Grayscale, the manager of the world’s largest publicly traded Bitcoin fund, reported that the new DeFi fund, which includes three altcoin projects, has started trading.

Grayscale announces new DeFi fund with three altcoin projects

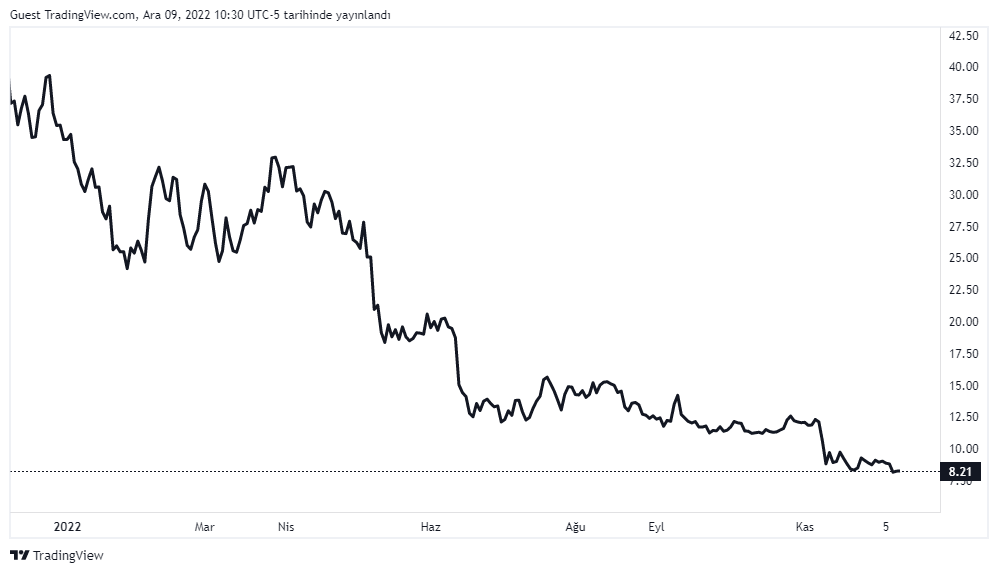

The “DEFG” fund, which started trading on the over-the-counter markets, comes at a time when the Grayscale Bitcoin Trust (GBTC) is trading at a record discount. The company, which offers crypto-focused investment products, reported that the new DeFi fund is now active. The start of trading for the new fund, abbreviated “DEFG”, was when GBTC shares were trading at a record 47% discount from the real Bitcoin price. Grayscale says he’s running his business as usual. But in recent weeks, speculation has surfaced among investors and on Twitter about the future of the fund. This is because it is a subsidiary of Digital Currency Group, which came to the fore with the news of bankruptcy. Likewise, Genesis is one of DCG’s parent companies.

Here are the altcoin selections of the new DeFi fund

Similar to Grayscale’s other investment vehicles, the new DeFi fund will monitor the price movements of a basket. These include Aave (AAVE), Uniswap (UNI), and Compound (COMP). According to the press release, the components of the fund will be evaluated quarterly. According to the announcement, this was Grayscale’s 15th cryptocurrency investment product traded on OTC markets.

GBTC trades at record discount

The GBTC price reached a record 50% reduction compared to the Bitcoin price on December 8th. The Trust product is the way investors stay to invest in Bitcoin through a traditional investment vehicle. GBTC is trading at a 47.3% discount, according to data from crypto index provider TradeBlock. Bradley Duke, CEO of ETC Group, made the following statements about the GBTC situation:

Too bad for GBTC investors that Grayscale’s Bitcoin Trust is currently trading at around 50% discount. It really highlights the huge differences in build quality between different investment vehicles.

The bearish trend surrounding confidence has deepened over the past few weeks after fears surfaced that crypto trading firm Genesis Global Trading, owned by Grayscale’s parent company Digital Currency Group (DCG), could file for bankruptcy. Following the collapse of FTX, Genesis announced on November 16 that it will stop customer withdrawals. The company said the lender’s decision to freeze withdrawals would be a matter of “weeks” rather than days.

Speculation on Twitter was that a series of liquidity problems at DCG subsidiaries could eventually lead to the liquidation of GBTC. It is also suggested that this will lead to massive Bitcoin crashes on the open market. As we quoted as Kriptokoin.com, Genesis owned a large amount of FTT.