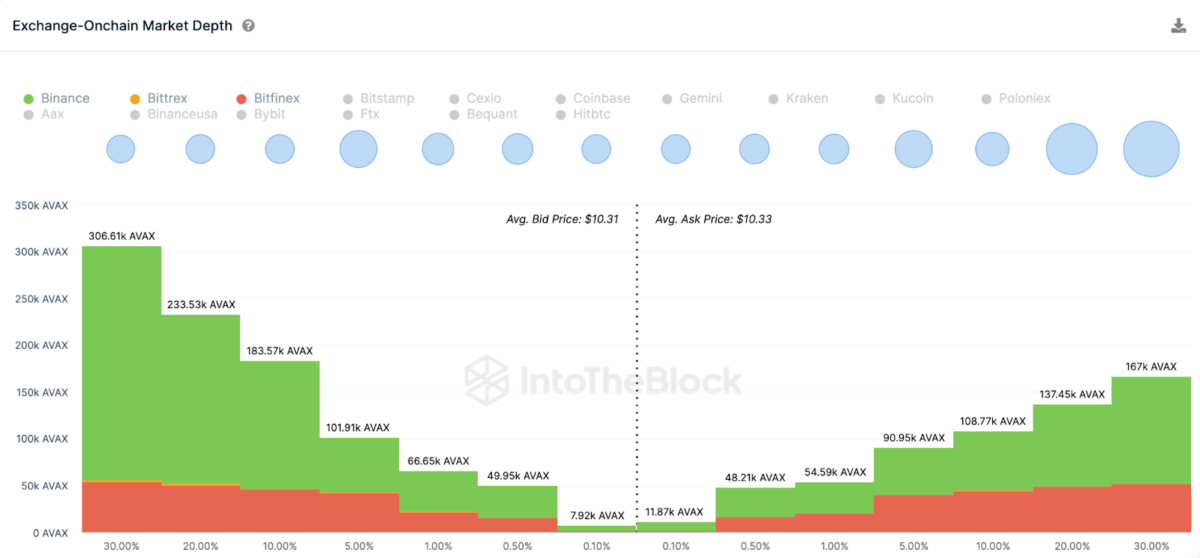

Meanwhile, Long-Term AVAX Investors have gradually sold only 100,000 Avalanches since May 28, according to IntoTheBlock data. On the other hand, strategic investors are waiting for bottom prices to buy. Currently, crypto investors have placed active orders to buy 950,700 Avalanche. Meanwhile, vendors only offered 618,840 AVAX for sale.

The AVAX unlocking of August 26, which we quoted as Kriptokoin.com, will be the main catalyst that will affect the price in the short term.