Counting hours for Shanghai and Capella updates, how does Ethereum (ETH) continue its pricing process?

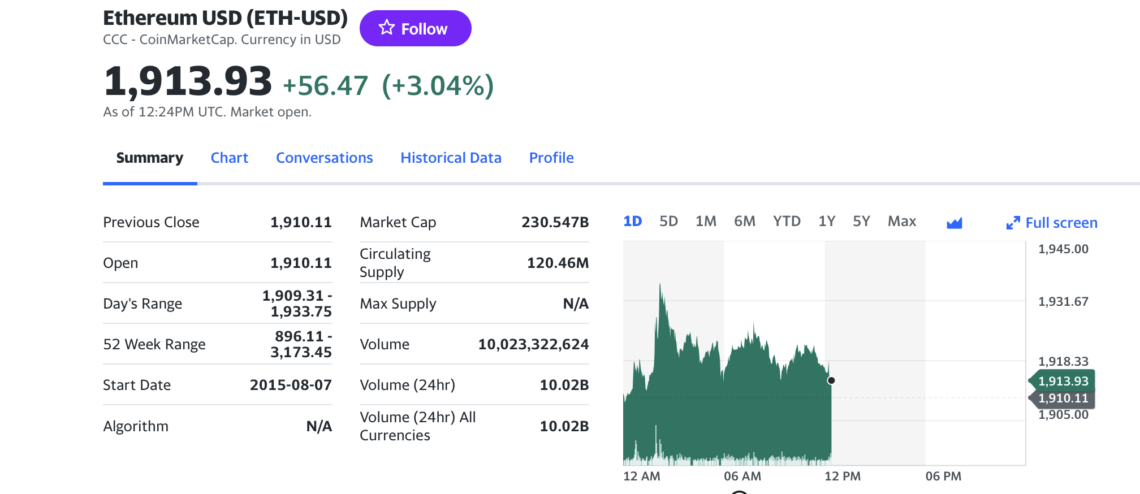

There are days left for the Shanghai and Capella upgrade, one of Ethereum’s big developments this year. With these developments, ETH, which takes the wind behind it, is close. At the same time, it saw the 7-month price peak by testing the 1942 dollar. Finally, in August of 2022, ETH, which exceeded the level of 1900 dollars, was strengthened by the record increase of the Federal Funds rate by the US Federal Reserve to combat inflation.

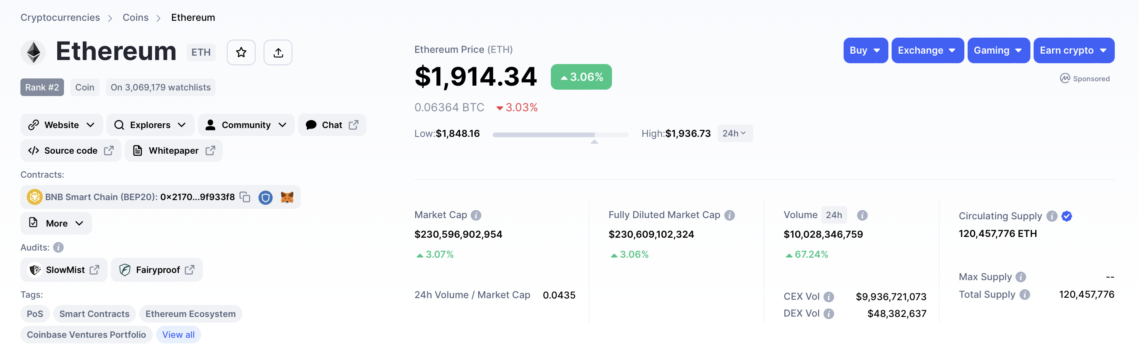

Looking at the current period, Ethereum, which will perform the Shanghai and Capella update on April 12, continues to keep expectations high. At the same time, ETH, which also strengthens the crypto market value, set a 10-month record in crypto market value when it reached $ 1942.

ETH’s Star is Shining with Shanghai and Capella!

Ethereum, which will sign a major update on April 12, not only attracted attention, but also reflected positive weather conditions in the crypto market. ETH tested the 1942 dollar, making short-term ATH in crypto market cap. The update dates on the popular project are attracting the attention of crypto investors. ETH managed to end the 7-month price longing by equaling $ 1900, which is difficult to overcome both psychologically and graphically. We can say that this positive atmosphere created by the updates still continues.

Targeting faster transactions at lower cost, these updates will enable EIPs. Additionally, the update will enable EIP-4895, which will allow validators and stakers to withdraw ETHs. Not only in the crypto industry, but also in the global financial markets, Ethereum continues to attract investor attention while counting the days for updates.

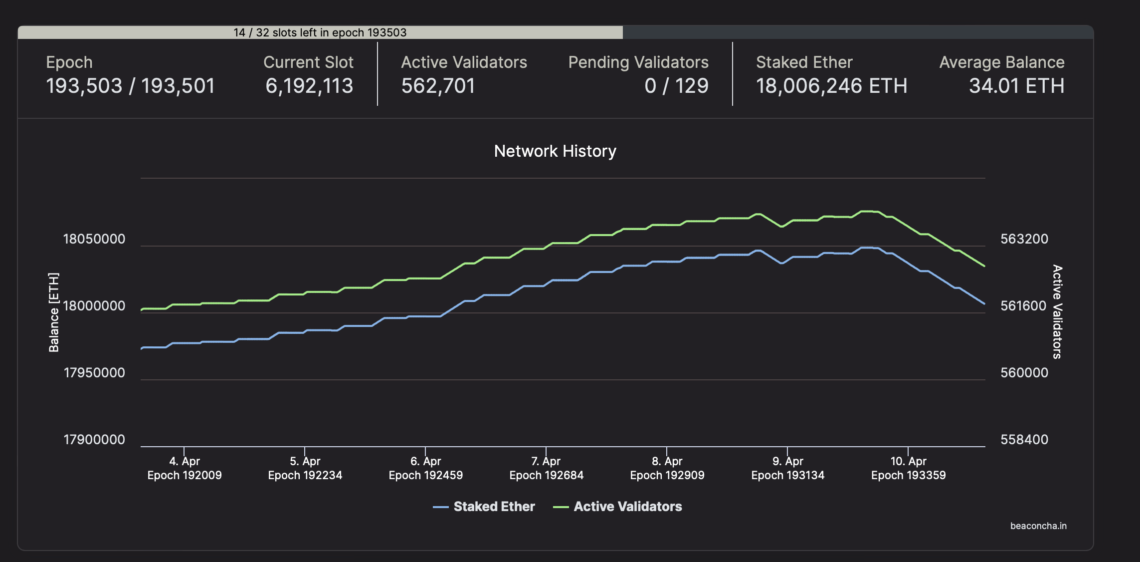

As of writing, Ethereum has broken the record by actively reaching 562,701 Validators. The stake amount is currently 18,006,246 ETH. The process after the Shanghai and Capella update is still a matter of curiosity.

Currently ETH Analysis, Can Price Rise Continue?

ETH, which opened the week at $ 1850, continues to stay on the agenda with the upcoming updates. It seems that ETH, which has gained momentum in every update it has made so far and priced it throughout that process, continues on its way in the same way. ETH saw $1828 as the lowest price level on the 24-Hours zone. The popular coin managed to move its price up again, in line with the “appetizing buyers” that it caught at this level.

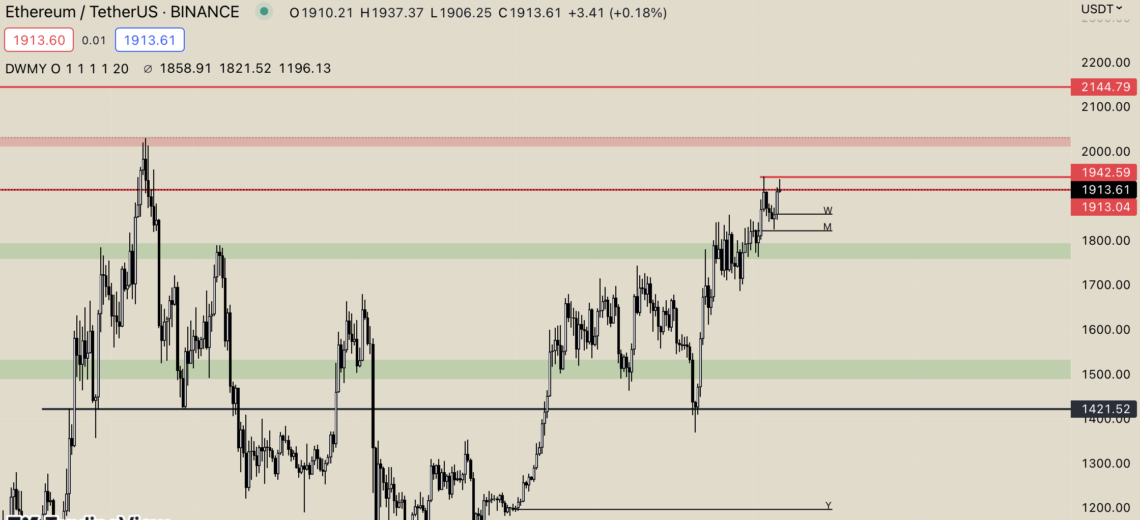

ETH, which gained momentum from its annual opening price of $ 1200, had a large buyer base, especially between $ 1200 and $ 1700. The negative effects of the ensuing regulators shook ETH, pulling the price to the $ 1500 levels. At that time, the problems in stablecoins also affected the crypto market and dragged many coins into decline. Not long after these problems, banking crises broke out. The banking problems triggered by Silicon Valley Bank (SVB) dragged other banks along, damaging the crypto ecosystem. ETH, which was affected by the FUD news feed, instantly saw $ 1400.

The ETH chart, where buyers are clearly gaining strength from the annual opening price, is currently watching at $ 1910. Moving close to the monthly opening price, ETH tested $ 1942 last week and managed to reach this value months later. When we look at the daily chart for ETH, it is seen that the annual opening price of $ 1200 actually has a very critical importance in the overall picture.

Another criterion that provided information on the rise was the reactions from the $1,500 levels. ETH, which tried this price a few times, caught a large buyer base and carried the price to the upper points. For ETH, which maintains the $1,500 level as the support zone, this point can be said to be the “trend point”.

Another region where buyers are most likely to be encountered is in the $1793 – $1757 range. This region, which should not be lost in order to continue the uptrend in a short time, has become even more critical with the upcoming update date.

Crypto investors, who are on hold for April 12, are curiously watching what kind of pricing will be in ETH. ETH finally settled on the peak of a 7-month adventure by testing the 1942 dollar. If the update process is successful and the result is positively reflected in the crypto market, the levels of 2010 and 2032 dollars, respectively, can be guiding. If these resistances are surpassed in volume, a rise to $2144 can be expected in ETH.

For the pioneer of altcoins, which is backed by Shanghai and Capella, the expectation from the crypto ecosystem is high. Crypto investors continue to wait with great interest for ETH, which currently shows its positive effects on the market.

Fidelitas Lex, one of the prominent names of the crypto market on social media, expressed his views on the subject;

It is still the most preferred address among Ethereum DeFi protocols. It should also be kept in mind that Ethereum is a kind of reserve currency within the DeFi, NFT and Metaverse ecosystem. Based on these assumptions, it is possible to evaluate that the Shanghai update will fund the ecosystem components mentioned above with “hot money”. Considering the current non-crypto conjuncture, where banks have a hard time and the issue of trust in traditional financial intermediaries is spoken loudly, it would not be wrong to think that a positive valuation can be seen in the TVL increase and the management tokens of these protocols, especially in DeFi protocols that have established their story on debt or idle investment evaluation.

Standing out with its remarkable posts on the crypto industry, WindCrypto expressed his views on ETH;

With the Shanghai update, Ethereum staked since December 2020 will be unlocked. Frankly, this does not sound good at first glance, but when we divide the stakers into two categories, there are those who make this move financially for profit on the one hand, and Ethereum maximalists on the other. When we look at those who do it for financial purposes and want to make a profit on the first side, we can think that these levels are not positive levels for those who locked their Ethereum in the bull season and could not sell their $ETHs in the $ 4,000 – $ 4,500 price band. When we turn our attention to Ethereum maximalists, they will be considering the advantages that the Shanghai update will add to Ethereum, rather than looking at this situation on a price basis. At this point, when we look at the next update on a price basis, it may have a negative movement in the short term, but I think it will have a positive effect on both the general market and the ecosystem for the medium and long term.

Standing out with its research and analysis on cryptocurrencies, CoinDelisi commented on the developments in ETH;

Ethereum Shapella is the biggest update since the Merge update last year, which made the transition from PoW to PoS. Pretty positive for Ethereum. I already like Ethereum’s long roadmap. Of course, the most important issue; Over 18M ETH staked since 2020 will become withdrawable for the first time. However, it is stated that this will spread over 2 months. I do not think that this will affect the ETH price much, as some of the stakers have bought the Ethereums they staked at a high price compared to now, which reduces the possibility of selling. Even when we think about Ethereum’s ecosystem, I don’t think some people who have staked in Ethereum will sell them. I think that the news has already been sold, but there is a possibility of a small fluctuation in the short term due to the fear that this situation will create (a possibility). In the long run, I am very positive.