Singapore-based crypto hedge fund Three Arrows Capital (3AC) faces liquidation risks as it continues to sell altcoins. On Thursday, Three Arrows Capital traded 5500 stETH for 6.1 million USDT.

Three Arrows Capital continues to sell altcoins

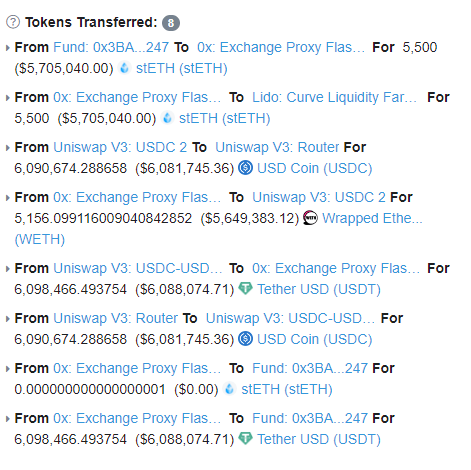

According to Etherscan data, one of Three Arrows Capital’s wallets exchanged 5500 stETH for 6,098,466.49 USDT on June 16. The hedge fund liquidates assets to repay loans while the top firms liquidate positions in the firm. Currently, the stETH balance of this address is approximately 14,118.

Recently, Three Arrows Capital announced that Ethereum (ETH) on June 14 after Lido’s equity stakes fell in secondary markets. for $33 million worth of stETH, causing several companies to liquidate their assets. The hedge fund has also been selling ETH since May. Ethereum appears to have drastically reduced its holdings. Additionally, the company has liquidated its assets in wallets on various DeFi protocols such as Compound and Maker.

3AC at risk of bankruptcy

Interestingly, Three Arrows Capital co-founder Zhu Su deleted Ethereum from his Twitter profile. It indicates that the firm may no longer look to Ethereum as the merger date remains uncertain. In fact, Three Arrows Capital was targeted by Danny Yuan, head of crypto trading firm 8Blocks Capital, for using around $1 million in 8Blocks funds to cover its margin call. The hedge fund is said to be at risk of bankruptcy. Somehow the lack of details from the firm and its liquidation of assets points to this.

stETH-ETH stability

As we quoted as Kriptokoin.com, according to Curve Finance, the depeg of stETH to ETH is now 0, dropped to 94. Lido Staked Ethereum (stETH) price is currently trading at $1,050.55. Ethereum (ETH) is at $1,118. What happened to

stETH And Celsius?

The failure of the UST started a bad game of the Defi system. USDD has also lost its stable value over the past few days. With stETH losing its stability lately, Celsius is likely to crash.

The event started with Ethereum announcing 32 ETH shares to become validators. People with small amounts of ETH cannot afford it. Then whales got involved, as did DeFi protocols. Thus, after owning STETH, he can stake in Celsius to earn interest. Or you can go to AAVE as collateral to borrow ETH. Thus, the ground for a death spiral was formed.

In summary, to attract money flow and increase trading volume, Celsius allowed users to earn 18% interest on stETH. Celsius is a crypto lending company that is one of Lido’s major clients. Users used the amount of stETH to continue collateral. Later, when the wallets attracted more than 54,103 stETH, it caused price instability between the two tokens.