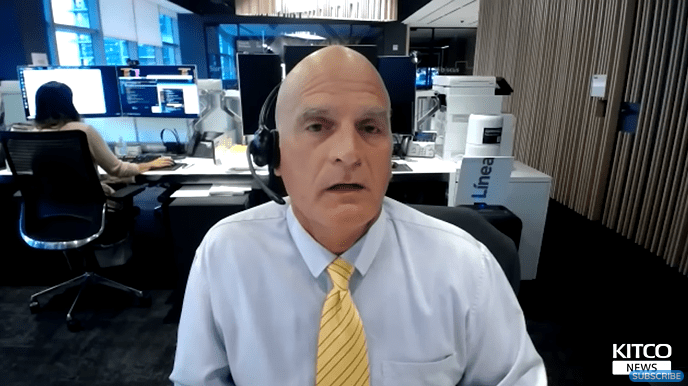

Mike McGlone, a senior analyst at Bloomberg, said that rising interest rates will end up worse than 2008. However, he predicted that 2 cryptocurrencies would peak during this time.

Mike McGlone expects ATH in these 2 cryptocurrencies during the crisis

“I think it will be worse than the 2008 fix, the big financial crisis,” McGlone said in a recent interview. The senior analyst has been renewing for a while that he finds the Fed’s monetary policy destructive:

The Fed started easing in 2007 and then they added massive liquidity. They can’t do this anymore.

However, McGlone predicts that Bitcoin and Ethereum will reach new heights as adoption increases. But he adds that this will only face one major fix:

Cryptos is the fastest horse in this race. Looking to the future, they will continue to appreciate, but for now… things are getting worse.

As you follow on Kriptokoin.com, McGlone said in the same interview that Bitcoin will exceed $ 100,000.

Fed policy and inflation

In response to high inflation, the Fed increased the key interest rate by 225 basis points for the year. The inflation rate in August was 8.3 percent, which is higher than the markets priced in, which McGlone blamed on the Fed’s earlier loose monetary policy. According to McGlone, wrong decisions force markets to fall:

The Fed now knows that they are somehow responsible for this massive inflation. It’s not going to slack anytime soon… Markets have to drop.

McGlone explained that the Fed has injected “too much liquidity into the market” in response to COVID-19, causing risk assets to appreciate:

The Fed won’t be easing anytime soon and… we now have the advantage of knowing the mistakes they made by easing too much. The pendulum of risk assets swayed too much to one side.

cryptocurrencies

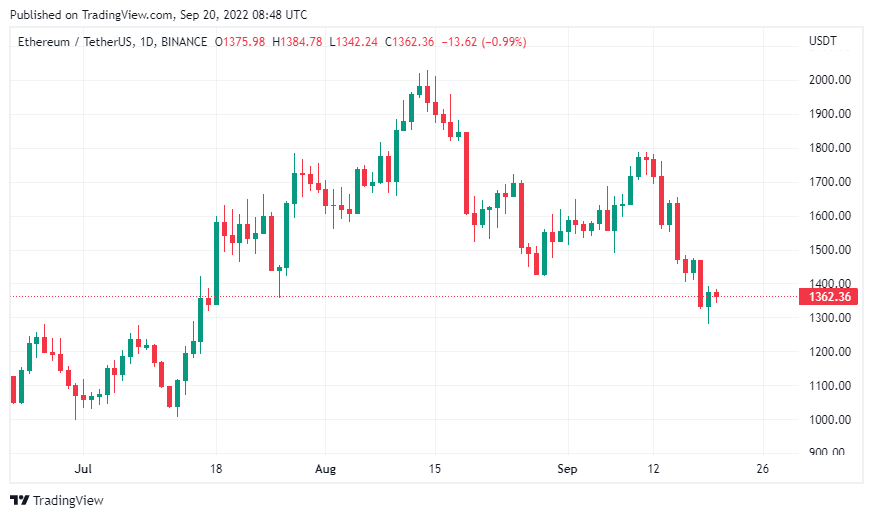

Ethereum has completed its highly anticipated rise since 2015. However, ETH price has been down since the merge was completed. McGlone says he expects further declines in the leading altcoin:

I’m afraid Merge got very angry. Ethereum price could rise to $1,000 or even drop a little more.

Over the next 5 to 10 years, McGlone predicted that Ether and Bitcoin would “go much higher,” but like all risk assets, the “Fed sledgehammer” would continue to hurt their value. McGlone had previously requested a price of $100,000 for Bitcoin by 2025 and told Makori that he was behind his call:

It’s only a matter of time before it reaches $100,000. By code, supply is falling, you can’t change that. Adoption and demand are appreciated… I think it will accelerate.