In Goldman Sachs’ bearish macro view, Bitcoin (BTC) risks falling to $12,000. According to crypto analyst Yashu Gola, Bitcoin derivatives data shows that sentiment has shifted in favor of a massive crash.

Is Bitcoin in its ‘bottom phase’?

A team of Goldman Sachs economists led by Jan Hatzius raised their forecasts for Fed rate hikes. In this context, they updated their forecasts of 0.5% and 0.25%, respectively, to 0.75% in September and 0.5% in November.

The Fed’s rate hike path has played an important role in determining Bitcoin’s price trends in 2022. The era of higher lending rates has turned investors away from riskier assets. Along these lines, it has pushed to seek shelter and safer alternatives such as cash. As you followed on Kriptokoin.com, Bitcoin has dropped almost 60% year-on-year. It is currently hovering around $20,000 psychological support. Some analysts say that BTC has entered a ‘bottom phase’ at current levels. These include a trader nicknamed Doctor Profit. However, the trader warns:

Please consider the Fed’s next decisions! The 0.75% bps increase is already priced in. However, we see blood in 1%.

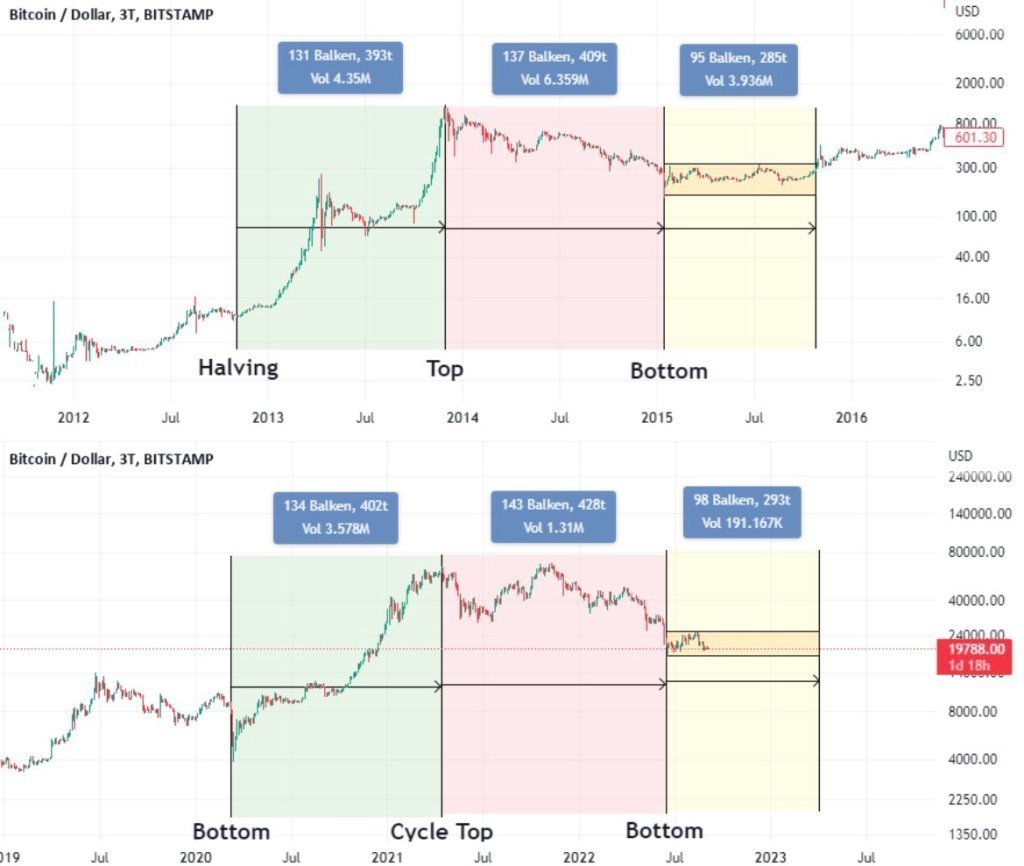

BTC price performance comparison between 2012-2016 and 2020-2022. Source: Doctor Profit / Trade View

BTC price performance comparison between 2012-2016 and 2020-2022. Source: Doctor Profit / Trade ViewOn the other hand, Bitcoin’s continued positive correlation with the US stock market poses deeper correction risks. Especially the correlation with the tech-heavy Nasdaq Composite. Goldman Sachs strategist Sharon Bell suggests that recent rallies in the stock market are likely bull traps. Hence, he reiterates his warning that stocks will likely fall 26% if the Fed gets more aggressive.

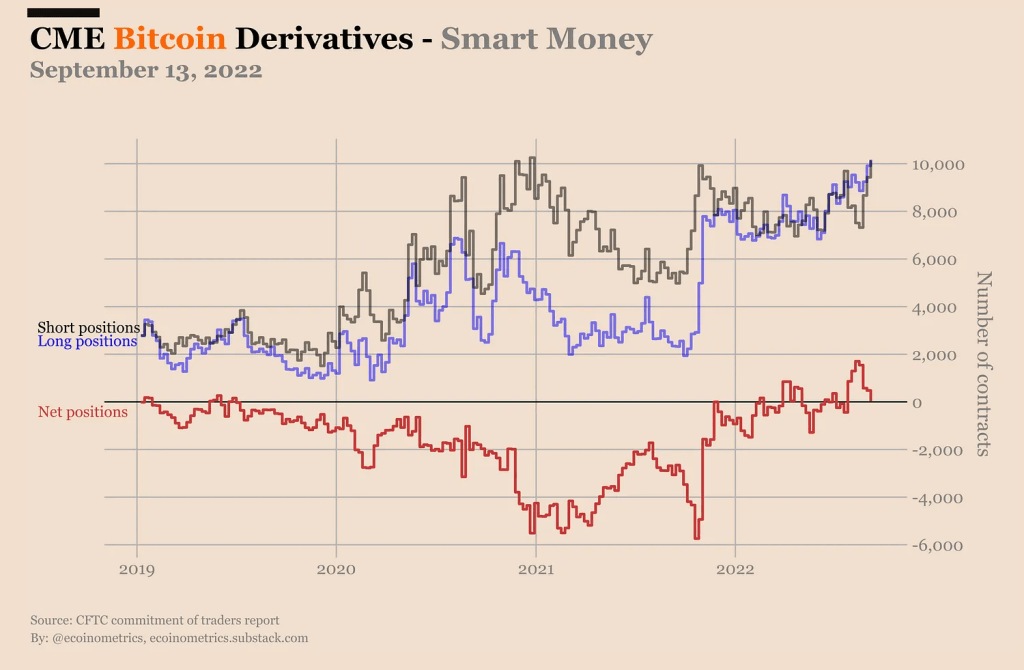

Interestingly, the warnings coincide with the recent surge in Bitcoin shorts held by institutional investors, according to CME data highlighted in the Commodity Futures Trading Commission’s (CFTC) weekly report.

CME Bitcoin derivatives held by smart money / Source: CFTC / Ecoinometrics

CME Bitcoin derivatives held by smart money / Source: CFTC / Ecoinometrics“It’s definitely a sign that some people are counting on a risk asset meltdown this fall,” says Nick, an analyst at data source Ecoinometrics.

Consensus on Options sees BTC at $12,000

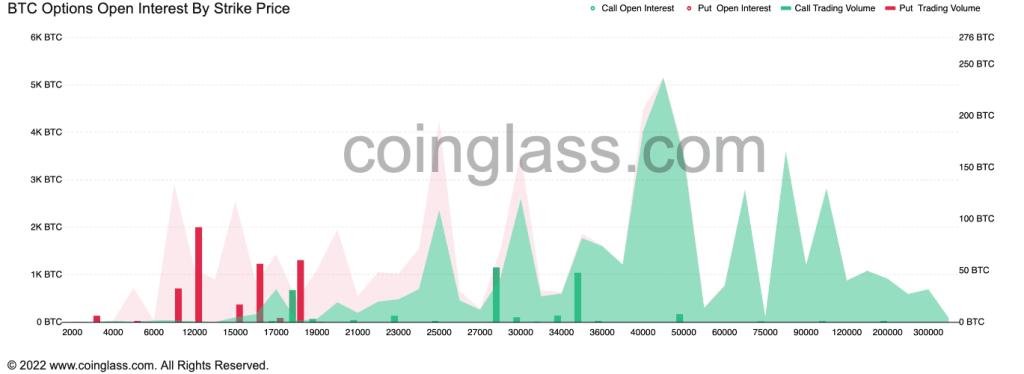

Yashu Gola analyzes the impact of options on BTC as follows. Bitcoin options expire at the end of 2022, with most traders suggesting that the BTC price has dropped as low as the $10,000-12,000 area.

Open interest for BTC options strike price / Source: Coinglass

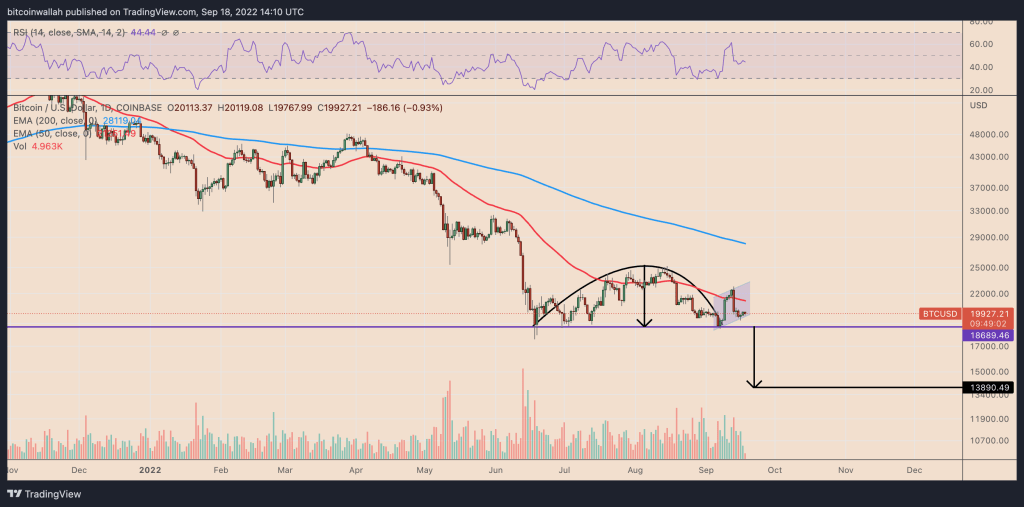

Open interest for BTC options strike price / Source: CoinglassOverall, the Call-Put open interest rate on September 18 was 1.90. Also, call options with a strike price of $45,000 carried the maximum weight. But strike prices between $10,000 and $23,000 showed at least four puts for every three calls. This is perhaps a more realistic, tentative assessment of market sentiment. From a technical standpoint, the price is forming a convincing upside-down and handling pattern. In this context, it is possible for the Bitcoin price to drop roughly 30% to $13,500.

BTC daily price chart with inverted ‘Cup and Handle’ setup / Source: TradingView

BTC daily price chart with inverted ‘Cup and Handle’ setup / Source: TradingViewConversely, a decisive rally above the 50-day exponential moving average (50-day EMA; red wave) near $21,250 would invalidate this bearish pattern. It is also possible that this could set BTC up for a rally towards $25,000 as the next psychological target.