Bitcoin advocates have argued that the maturing asset will replace gold as a hypothetical store of value and a hedge against inflation. However, Bitcoin and the overall cryptocurrency market underperformed in 2022 compared to gold. Here are the details…

Bitcoin underperformed gold

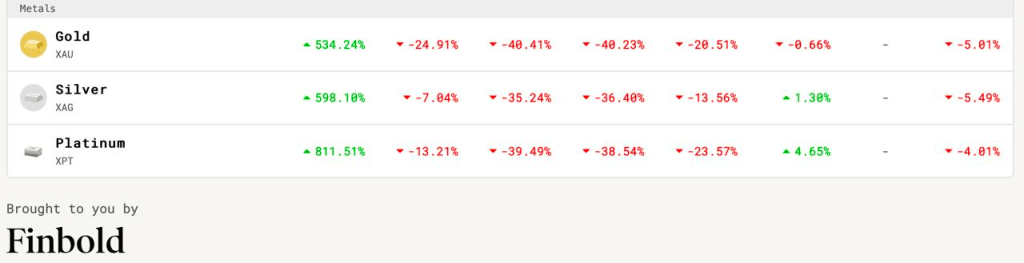

Data from the Finbold Bitcoin ROI tool, which allows users to compare the return on investment (ROI) of BTC with traditional assets such as stocks, currencies, indices and metals, shows that Bitcoin returns are underperforming compared to gold. The precious metal rose 40.41 percent year-on-year. However, Bitcoin has still provided a superior ROI over gold, at 534.24 percent over the past four years. Other precious metals, including silver and platinum, have outperformed Bitcoin by 35.24 percent and 39.49 percent, respectively, since the start of 2022.

Bitcoin started the year hoping to climb above its all-time high of almost $68,000 in November last year. At the beginning of 2022, the value of the coin was $46,700. However, it is currently trading at $20,800. In other words, it has experienced a decrease of over 55 percent since the beginning of the year. The losses of the largest cryptocurrency in 2022 affected the overall market, which lost over $2 trillion in market capitalization. The losses also peaked when Bitcoin recorded its worst quarter in more than a decade after the value plunged by over 56 percent in the second quarter of 2022.

Confidence in the cryptocurrency space has dwindled

Interestingly, both Bitcoin and gold are operating in a hyperinflationary environment with possible continued interest rate hikes from the Fed. The performance of gold in the current environment can be attributed to the metals’ decades of existence. However, Bitcoin is a young asset class in the long run. Therefore, according to expert Justinas Baltrusaitis, BTC’s lack of longevity reduces its ability to be an effective hedge against inflation.

Moreover, prospects for Bitcoin have been complicated by regulatory uncertainty. Additionally, the price of Bitcoin was affected by the controversial Terra (LUNA) ecosystem collapse. According to the expert, the collapse of Terra eroded confidence in the cryptocurrency space and led investors to assets like gold.

The future of bitcoin and gold

Despite Bitcoin posting negative returns in 2022, proponents of the asset believe it will surpass gold in the next few years. Ronald-Peter Stoeferle, managing partner of investment management firm Incrementum AG, noted that despite the ongoing bear market, Bitcoin has eclipsed gold. In the longer term, Stoeferle thinks Bitcoin will become a less risky asset. He says it will eventually become a store of value.

Additionally, Bitcoin’s price action is correlated with the overall stock market, as we reported on Cryptokoin.com. This correlation is seen as confirmation that Bitcoin is a risk asset. Notably, despite outperforming gold, Bitcoin performed quite well in 2022 compared to some stocks. Shares of companies such as Paypal, Netflix, Shopify performed worse than BTC.