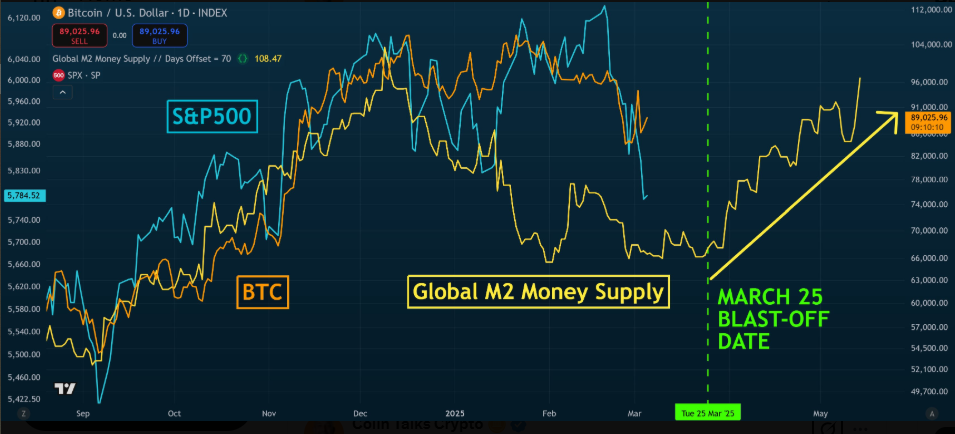

The latest assessments made by crypto analysts reveal that Bitcoin price movements are closely related to global M2 money supply. Based on this, they foresee potential rise acceleration for the crypto market in late March.

Global M2 Money Supply and Effect on Bitcoin

M2 Money Supply represents a wide measure of liquidity containing cash deposits and easily converted to money. Historically, Bitcoin showed a strong correlation with M2 fluctuations. Because the increasing liquidity in financial markets usually increases the demand for alternative assets such as crypto currencies. An analyst named Colin Talks Crypto pseudonym emphasizes this correlation by pointing to a sharp increase in the global M2. It describes this as a “vertical line ve in the graph and points to a close increase in asset prices.

It is estimated that the rally for stocks, Bitcoin and wider crypto market is expected to start on March 25, 2025 and last until May 14, 2025. In this context, the analyst said, “Global M2 Money Supply graph has just formed another vertical line. Stocks will be an epic for Bitcoin and crypto. ” says.

Bitcoin and M2 Money Correlation. Source: Colin Talks Crypto /X

Bitcoin and M2 Money Correlation. Source: Colin Talks Crypto /X“BTC price is following M2!”

Vandell, the founding partner of Black Swan Capitalist, supports that global M2 movements directly affect Bitcoin’s price. The decreases in the global M2 are usually followed by decreases in the Bitcoin and crypto money market after about ten weeks. Despite the short -term decline potential, Vandell believes that this cycle paves the ground for a long -term rise trend. In this respect, the analyst makes the following assessment:

As seen recently, when the global M2 fell, Bitcoin and the crypto follow it about 10 weeks later. Although more decrease is possible, this decrease is a natural part of the cycle. This liquidity change will probably continue throughout the year and prepare the ground for the next rise.

![]()

Michaël Van de Poppe: Bitcoins and Altcoins recover is only a matter of time before!

Similarly, another popular analyst Michaël Van de Poppe sees M2 expansion as one of the five basic indicators for an early market recovery. He emphasizes that inflation is no longer the primary focal point and the Fed’s interest rate reduction expectations have become more favorable for Bitcoin. In this context, the analyst makes the following statement:

As a result: Inflation is not the main issue, it will probably fall. Fed will make an interest rate reduction. The dollar will greatly weaken. Returns will fall. M2 supply will expand to a significant extent. And when this process begins, it is only a matter of time before the recovery of subcoins and crypton. So Taurus,

![]()

Historical Context and Projectings

The correlation between the price of Bitcoin and the global M2 growth is not new. Tomas, a macroeconomist, recently compared previous market cycles, especially in 2017 and 2020. At that time, significant increases in the global M2 coincided with Bitcoin’s most powerful annual performance. Analyst explains his observations as follows:

The money supply is expanding globally. The last two major global M2 increase occurred in 2017 and 2020. Both coincided with mini ‘everything balloons’ and the strongest years of Bitcoin. Can we see it again in 2025? This depends on whether the US dollar will weaken significantly.

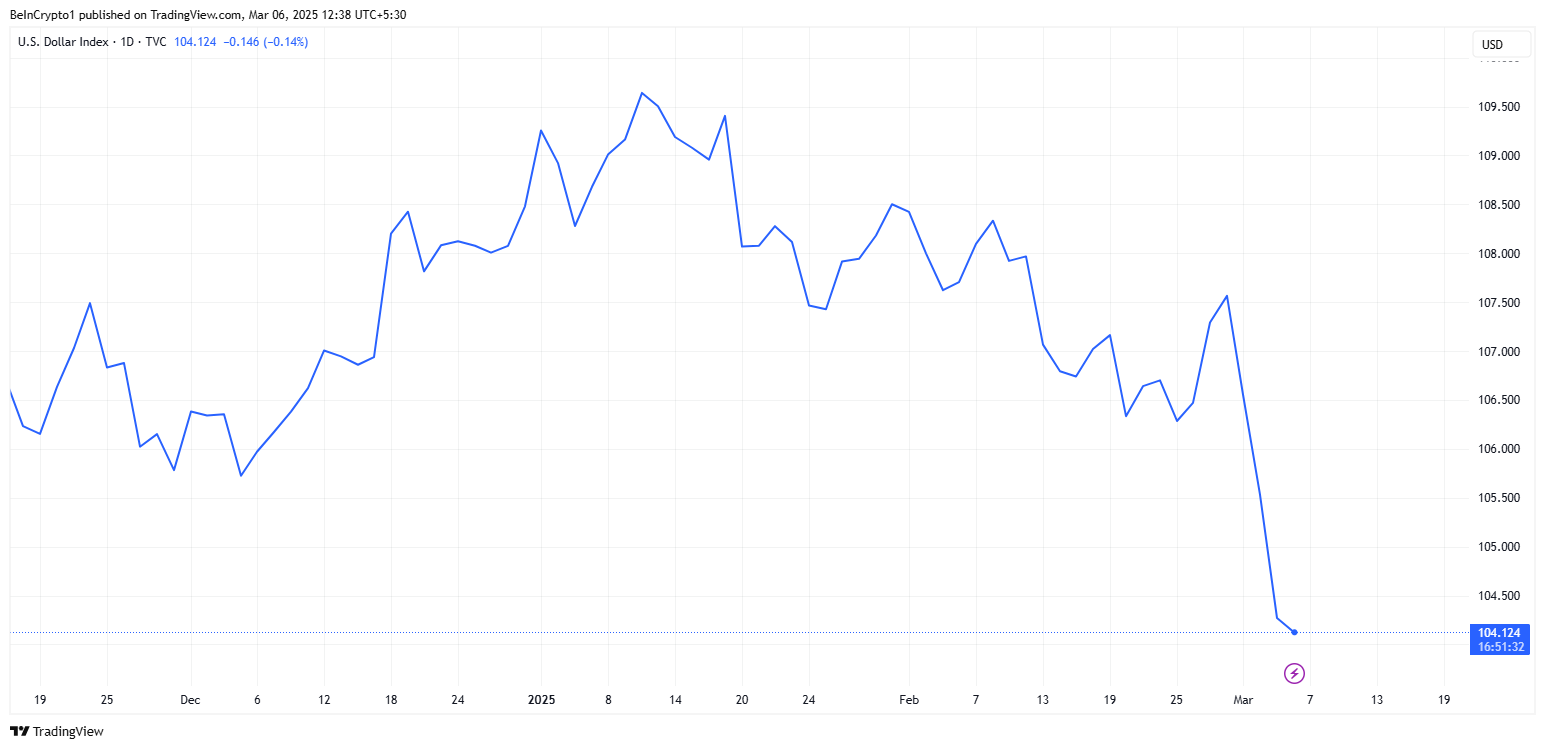

Tomas also emphasized the impact of the Central Bank policies, while large banks reduce interest rates, while the power of the US dollar pointed out that the power of the US dollar could be a limiting factor. If the dollar index (DXY) falls to around 100 or below, it can create conditions similar to previous Bitcoin bull runs.

DXY performance. Source: TradingView

DXY performance. Source: TradingView