The circulating supply of The Graph’s GRT token soars as Framework Ventures unlocks it. Prior to Framework Ventures’ on-chain actions, 99 million GRTs, worth roughly $7 million, had been sitting in The Graph’s staking contract since February and March 2021. Interestingly, the altcoin price went up after this huge unlock.

Huge token unlocked in altcoin project

The circulating supply of The Graph, a data query protocol for blockchains, jumped over 1% this week after startup backer Framework withdrew 99 million GRT tokens, valued at approximately $7 million, from The Graph’s GRT staking contract. Incidentally, this transaction was the address’s largest withdrawal ever.

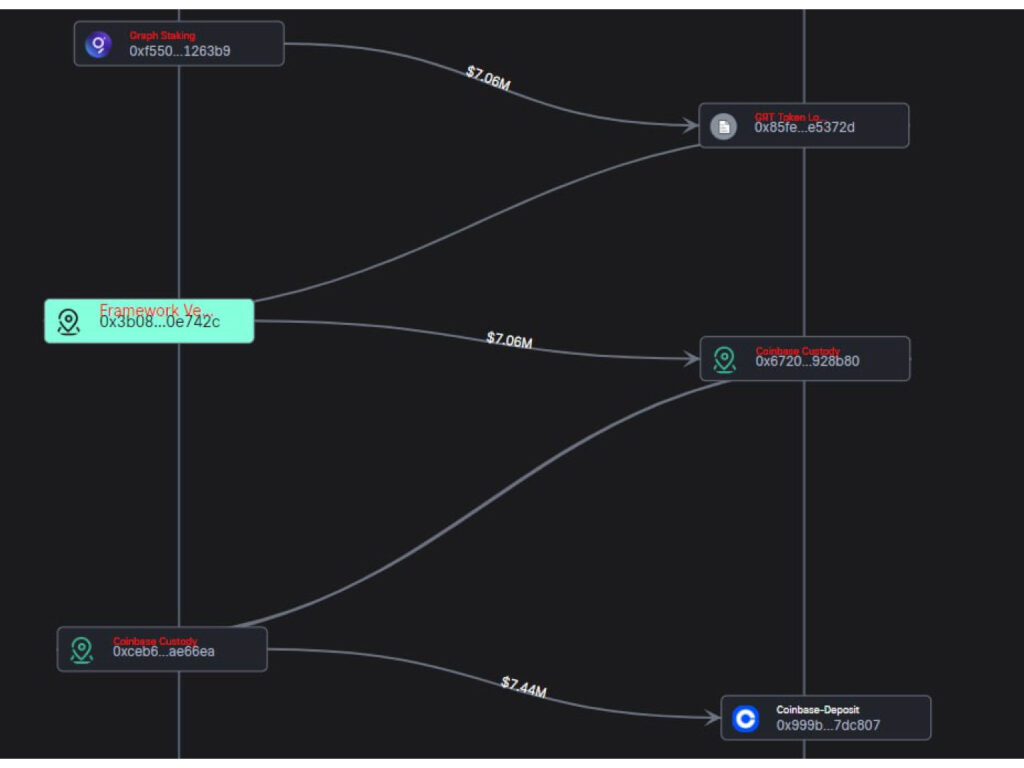

On January 9, Framework Ventures sent 99 million GRT worth approximately $7 million to Coinbase, just after The Graph triggered withdrawals from its GRT staking contract and token locking contract.

99 million GRT token movement / Source: CryptoQuant

99 million GRT token movement / Source: CryptoQuantAs we reported on cryptokoin.com, Framework Ventures pulled tokens from The Graph’s Token Lockup contract, increasing the circulating supply of The Graph’s GRT token, which is currently around 7.4 billion. Simply withdrawing their tokens from a staking contract may mean that the Framework may waive future staking profits.

How has the altcoin price been affected?

It’s impossible to know if the framework is selling GRT tokens on Coinbase. The fund did not make any statements until press time. According to Nansen, the number of GRTs transferred by Framework Ventures is among the top 10 GRT transactions in at least the last 12 months. Hochan Chung, head of marketing at CryptoQuant, said that a transfer of this size is “an enormous transfer, accounting for 1% of circulation”. Despite this, GRT has hovered around $0.07 since the January 9 transfers and there has been no significant downside movement. On the contrary, the altcoin price rose 3.65% today to $0.07511.

GRT daily price chart / Source: CoinMarketCap

GRT daily price chart / Source: CoinMarketCapThis is the second time the Framework is incentivizing transactions to withdraw from The Graph’s GRT staking contract and token locking contract, the first being on October 10 (tx1, tx2, and tx3). On January 9 at 23:38:35. UTC, a Framework Ventures wallet, has triggered a transaction to withdraw 99 million GRTs from The Graph’s Staking Proxy contract and secure a Token Lock contract. Framework then transferred the $7 million to a wallet it controlled and eventually sent it to Coinbase. Nansen had tagged every 0x address.

Framework Ventures was a major supporter of The Graph!

Meanwhile, it should be noted that Framework Ventures is a long-time supporter of The Graph. In the summer of 2020, The Graph raised $5 million in a token sale with Framework Ventures, Coinbase Ventures, CoinDesk parent company Digital Currency Group, and others.

According to Artemis Analytics, The Graph has 19 active developers who index and query Blockchain data. The GRT token is used to ‘secure and manage the network and encourage behaviors that are critical to the development of the network. Staking rewards on The Graph Network vary depending on which indexer or node operator a user decides to choose when staking GRT tokens. Estimated APR for the top 10 indexers by revenue ranges from 7.01% to 10.99% at the time of writing.

Framework co-founder Vance Spencer has previously spoken of the long-term buy-and-hold mantra for those he considers his fund a ‘really good team’. In an April 2021 episode of the ‘UpOnly’ podcast, “Our hope is basically to keep this going forever. Also, we probably do this with 90% to 95% of the Framework Ventures book,” he said.