Crypto whales are on the move as the cryptocurrency market continues to fluctuate. Two giant crypto whales dumped the native token of DeFi altcoin project GMX into Binance.

Crypto whales moved these altcoin tokens to Binance!

GMX is a decentralized spot and perpetual exchange that supports low clearing fees and zero price-impact transactions. Trading is supported by a unique multi-asset pool that earns liquidity providers fees from market making, clearing fees, leverage trading and asset rebalancing. Two crypto whales moved approximately $3 million worth of GMX tokens to crypto exchange Binance, according to on-chain data.

As you follow from Kriptokoin.com, token transfer to crypto exchanges is often considered a shot signal. GMX stands in the red zone on the weekly outlook, gaining 1.33% over the past 24 hours. The bearish trajectory of the altcoin project in the last few days also makes the whale movements more meaningful.

GMX weekly price chart / Source: CoinMarketCap

GMX weekly price chart / Source: CoinMarketCapThe first whale in question had 13,000 GMX ($1 million). This whale made a profit of around $760,000 as a result of the token sale. The whale’s profit percentage is about 200%, which is quite satisfactory. The other whale had 25,000 GMX (about $2 million). This whale, on the other hand, made a profit of approximately $ 300,000, gaining 25% from the sale.

GMX: Analysis of metrics

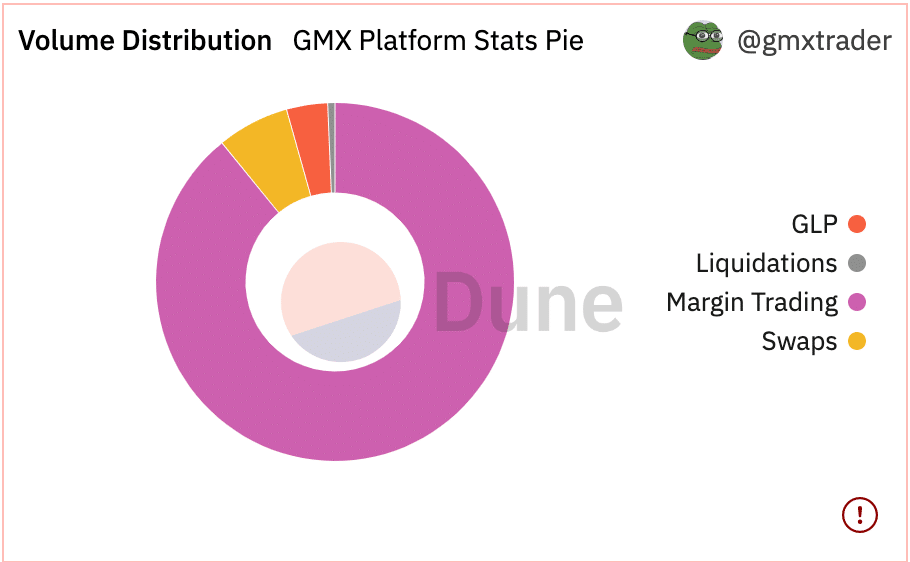

The high trading volumes of the GMX protocol can be attributed to several factors such as liquidations, swaps and margin trading. However, the biggest contributor to increased trading volumes is margin trading. Margin trading refers to a trading method where users can borrow funds from the platform to trade assets with leverage, potentially increasing their profits.

However, high margin trading can also increase the platform’s exposure to risk. Margin trading involves borrowing money to trade assets with leverage, which can result in significant losses if trades don’t go as expected.

Source: Dune Analytics

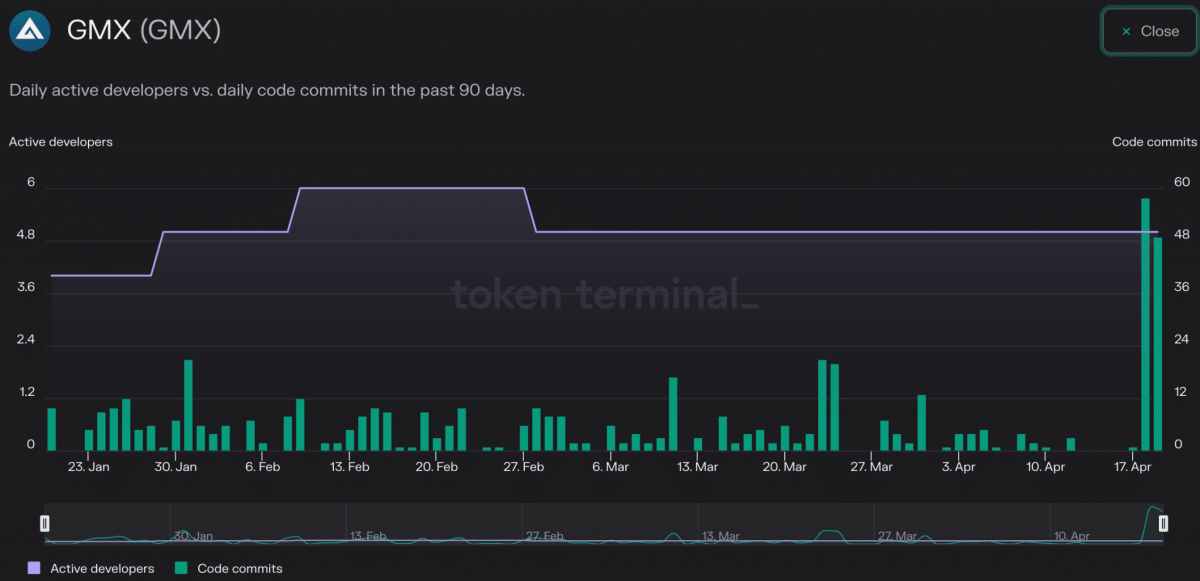

Source: Dune AnalyticsThe GMX protocol uses the increased revenue generated by higher fees to improve its infrastructure. According to data from Token Terminal, there has been a 25% increase in active developers and an 85.5% increase in code commits over the past few months. This shows that it has invested in the development of the platform and improved its technology to meet user demand effectively.

Source: Token Terminal

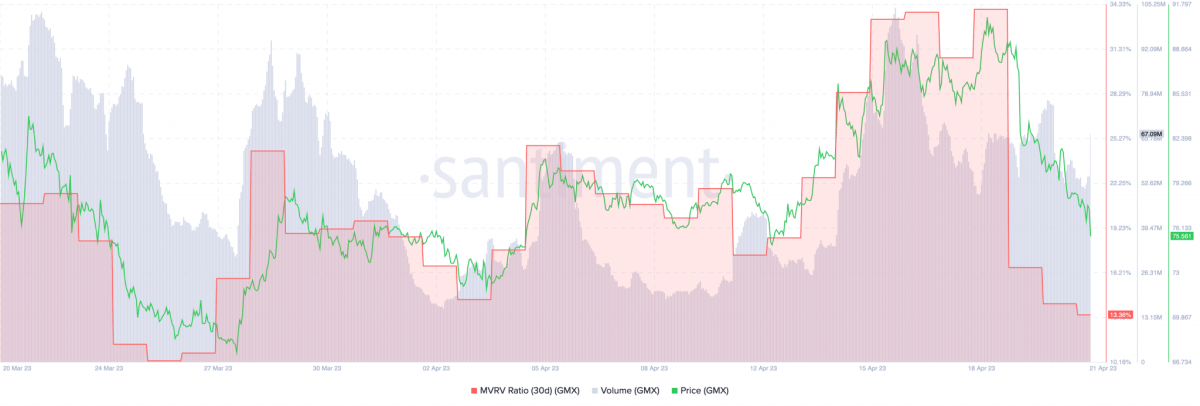

Source: Token TerminalContrary to the protocol, the token isn’t all that good. According to data from Santiment, the price of GMX has dropped significantly over the past few days. In addition, token volume also declined during this period. However, the overall MVRV ratio remained positive, suggesting that despite falling prices, there are still addresses that encourage selling.

Source: Santiment

Source: Santiment