The altcoin market took a comfortable reason as Bitcoin (BTC) recaptured the $19k region it briefly lost. AXS in particular is under pressure as the $215 million unlock is imminent. New analysis shows that Dogecoin, AXS, ETC and XRP are ready to break critical technical levels.

Dogecoin struggles with consolidation as it awaits 700,000 investors

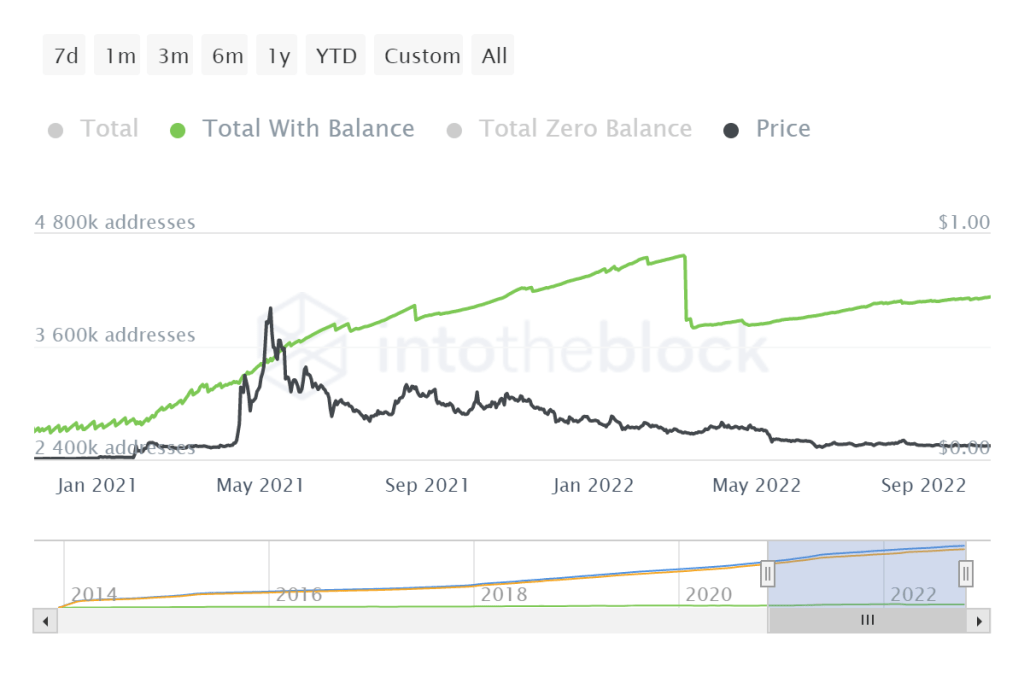

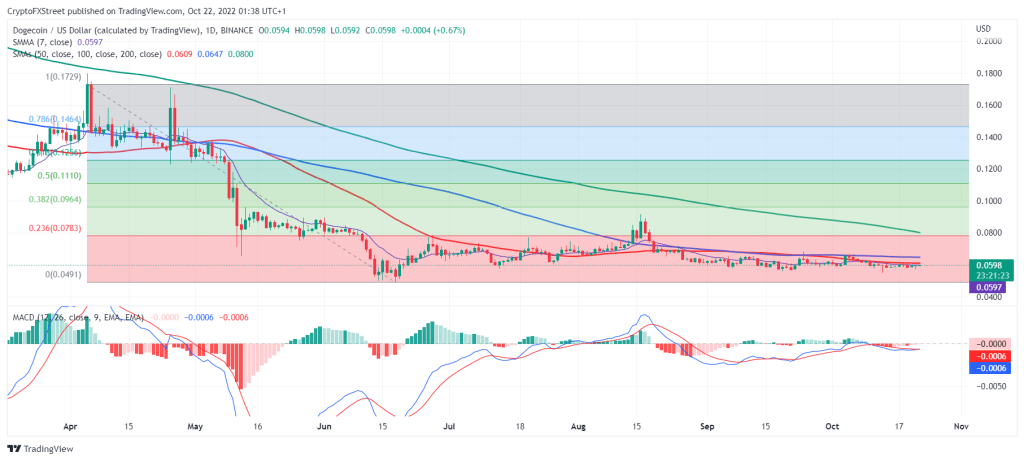

In March of this year, over 700,000 Dogecoin traders left the market in just 48 hours. The reason behind this is not yet clear. However, this separation did not have much effect on the price. After a short fluctuation, Dogecoin price stagnated at 0.059 in the month. It has been moving horizontally ever since. Despite being stuck between the $0.1729 and $0.0491 Fib levels throughout the process, the 23.6% Fib line failed to surpass $0.0783.

Currently, all three SMAs (50-days (red), 100-days (blue) and 200-days (green)) have been acting as resistance for almost two months, although the price indicators seem to be pointing to the good.

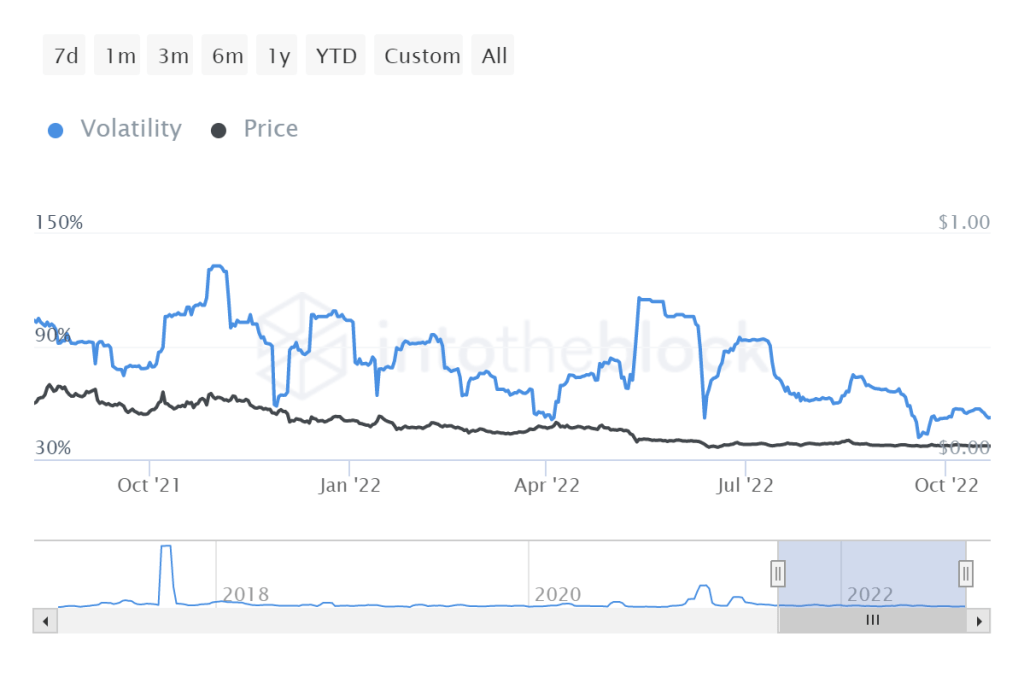

Also, this month, Dogecoin, which had been following a positive course, was wiped out after the bearish MACD. Based on this data, FXStreet analyst Aaryamann Shrivastava says the future of Dogecoin will be linked to the overall market. Additionally, its volatility will be another important factor.

If volatility remains low, the probability of price volatility also decreases. This causes DOGE to get stuck at current price levels. Currently, Dogecoin’s volatility is only at 52%. According to the analyst, this figure needs to at least double to survive the consolidation phase. Only then will Dogecoin show signs of recovery.

Tony Montpeirous: Ethereum Classic price has potential

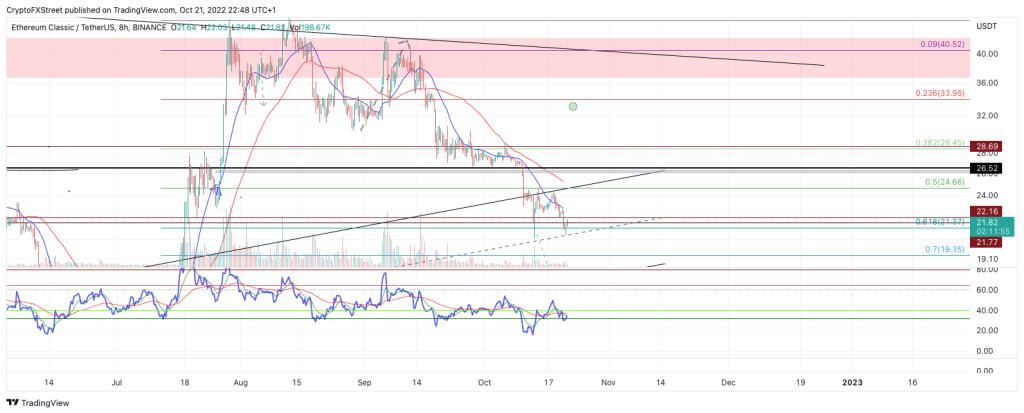

Ethereum Classic price is currently trading at $22.79. The RSI shows that the price has reached the oversold zone in the middle of the last drop. The index has reached the equivalent level where ETC fell to $13 before the 3x bull run.

Price action is still in favor of the bulls as the biggest candlesticks in the previous uptrend and the current sell-off are the candles engulfing the green. A Fibonacci retracement tool surrounding the entire 3x rally shows the current $22 ETC as just a 61.8% retracement.

Ethereum Classic price is showing multiple bullish signals while putting everything together. A rally to the previously broken $27 support will yield 25% returns for early bulls. The invalidation of the anti-bullish idea will occur when you lose $20. If the bears hit that target, the entire trend is probably in jeopardy. After this point, the bears could head south towards the summer low of $13, resulting in a 20% drop from the current Ethereum Classic price.

XRP price could give traders a chance to recoup losses

Looking at the XRP chart after ETC, Tony Montpeirous expects a recovery rally from the XRP price over the weekend. XRP price is currently spending time in the $0.46 region. RSI data is hovering above support after being in oversold territory for a few days. Also, there is a bullish divergence with the new monthly low at $0.45 and the previous October low at $0.45.

Analyst Montpeirous says retail sales will be challenging for XRP, given the market conditions. The 8-day exponential moving average will be the first target for a possible rally. Such a move leads to a 5% recovery rally. If the bulls can find support, an additional rally to $0.50 will mean a 15% gain.

However, a break of $0.42 will invalidate the upside move. The bears will then press for an additional drop to $0.39. Such a move would mean a 14% drop from the current XRP price.

Axie Infinity investors pay attention on this date

Axie Infinity is gearing up for an unlock event three days from now, October 25th. AXS price started falling just before that. This is because 21.5 million AXS tokens have been released. However, the tokens will not be released anytime soon. Thus, AXS is freed from a sales pressure of 215 million dollars. As Kriptokoin.com, we have transferred the details in this article.

On the technical side, AXS price is down 2% in the last 24 hours, breaching the $9 support. Also, it is facing serious selling pressure on the RSI. However, as unlocked tokens will take some time to circulate, AXS will have a chance to recover before then.