The cryptocurrency market continues to struggle due to a negative economic outlook. Bitcoin (BTC), the largest cryptocurrency, has been sideways in the last 24 hours. It is currently trading at $19,141. It’s about 72 percent below the record level it set in November 2021. So, what levels will Bitcoin price see in the coming period? Direction up or down?

Santiment points to negative metrics

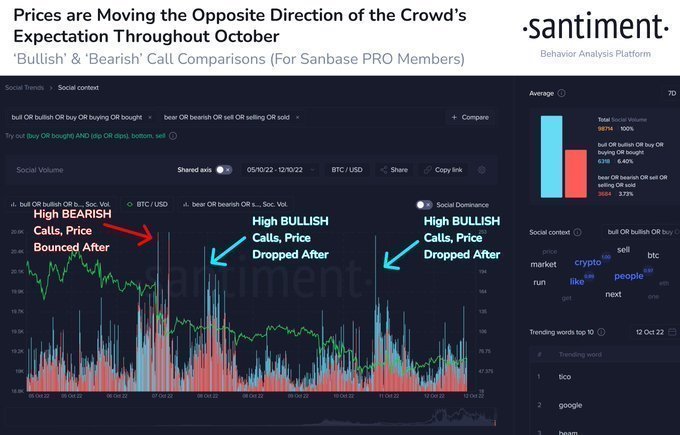

Cryptocurrency analytics platform Santiment says one key metric is bearish for Bitcoin (BTC). Santiment says that Bitcoin’s social dominance level is at 13.15 percent. According to the analytics platform, crypto prices typically start to rise when the social dominance level is above 20 percent.

Santiment also says that long-term traders are currently waiting for the social dominance level of BTC to rise again before potentially re-entering the market. The crypto analytics platform also noted that so far this month, crypto prices have been acting contrary to the prevailing market sentiment. According to Santiment, the extreme bearish sentiment is causing crypto prices to rise. On the other hand, the extreme bullish sentiment caused crypto prices to plummet.

Justin Bennett: Break is coming for Bitcoin price

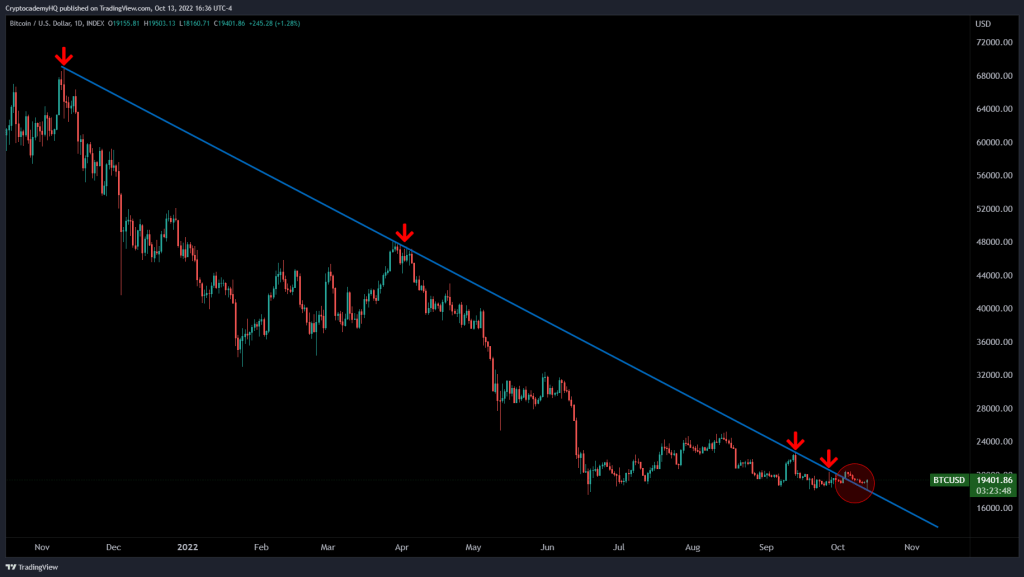

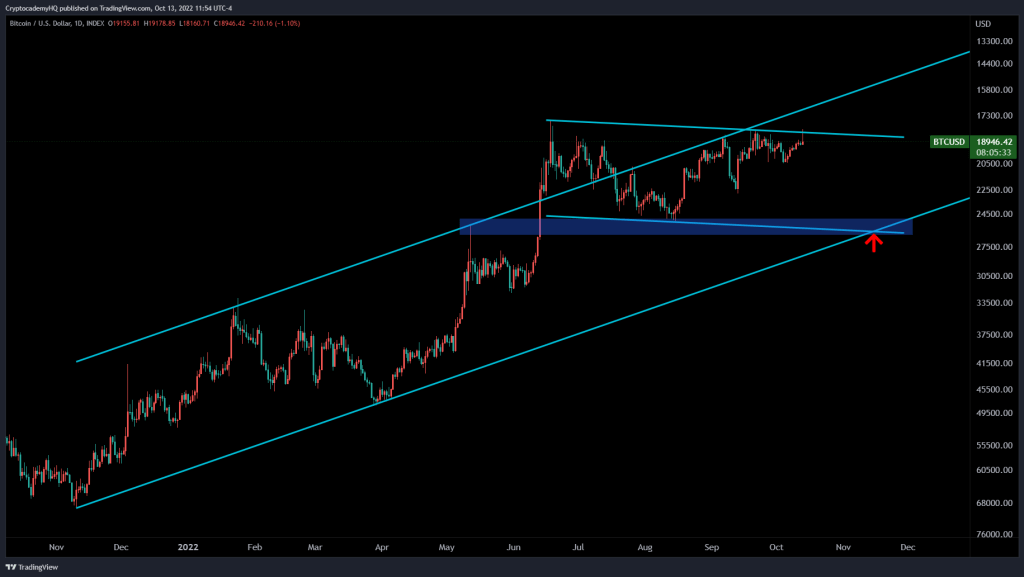

Justin Bennett, a closely followed crypto strategist and trader, shared his expectations for Bitcoin. Analyst Justin Bennett told his 109,800 Twitter followers that Bitcoin has successfully crossed a cross trendline that has kept the market bearish since November 2021. With the cross-resistance gone, Bennett thinks Bitcoin will rise to around $27,000. So he says he’s prepared for a rally of about 40 percent.

The analyst also looked at BTC’s inverse price chart. Traders sometimes do this to see a different perspective. Based on his chart, Bennett predicts that Bitcoin will reach its target by December 2022. But in the short term, the crypto strategist says that Bitcoin could still drop below $19,000 before it begins its rally. It indicates a liquidity deficit at $18,500. It is worth noting the expectation of divergence above $19,540.

The expert draws attention to the relationship between the stock market and BTC

Finally, Professor Jeremy Siegel of the University of Pennsylvania points out that the stock market is currently undervalued. He believes it will rise between 20-30 percent next year. He believes that the FED has dampened the enthusiasm in the market. The crypto market is strongly correlated with the overall stock market. Bitcoin in particular is strongly associated with the tech-focused NASDAQ-100. According to Coinbase Research, crypto assets are highly correlated with the overall stock market. Coinbase research also highlights that the crypto winter is mostly about the macroeconomic outlook rather than the crypto industry.

The Fed’s hawkish stance and raising interest rates caused a massive sell-off in the crypto market. However, this stance of the Fed brought with it the risk of recession. According to Siegel, the risk of recession outweighs the cost of inflation in the economy. He also emphasizes that if the Fed follows long-term trends, it will soon change direction.