Crypto exchange Gemini invested $113 million for multisig wallet SHIB Coin and 3 altcoins. This move by Gemini led to market speculation. The exchange made its highest bet on the leading altcoin Ethereum. The heavy bets have sparked debate about its potential impact on crypto prices in the coming days.

Gemini Multisig Wallet is betting big on these altcoins!

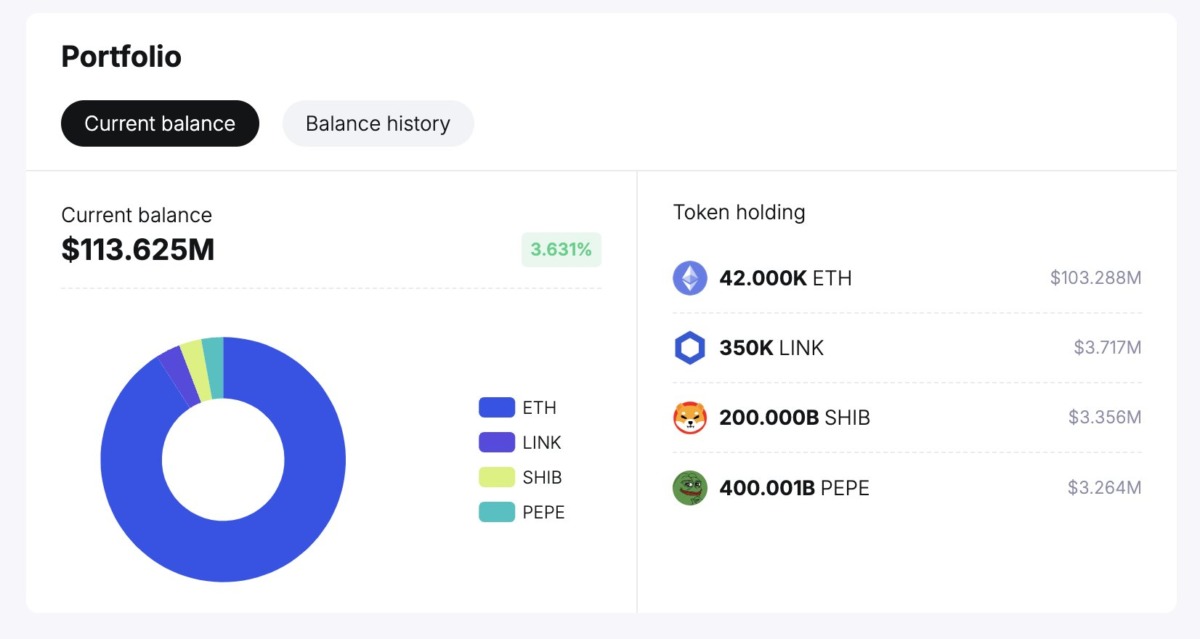

As you follow on Kriptokoin.com, the market continues its volatile course. Investors are taking a cautious stance ahead of the critical US presidential elections. However, there are also market players who prefer to bet big. The newly created Gemini multisig wallet is heavily invested in four altcoins, on-chain analysis platform SpotOnChain reported. The report reveals that this wallet received significant amounts of ETH, SHIB Coin, LINK and PEPE. For this, the stock market sacrificed 113,625 million dollars.

Taking a closer look at the report, we see that the exchange has the largest amount invested in Ethereum. Gemini spent $103.8 million to raise 42 thousand ETH, sparking optimism in the market. Additionally, he demonstrated his confidence in the altcoin industry by accumulating 350 thousand LINK worth $3.77 million. On the other hand, the wallet also seems to be shifting its focus towards the best meme coins. Notably, it added 200 billion SHIB Coins and 400 billion PEPE to its portfolio, worth approximately $3.39 million and $3.29 million respectively.

Source: Spot On Chain

Source: Spot On ChainWill PEPE, ETH, LINK and SHIB Coin prices rise?

Following the news of Gemini multisig wallet savings, SHIB Coin price increased by 3.62% to $0.00001693 today. The token’s trading volume increased by 19.5%, reaching $275 million. However, SHIB Futures Open Interest is down 1.15% at the time of writing. Meanwhile, some analysts are making ambitious predictions that SHIB will go to $1. Whether this is possible or not is a separate matter of debate. Simultaneously, PEPE Coin was trading at $0.000008171, up 2.4%. The token’s trading volume increased by 19% to $567 million. PEPE Futures Open Interests also remained near the flat line, indicating waning market interest. Additionally, a recent PEPE price analysis suggests that the coin could spark market interest by mirroring Dogecoin’s 2021 rally.

The leading altcoin increased by 1111% to $ 2,469. However, Ethereum Futures Open Interest fell 0.5% to $13.46 billion. Despite this, some analysts are pointing to a potential rally for ETH to $6,000. However, despite these developments, the LINK price is down approximately 1.66% today to $10.44. This altcoin price decline or muted trading suggests that investors may remain on the sidelines seeking more clarity on market trends in the coming days.