A robot with a history of accurately predicting the markets has released its latest altcoin portfolio and the results are astonishing…

Trading robot shared 3 altcoins

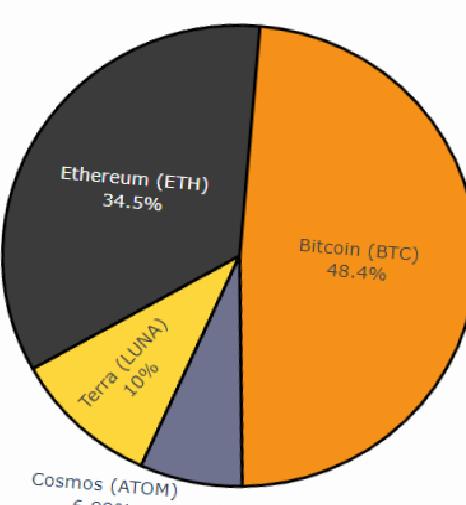

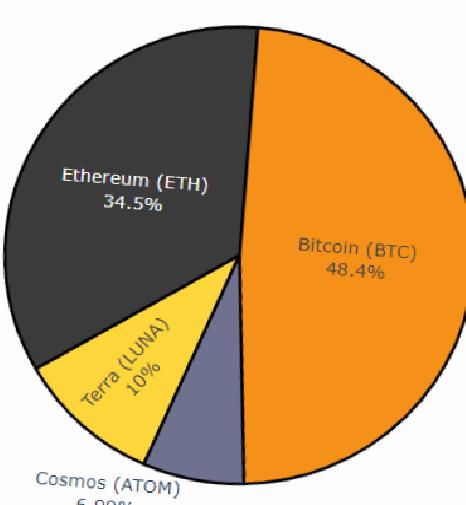

“Real Vision Bot”, weekly, algorithmic portfolio analysis collects and interprets cryptocurrency-related survey data to ensure In the current portfolio distribution based on the survey, Bitcoin (BTC) takes the lead with 50.1%, followed by Ethereum (ETH) with 35.1%, Terra (LUNA) with 9.4% and Cosmos (ATOM) with 5.37%. The portfolio created by the bot matches the results of the trader survey. Survey respondents are interested in the same four cryptocurrencies, BTC 48.4%, ETH 34.5%, LUNA 10% and ATOM 6.99%. The bot cites in a tweet that the increased use of cryptocurrencies in recent days shows that investors are looking for a safe haven in times of heightened geopolitical tensions.

Portfolio may be shaped by market conditions

The bot’s allocations this week are significantly different from the previous week, supporting the hypothesis that it could be a safe-haven game. Real Vision Bot reduced its BTC portfolio by 12% on March 7. This week, Bitcoin’s share has increased by about 30%. While there was a 13% decrease in ETH last week, it is seen that the week has increased by about 15%. Finally, the bot’s Terra allocation increased by about 3% a week ago, but is now down by about 13%.

Bitcoin held by long-term investors

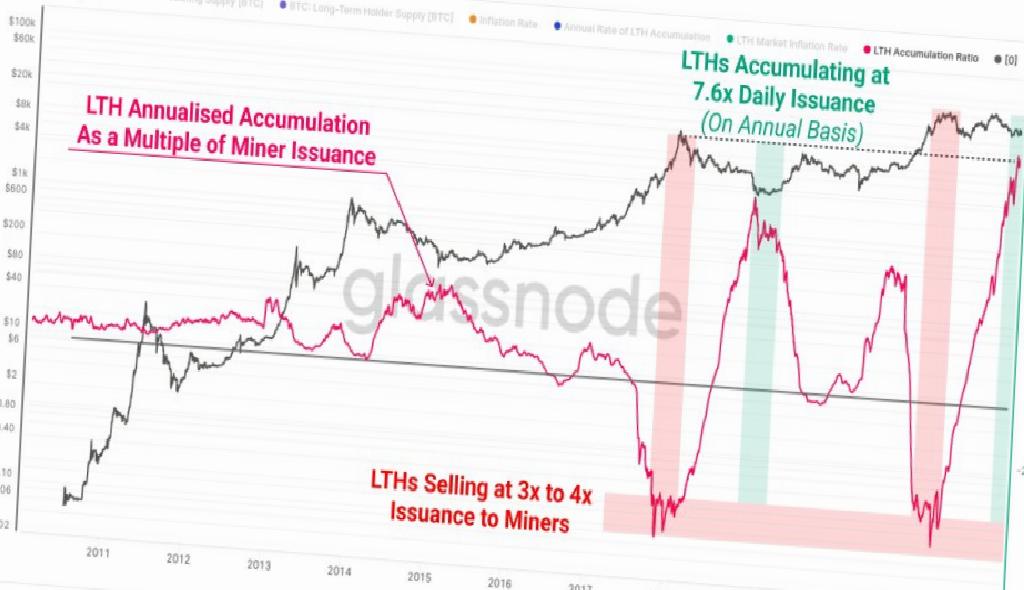

Current on-chain statistics provided by Glassnode, the probability of long-term investors selling their BTC after holding Bitcoin for more than 155 days He says that lower-ranking organizations are accumulating Bitcoin quickly.

In addition, Glassnode says that the Bitcoin inflation rate has dropped to -10.9% due to the heavy accumulation of long-term investors. Historically, an effective inflation rate of -14% to -15% has marked bear market bottoms for BTC, according to the analytics firm. Glassnode compares current data with past bear cycles:

Approaching historic lows that marked bear market lows in past cycles and another long-term constructive tone.