As the month ends, large-volume Bitcoin options contracts expire today. Options have a notional value of $2.08 billion and $29,000 is critical. Can the BTC price drop when the contracts expire, let’s answer…

$2 billion worth of Bitcoin options contracts expire today

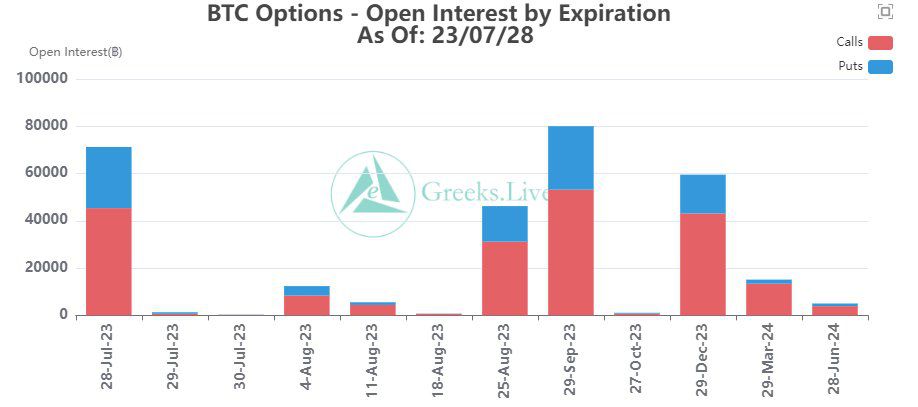

This week’s expiration has a notional value of $2.08 billion. This represents one of the biggest positions of recent times. The contracts’ maximum pain point is at $29,000. Bitcoin is currently trading pretty close to this level. The maximum pain point is the price level with the most contracts. It is also the level at which the most damage will be done when the contracts expire.

Today’s expiring BTC options contracts have a buy/buy ratio of 0.57. This means that the purchase contracts being sold are almost twice that of the purchases. The ratio is obtained by dividing the number of short seller contracts (puts) by the number of long seller contracts (calls). Also, values below 1 mean more purchase contracts. This usually indicates a bullish trend for the underlying asset.

Analysis channel Greeks Live noted that volatility remained low as Monday’s drop brought this month’s delivery price to its maximum pain point. “The expiration of the monthly deadline has not even brought much change in positions,” the report said. Whales are very careful when walking out the door. “Bears need to be more patient and simmer with time.”

How is the BTC price doing before the deadline?

Bitcoin price slumped to $29,140, down 1.15% on the day. Meanwhile, volumes have dried up and have remained at that level for most of this week. BTC failed to hold above $30,000 last weekend and did not revisit this price level throughout the week. This shows that resistance is very strong and an easier path for his next move may be down.

In terms of price prediction, we have included the long-term expectations of Mark Yusko, the founder of Morgan Creek Capital Management, in this article of Kriptokoin.com.

What does on-chain data say about BTC?

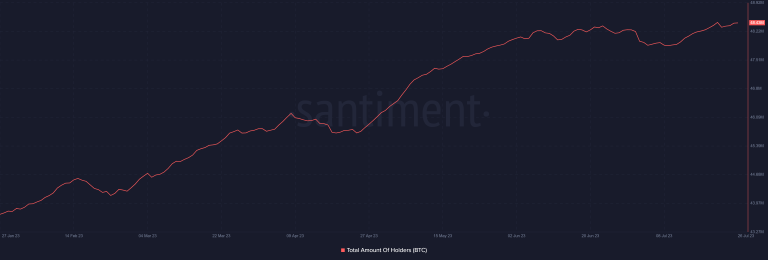

Recent data on Bitcoin has shown significant network growth at the moment. According to the data, monthly figures revealed higher activity when the average number of new wallets per month compared with the average number of new wallets per year.

Also, according to Glassnode, more than 1 million addresses were holding multiple Bitcoins, which is also on the rise. These trends indicated that BTC accumulation continued even as new addresses continued to emerge.

Earlier reports showed that Bitcoin was experiencing an increase in the number of new addresses joining the network. However, it was observed that there was no corresponding increase in the number of active addresses.