Credit Suisse slammed US stock markets. But there is also a positive sign, according to crypto analyst Rakesh Upadhyay, that Bitcoin and elite altcoins are holding near their local tops. So, can altcoins like Bitcoin and DOGE rise above the general resistance levels and start the next leg of the up move? The analyst examines the charts of the top 10 cryptocurrencies to find out.

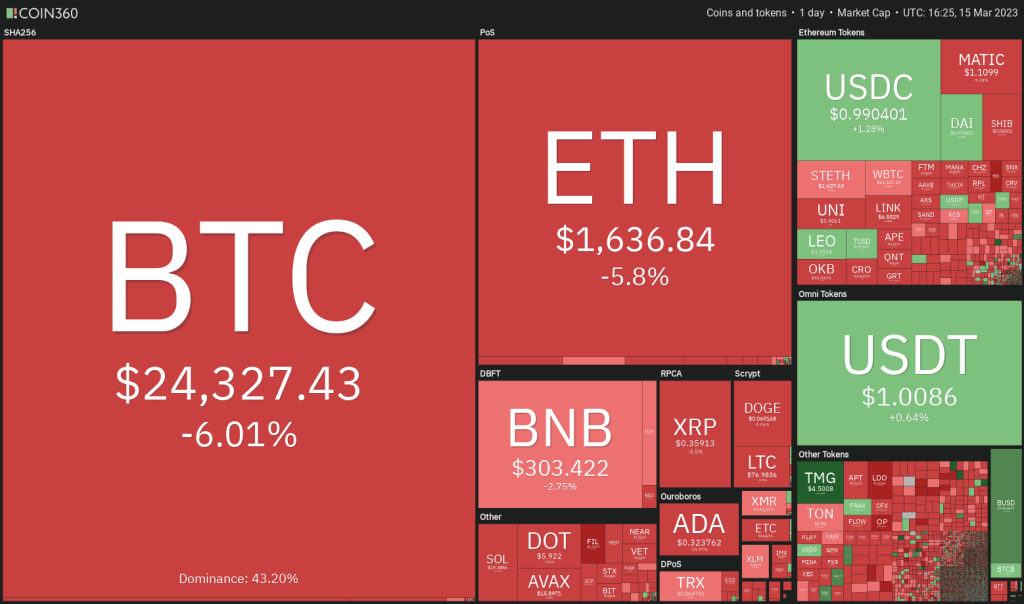

An overview of the cryptocurrency market

As you follow on Kriptokoin.com, the US stock markets turned upside down on March 15 after the Saudi National Bank, Swiss Bank Credit Suisse’s largest investor, said it would not be able to raise more funds for Credit Suisse due to regulatory restrictions. Investors are nervous as Credit Suisse, which has large operations in the US and globally, warned on March 14 that it has found ‘certain significant weaknesses’ in its 2021 and 2022 financial reporting processes. Credit Suisse shares fell to an all-time low on March 15.

After the events of the last few days, the S&P 500 has bounced back all its gains for the year and is trading sideways. In contrast, Bitcoin retains the bulk of its earnings and has increased by about 47% in 2023. Trezor Bitcoin analyst Josef Tětek believes the banking crisis could be positive for Bitcoin as it could emerge as a safe-haven asset.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Capriole CEO and founder Charles Edwards says Bitcoin has created a “pop and run reversal pattern” with a target of $100,000 and higher. However, Edwards warns traders that the model could fail. For this reason, he states that it should not be used to create a trading or investment plan. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

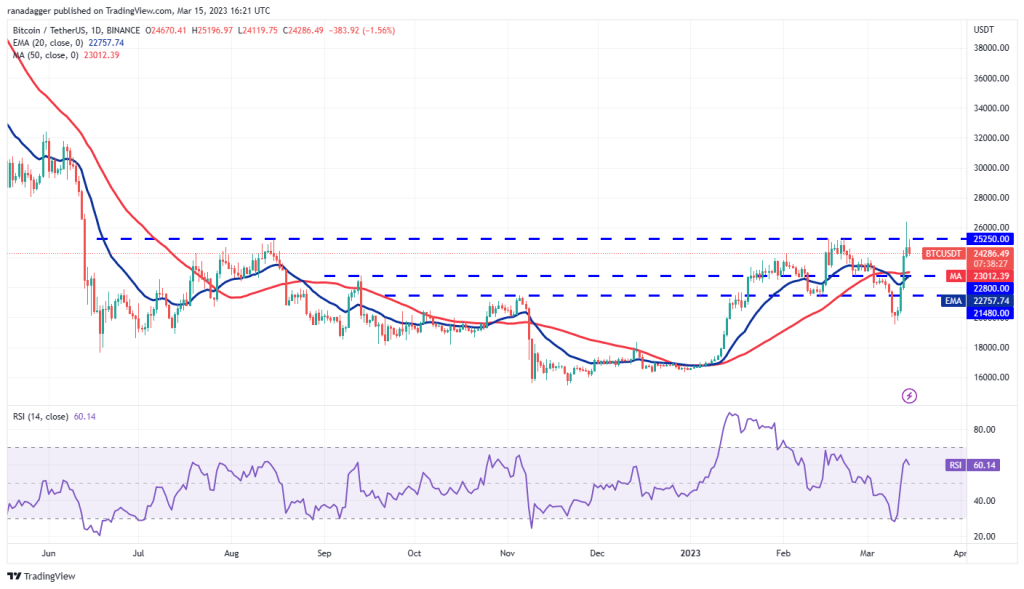

Bitcoin (BTC): Your bears won’t surrender without a fight

The bulls pushed Bitcoin above the overhead resistance of $25,250 on March 14, but the long wick on the candlestick indicates that the bears are not ready to surrender without a fight. Strong selling pushed the price below $25,250.

The 20-day exponential moving average ($23,012) has started to rise, and the relative strength index (RSI) is in the positive territory, showing an advantage for buyers. If the bulls do not give up too much from the current level, the chances of a break and close above $25,250 increase. If this happens, BTC will complete an inverted head and shoulders (H&S) bullish pattern. This will signal a potential trend change. BTC could rush towards $32,000 later. If the bears want to slow down the bullish momentum, they will have to quickly push the price below the moving averages.

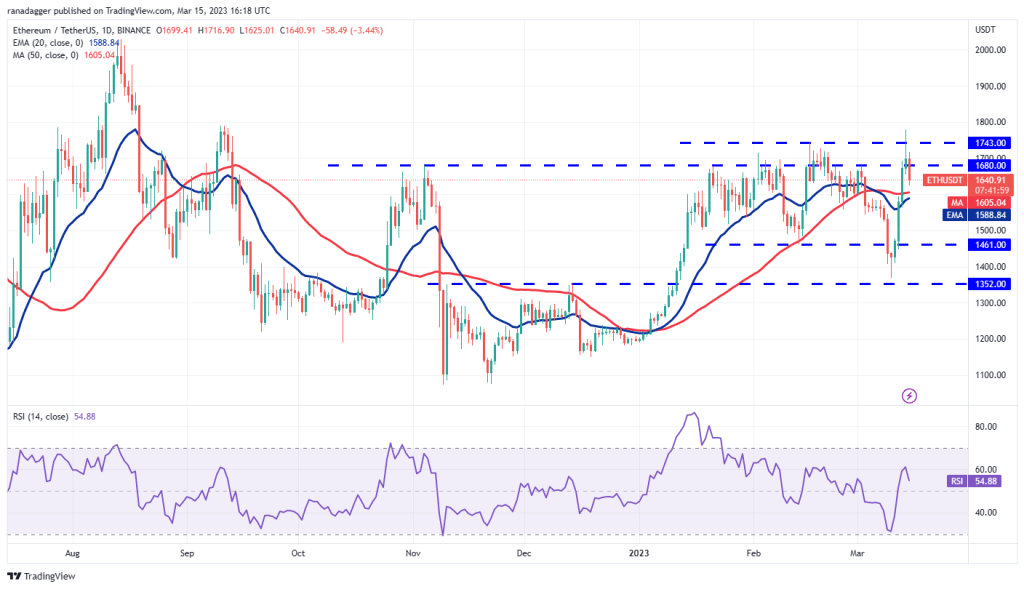

Ethereum (ETH): Bears try to maintain overall resistance

ETH climbed above the overhead resistance at $1,743 on March 14, but the bulls were unable to sustain higher levels. This indicates that the bears are trying to maintain the level.

If the price consolidates between $1,743 and the 20-day EMA ($1,588), this will indicate that sentiment has turned positive and traders are buying on the dips. This will increase the likelihood of a breakout and a close above $1,743. ETH is then well positioned for a strong rally towards the psychological level of $2,000. Contrary to this assumption, a dip below the moving averages will indicate that ETH could consolidate in a wide range between $1,743 and $1,352 for a while.

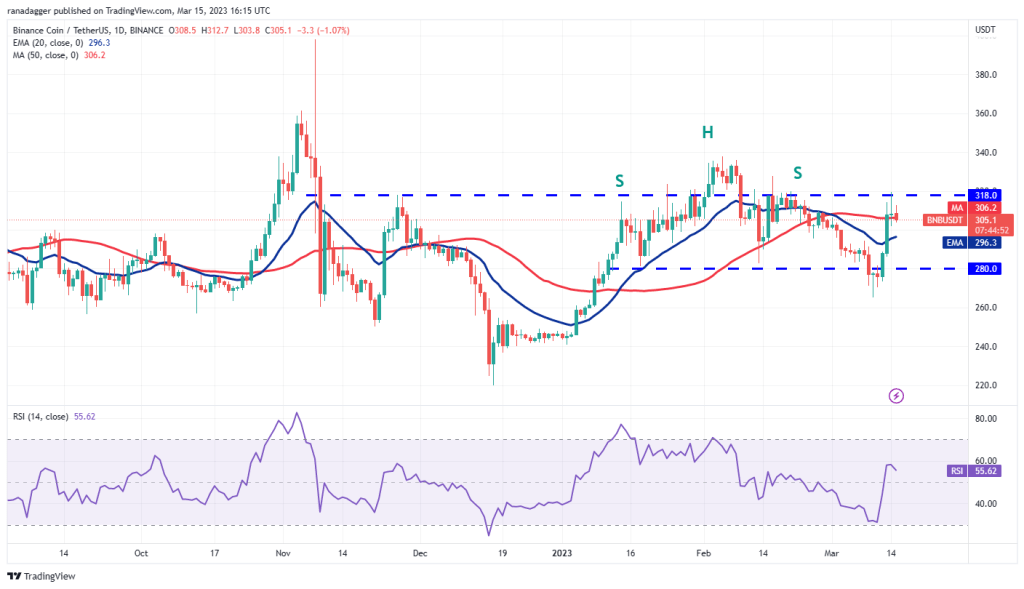

Binance Coin (BNB): Bears try to defend strong resistance

BNB bounced back from strong resistance near $318. This shows that the bears are trying to defend the zone between $318 and $338.

A small plus in favor of buyers is that they did not allow the price to drop below the 50-day simple moving average ($306). Shallow retracement shows that every small decline is bought. The bulls will make another attempt to push the price above the general zone. If they do, BNB could rise to $400. Conversely, if the price breaks below the 50-day SMA, BNB could slide to the 20-day EMA ($296). A break below this level will signal an advantage for the bears.

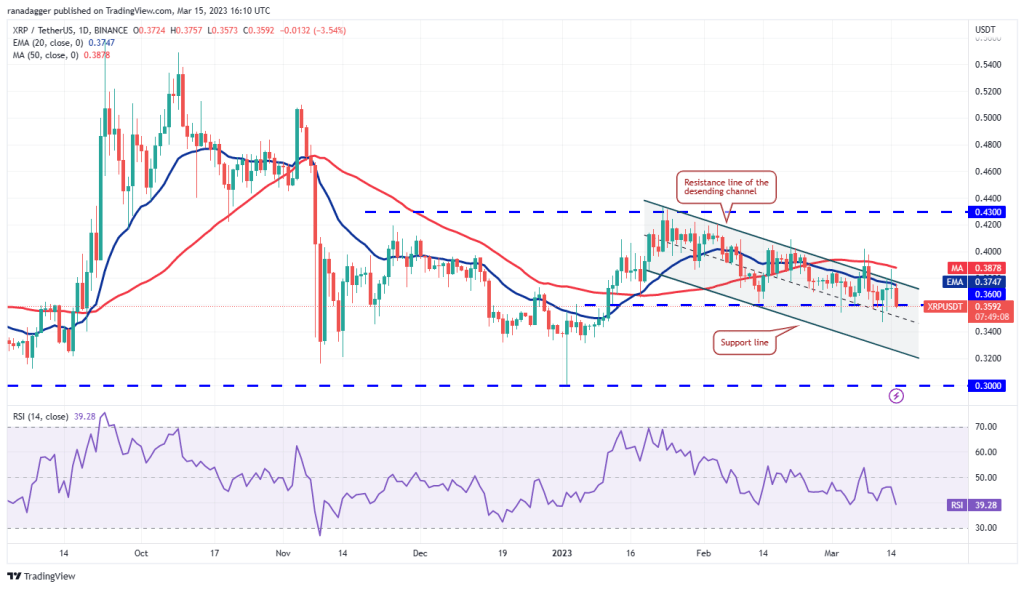

Ripple (XRP): Indecision between bulls and bears

XRP bounced back from the 50-day SMA ($0.38) and formed a Doji candlestick pattern on March 14, showing indecision between the bulls and bears.

Uncertainty was resolved to the downside on March 15 and the price declined to the strong support at $0.36. In case of breaking out of this level, XRP can regress to $ 0.32 of the channel. On the other hand, if the price stays above $0.36, the bulls will again attempt to break through the 50-day SMA and $0.40 hurdle. If they can achieve this, XRP could gain momentum and climb to $0.43.

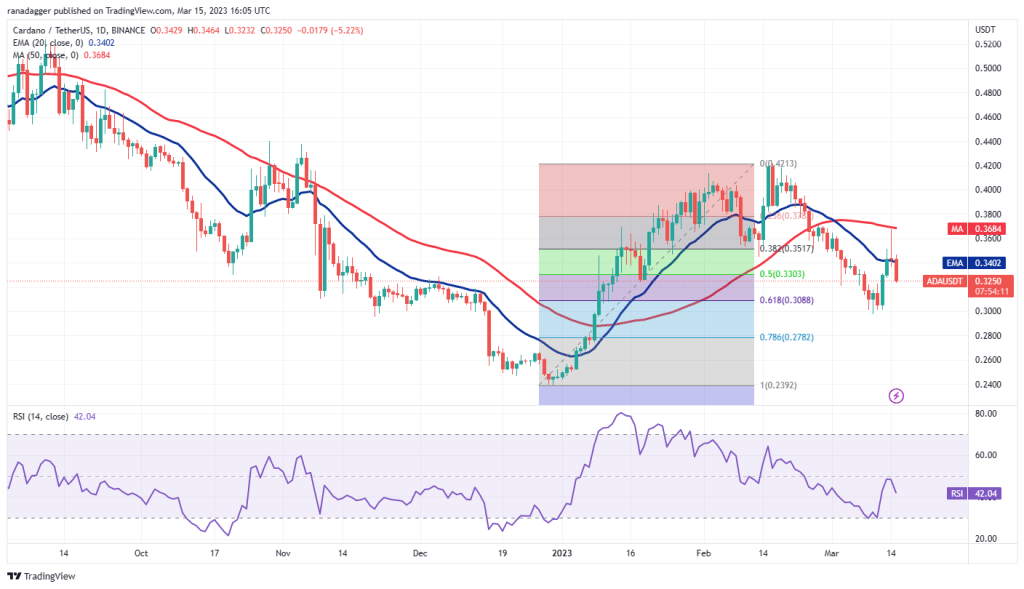

Cardano (ADA): Bears sell aggressively in rallies

ADA accelerated on March 14 and reached the 50-day SMA ($0.36), but the long wick on the day’s candlestick indicates that the bears are selling aggressively in the rallies.

The bears pushed the price below the 20-day EMA ($0.34) on March 15, paving the way for a possible retest of $0.30. Buyers will likely hold this level in full force as the next support is much lower at $0.27. Alternatively, if the price rebounds from the current level or $0.30, this will indicate that traders are buying on the dips. This could keep ADA between the 50-day SMA and $0.50 for a few days.

DOGE, MATIC, SOL, DOT and SHIB analysis

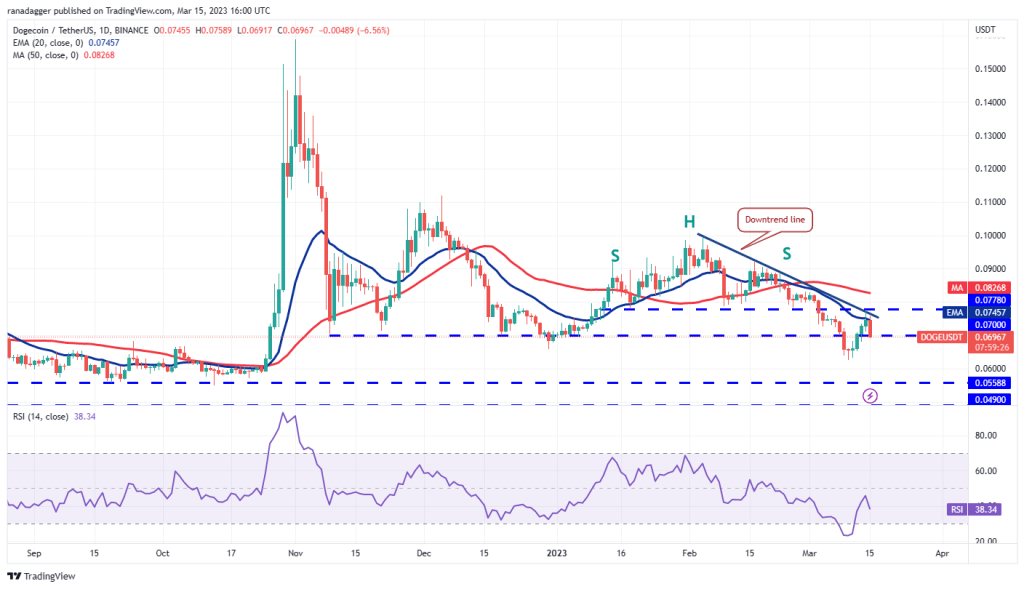

Dogecoin (DOGE): Under the control of the bears

DOGE recovery has reached downtrend line where bears are forming strong resistance.

The downward sloping 20-day EMA ($0.07) and the RSI in the negative territory suggest that the bears are in control. Sellers are attempting to push DOGE price below the $0.07 close support. If this support collapses, DOGE can go down to $0.06. On the contrary, if DOGE price bounces back from the current level, it indicates that lower levels are attracting buyers. The downtrend line remains the key upside as a break above it could start a relief rally towards $0.10.

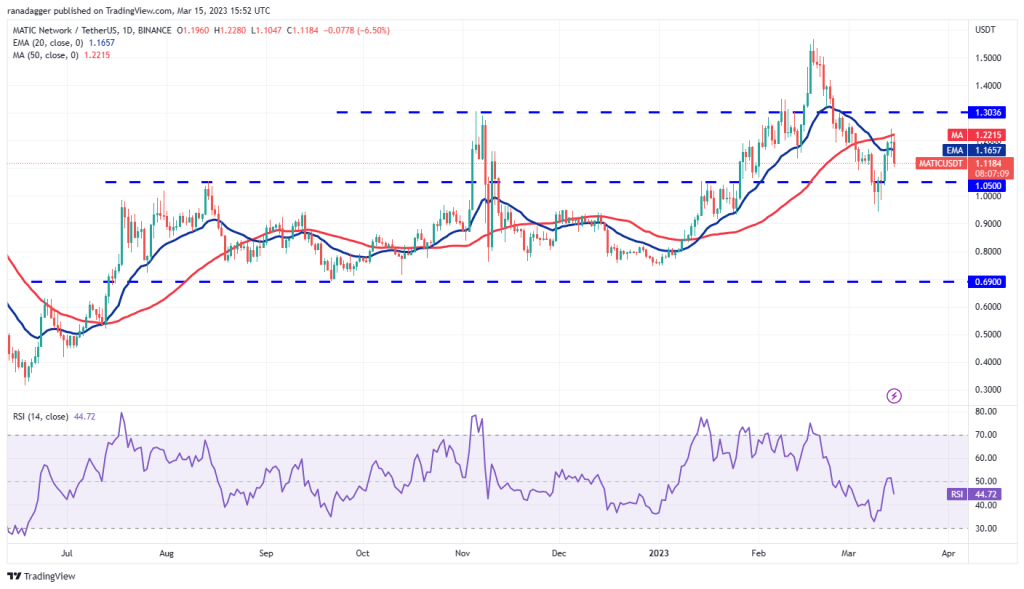

Polygon (MATIC): Facing stiff resistance

The MATIC relief rally is facing stiff resistance at the 50-day SMA ($1.22). This brought the price below the 20-day EMA ($1.16) on March 15.

MATIC could decline to strong support at $1.05. This is an important level to watch out for because if it breaks, MATIC could retest the $0.94 support. A break below this level will open the doors for a potential drop to $0.69. Another possibility is for the price to break above the $1.05 support. If this happens, the bulls will try to push the price back above the 50-day SMA. If they are successful, the probability of a break above $1.30 increases.

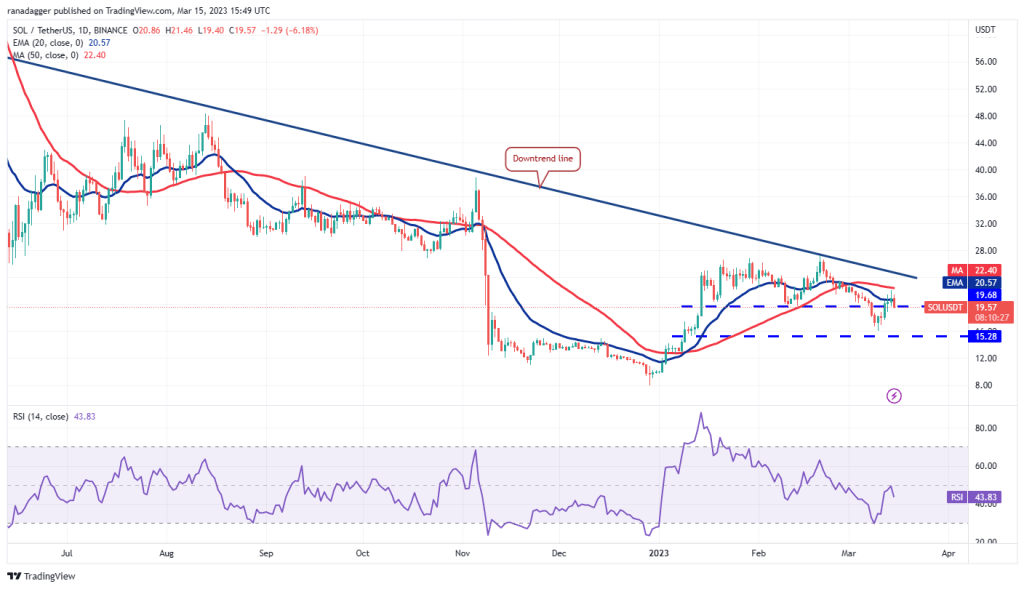

Solana (LEFT): Bears and bulls clash

The bears are trying to stop the SOL rally at the 50-day SMA ($22.40), but the bulls are trying to keep the price above the $19.68 close support.

This indicates that the bulls will try to push the price back to the downtrend line. This is a vital resistance to consider. Because a break and close above it will signal a potential trend change. There is a minor resistance at $28 but it is likely to be surpassed. SOL could later rise to $39. Instead, if the price continues to decline below $19.68, it will show that the bears have not given up yet. SOL could decline to strong support at $15.28 later.

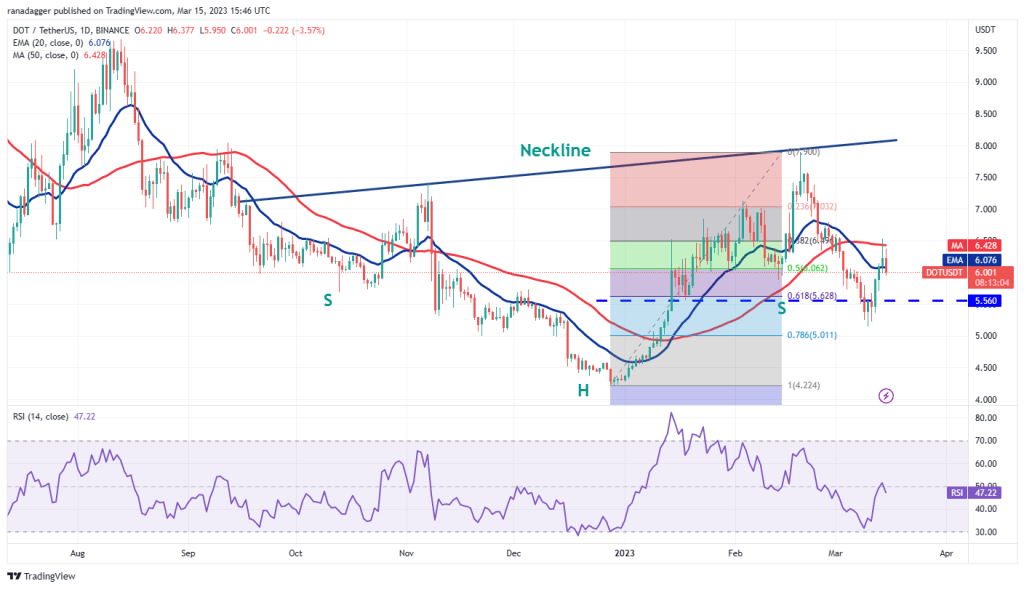

Polkadot (DOT): The bears didn’t give up

Buyers tried to push the DOT above the 50-day SMA ($6.42) on March 14, but the bears did not give up. This suggests that higher levels are attracting sellers.

Both moving averages have flattened out and the RSI is just below the midpoint, indicating an equilibrium between the bulls and the bears. If the price breaks and stays below the 20-day EMA ($6.07), the DOT could swing between the 50-day SMA and $5 for a few days. If the buyers push the price above the 50-day SMA, the DOT could gain momentum and move higher towards the neckline of the inverse H&S pattern. On the downside, the bears will need to pull the DOT below $5 to indicate a reversal.

Shiba Inu (SHIB): In a descending channel pattern

SHIB is trading within a descending channel pattern. The bulls tried to push the price above the channel but the bears held their ground.

The bears will again try to push the price below the psychological support at $0.000010. If they manage to do so, SHIB could drop towards the support line of the channel. The bulls are likely to defend the $0.000008 to $0.000007 zone with all their strength. If the price bounces back from this level, it will indicate that SHIB may consolidate in the wide range between $0.000018 and $0.000007 for a while. In the near term, a break above the 50-day SMA ($0.000012) will turn the advantage in favor of the bulls. SHIB could then attempt to rise to $0.000014 and then to $0.000016.