According to rumors circulating on Twitter, Ripple Labs plans to buy back 10 billion XRP from the market at its current price. Such a situation will have a direct impact on the altcoin price.

Ripple lawyers question the company’s move to buy 10 billion XRP

Recent allegations suggest that XRP-related blockchain company Ripple Labs plans to repurchase a staggering 10 billion XRP from its circulating supply. The allegations were questioned by several Ripple-related names. According to some, there are negative effects of such an effort. Ripple needs to sacrifice $5 billion for this buyback.

“I don’t believe the company will repurchase 10 billion XRP until I hear from Ripple,” wrote pro-XRP attorney John Deaton on Twitter regarding the allegations. Deaton’s suspicions also found support from another XRP lawyer, Bill Morgan, who delved deeper into the financial implications of the buyback. Morgan questioned the source of the $5 billion the company needed for the buyback.

Where are they obtaining the $5 Billion to buy it at its current price. Who would lend Ripple the funds, given the lawsuit, to buy back a token under a litigation cloud – unless there is another source of funding such as an IPO. https://t.co/N1iF0BDzhQ

— bill morgan (@Belisarius2020) June 25, 2023

Morgan also stated that due to the ongoing SEC litigation, Ripple will find funding immediately. Additionally, he suggested that obtaining the necessary funds may be difficult unless there is an alternative source of financing, such as an IPO. Meanwhile, XRP’s price movements have been showing complex back and forth movements over the past three months.

XRP about to surpass first quarter performance

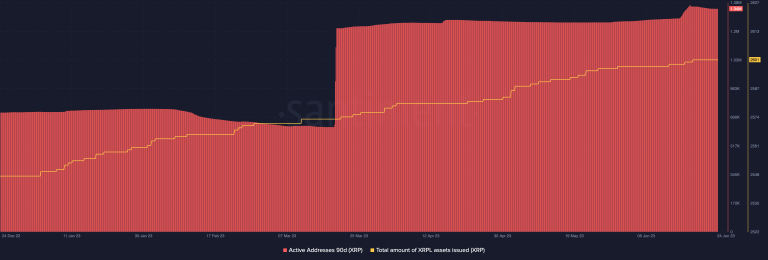

After its impressive first-quarter performance, XRP is on the verge of surpassing the records of the aforementioned period. However, this will depend on the project’s ability to maintain momentum around a range of on-chain activities. To begin with, XRP’s active addresses were mostly around 600,000 in Q1 and around 750,000 in Q1. However, as the last month of Q1 draws to a close, there has been a massive increase in the metric.

Like active addresses, the total amount of tokens issued on the XRP Ledger (XRPL) started to rise towards the end of March and the beginning of April. At the time of writing it was up to 2601.

These data show that activity on the XRP Ledger has improved from trading volume to wallet distribution and available liquidity. However, the price of XRP could be a stumbling block for overall performance as Q2 draws to a close. It should be noted that XRP price closed the first quarter on a high note above $ 0.5.

Which direction are altcoin investors betting?

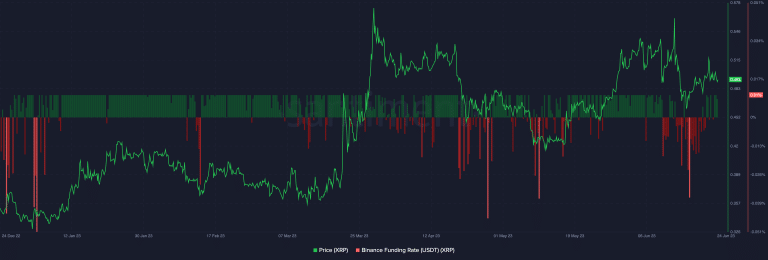

For the answer to this question, we can look at the funding rate of market participants. At the time of writing, XRP’s funding rate was 0.01%. This shows that long positions dominate and they pay short positions to hold their positions. Also, the continued payment of short-term funding fees can keep XRP’s trajectory up over time.

As we quoted as Kriptokoin.com, the SEC case is expected to be concluded before July 1st. Aside from the metrics, it will be the outcome of the legal battle that will be the main determinant for the XRP price.