Raoul Pal, macro expert and former co-chairman of Goldman Sachs, predicts the types of altcoins that might outperform the leading altcoin after the Ethereum (ETH) merge.

This altcoin sector could outperform Ethereum

According to the famous economist, the transition of Ethereum to the PoS consensus mechanism is very beneficial for him and the market. However, Ethereum’s Tier 1 competitors have an advantage over Ethereum in terms of scalability and affordability. Therefore, Raoul Pal says that L1 Blockchains will outperform ETH:

My hunch is that when we all wake up tomorrow, we will realize that the PoS change has been very positive for ETH over time. Only then will people realize once again that cheaper and faster chains are still needed and that marginal money is where to flow. Because these tier-1s are earlier in the network adoption curve, they will generally outperform in a bull market.

The altcoin projects on the list are currently the largest L1 Blockchains in the market. According to data from Chainalysis, Solana, Cardano, Polkadot, Avalanche, Cosmos and Binance Chain are among the most popular examples of tier one networks.

Meanwhile, according to Raoul Pal, the merger merger, which went into effect early Thursday, will initiate a bullish cycle in the DeFi market and accelerate the growth of other financial products in the cryptocurrency space. However, the market is struggling to keep critical supports away from this outlook for now.

Is the leading altcoin thinking to get rid of it?

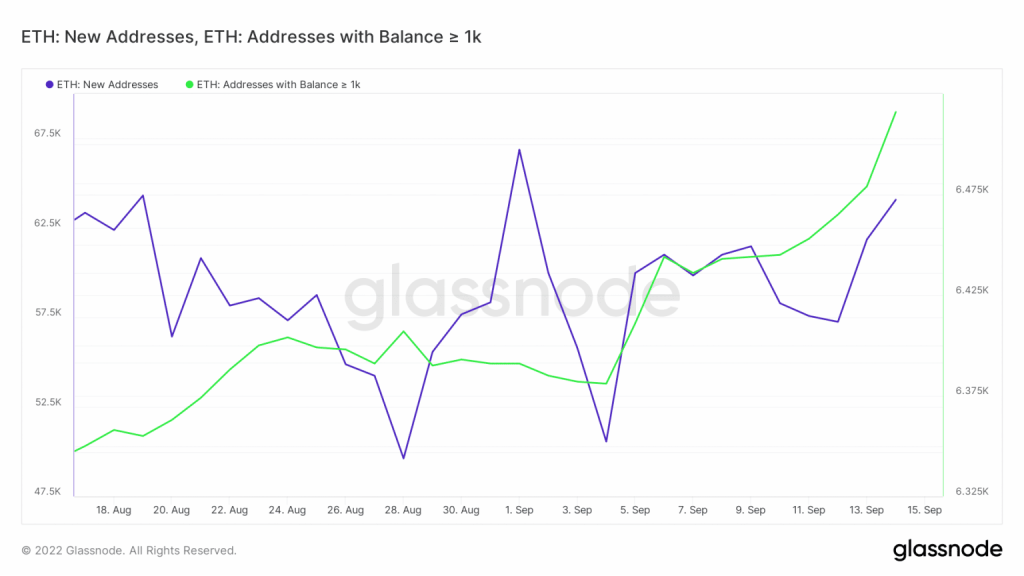

Ethereum has recorded a net increase in the number of new addresses since Sept. This reflects positive expectations ahead of the merge, although purchasing volumes were not enough to offset selling pressure.

The number of addresses holding more than 1,000 ETH in the last 10 days has also increased. This data reflects buying pressure from some whales. We can also interpret it as a sign that ETH demand is slowly recovering. This level of demand will provide a strong uptick if whales hit the brakes to upset their balance.

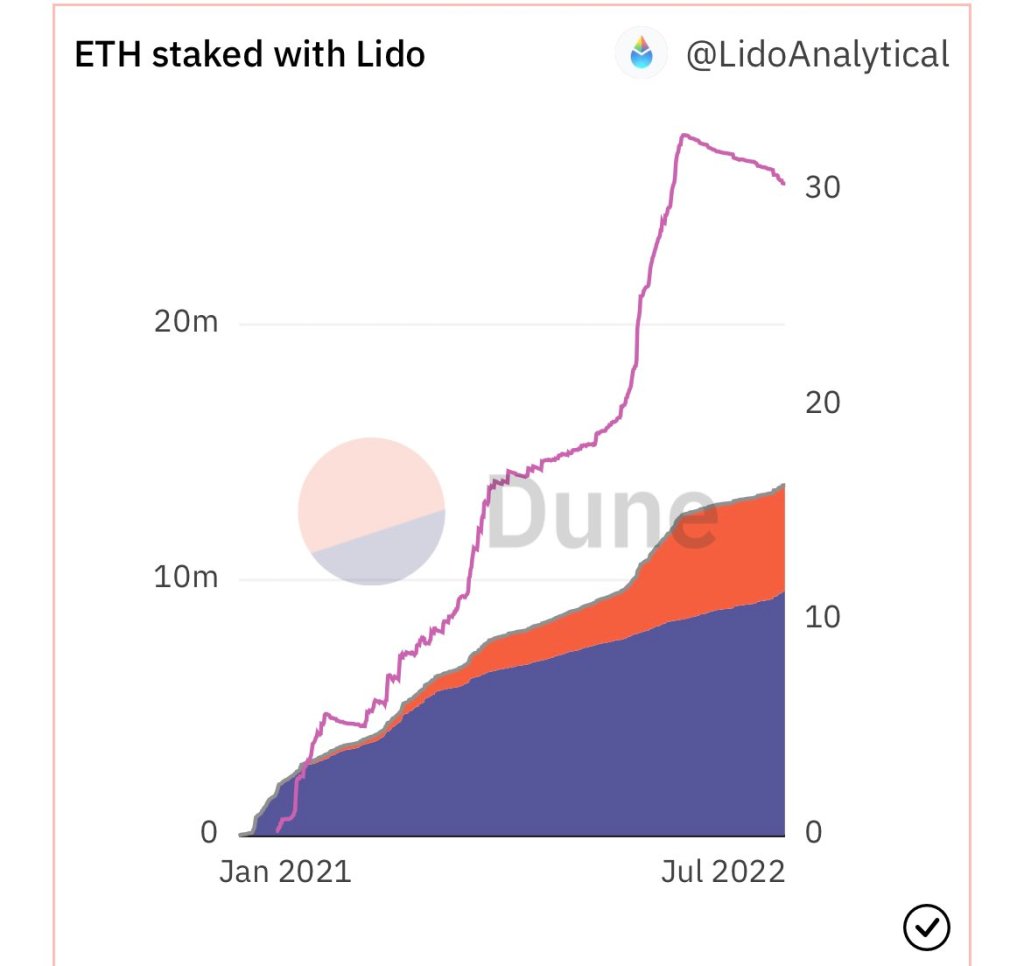

Despite the successful outcome, there are still some concerns about the merge. One of these concerns is determining pool decentralization. Over 55% of the total supply of ETH is currently in four of the largest PoS holdings.

Concerns are emerging about the centralized nature of some of these assets and the potential risks involved. However, Ethereum’s PoS has just passed through its birth phase. Analysts are concerned that it will become more decentralized over time as a result. Also, the data released hours after the merge raised concerns about the alleged centralization of PoS. Analysis from Santiment shows that 46.15% of Ethereum’s PoS node operators are controlled by just two addresses.

https://twitter.com/santimentfeed/status/1570339602346684416

As you follow on Kriptokoin.com, Ethereum spent most of the day retrieving $1,450.