Ethereum (ETH) worried investors by falling below the critical $ 3,000 level. The harsh decline in recent days has led to great losses throughout the market. However, some analysts think that these levels offer opportunities for long -term investors.

Ethereum investors are experiencing great losses!

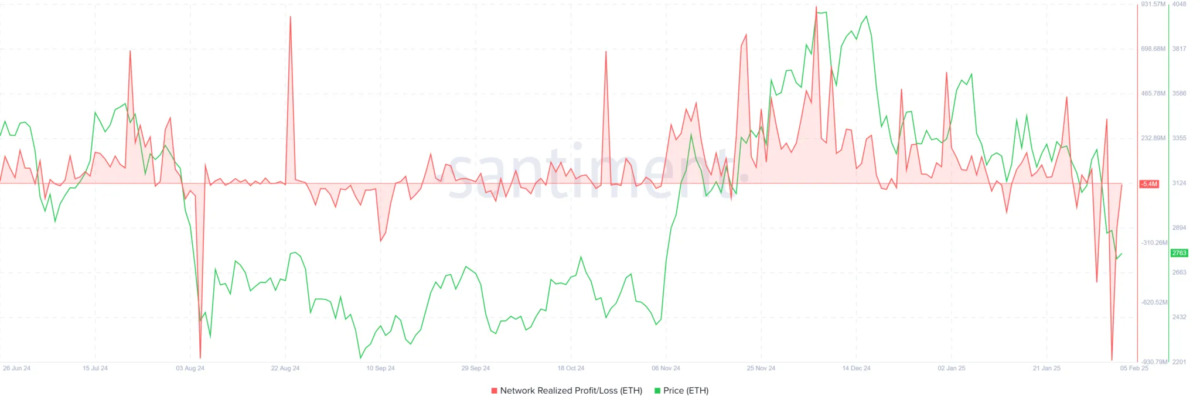

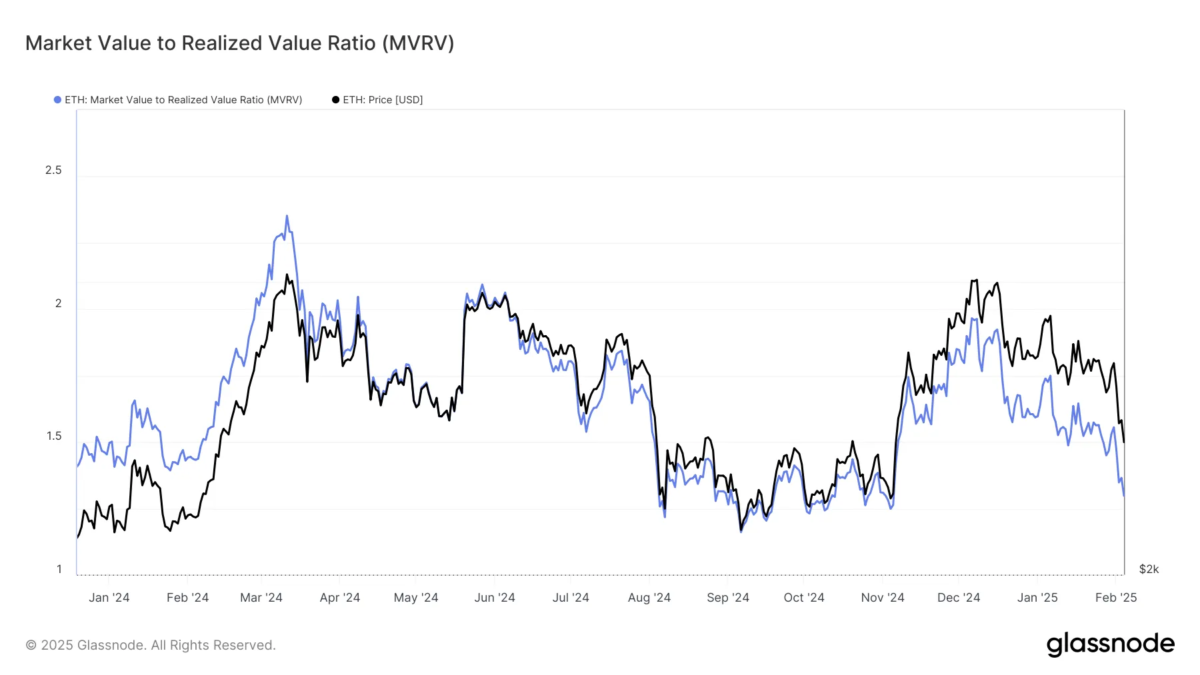

Ethereum’s loss of $ 3,000 supported the biggest damages of the last six months for investors. With this decline, many investors sold their assets to minimize their damages, and market sensitivity quickly turned negatively.

For now, ETH owners are afraid to make transactions by waiting for the market to recover. While the fear in the market increases, short -term investors prefer to behave cautiously and are waiting in case of further possibility. This shows that the market can move at existing levels for a while.

What are the critical levels for Ethereum?

Ethereum lost 17 %in the last few days and disappointed investors. The failure to exceed $ 3.303 accelerated the decline trend and invalidated the current rise formation.

ETH is currently trying to hold up to $ 2,698. If this support is maintained, Ethereum can re -test $ 3,028. Out above this level can trigger a new wave of rise up to $ 3,131. However, if the decline persists, the price may decrease to $ 2,546 or lower.

Is it possible to recover?

The future of Ethereum will largely depend on market conditions and investor sensitivity. If the bull market returns, it may be possible for ETH to rise again. However, if the sales pressure persists, the price is likely to decline to $ 2,500. In particular, Bitcoin’s price movements can also determine the direction of Ethereum.

Investors should closely monitor transaction volume, support levels and in -chain data. If ETH falls below $ 2,698, a larger wave of decrease in the market may be seen. On the other hand, if the price can exceed $ 3,000 again, a strong recovery process may begin. Considering the volatility in the crypto market, it is of great importance that investors do risk management.