Traders will closely follow the macroeconomic events of the next week. While we await these events, most major altcoins, including Bitcoin and DOGE, remain stuck in a range. According to crypto analyst Rakesh Upadhyay, he says that the outcome of next week’s events is likely to increase volatility in Bitcoin. The analyst studies the trend in Bitcoin and altcoin prices.

A look at the cryptocurrency market

US stock markets closed the week lower as market participants acted cautiously ahead of important November CPI data next week. According to the FedWatch Tool, markets expect the Fed to increase interest rates by 50 bps. The CPI report will be followed by the FOMC meeting to be held on December 13-14.

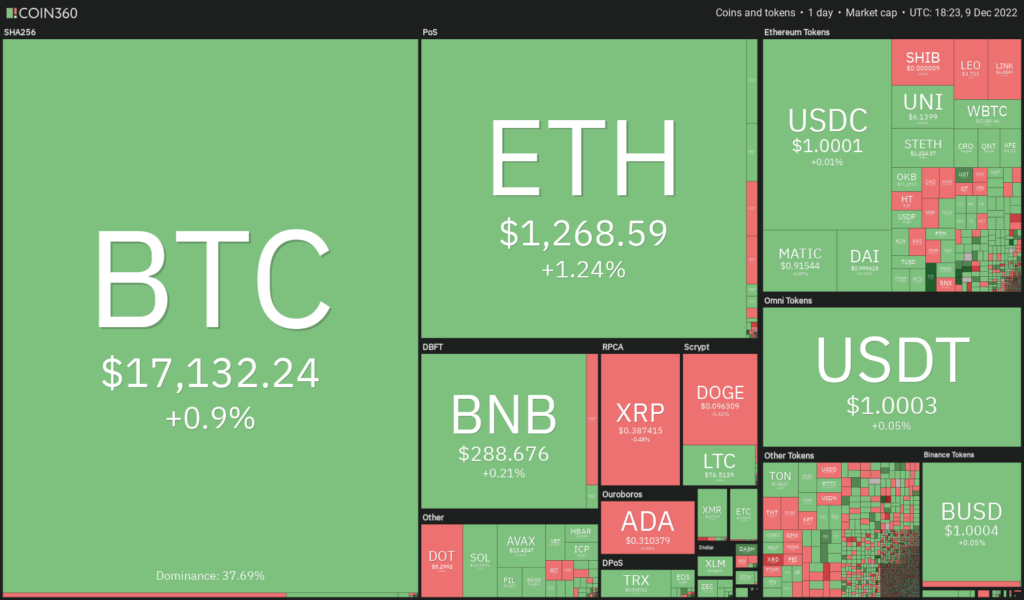

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360As you follow on Kriptokoin.com, 2022 has been a terrible year when some high-profile crypto companies went bankrupt. After these, the bulls will expect 2022 to end on a strong note. The bears will also try to protect their strongholds and prolong the fall next year. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

Bitcoin (BTC)

The bulls successfully held the $16,787 support on Dec. This points to strong demand at lower levels. Buyers pushed Bitcoin above the 20-day exponential moving average ($17,004) on Dec.

The flat 20-day EMA and the relative strength index (RSI) near the midpoint point to possible range-bound action in the near term. Usually, narrow range trades are followed by a range expansion that leads to a trend move. Sometimes, the first break tends to be a fake move. Therefore, traders can wait for a confirmation before jumping in to take the trade.

If the price climbs above the resistance zone between $17,622 and the 50-day simple moving average ($18,046), it is possible for BTC to signal a potential trend reversal. It is possible for Bitcoin to rally to $20,000 and then to $21,500 later. Conversely, if the price dips below $16,787, the bears will attempt to pull BTC to the main support at $15,476.

Ethereum (ETH)

ETH broke below the 20-day EMA ($1,254) on Dec. But the bears failed to sustain lower levels. The bulls bought the dip and pushed the price above the 20-day EMA on Dec.

Buyers will once again try to push the price above the overhead resistance at the 50-day SMA ($1.331). If they succeed, it is possible for ETH to rise towards the resistance line of the descending channel. On the contrary, if the price breaks from the 50-day SMA, it is likely to hold ETH within the range for a few days. The flat moving averages and the RSI just above the midpoint also point to a consolidation in the short term. If the price drops and dips below $1,212, the advantage is likely to turn in favor of the bears.

Binance Coin (BNB)

BNB closed below the $285 support on Dec. But the bears did not take advantage of this opportunity. The bulls bought the dip and pushed the price up to the 20-day EMA ($291).

The flattening moving averages and the RSI above 48 suggest a balance between supply and demand. It is possible that this will result in variable range-bound action in the near term. However, the boundaries of the range have not yet been defined. If the price drops from the moving averages, the bears will try to push BNB below $281. If this happens, the sell-off is likely to accelerate and BNB to drop to $275 and then strong support at $250. If the bulls want to gain the upper hand, they will have to push and sustain the price above $300.

Ripple (XRP)

XRP rallied from the strong support at $0.37 on Dec. This indicates that the bulls are buying the lows. This is the second time the bulls have defended this level. Therefore, $0.37 becomes an important level to watch out for.

The 20-day EMA is flat and the RSI is near the midpoint, implying that XRP will be stuck between $0.37 and $0.41 for a while. If the buyers push the price above the 20-day EMA, it is possible for XRP to rally to $0.41. This level is likely to act as a major hurdle for the bulls. However, if they manage to surpass it, XRP is likely to gain momentum and rally towards $0.51. If the price breaks from the 20-day EMA, the bears will try to push XRP back below $0.37. Also, the bears will strengthen their grip. If they do, it is possible for XRP to drop to $0.34.

Cardano (ADA)

ADA is consolidating in a downtrend. Also, the positive divergence in the RSI indicates that the selling pressure is decreasing.

Buyers have the opportunity to start a recovery by pushing the price above the 20-day EMA ($0.32). If they do, an attempt to rally towards ADA’s downtrend line is possible. The 50-day SMA ($0.35) is likely to face minor resistance. However, it is likely to exceed this level. If the bulls fail to quickly clear the 20-day EMA, the chances of a break below the critical support of $0.29 increase. This signals the resumption of the downtrend. Thus, it is possible for ADA to drop to $0.27.

DOGE, MATIC, DOT, LTC and UNI analysis

Dogecoin (DOGE)

The bulls bought the dip to the 50-day SMA ($0.09) on Dec. However, they are facing resistance at the psychological level of $0.10. This shows that the DOGE bears have not given up yet and continue to sell the rallies.

If the sellers pull and sustain the price below the 50-day SMA, DOGE risks falling to $0.08 and then vital support at $0.07. On the contrary, if buyers hold the price above the 50-day SMA, DOGE could consolidate between $0.09 and $0.11 for a few days. The flattening 20-day EMA ($0.10) and the RSI just above the midpoint point to range-bound action in the near term. A bullish momentum for DOGE is possible above $0.11.

Polygon (MATIC)

MATIC broke below the 20-day EMA ($0.90) on Dec. However, the long tail on the day’s candle indicates that lower levels are attracting buyers.

The bulls will attempt to maintain the buying pressure and push the price above the overhead resistance of $0.97. It is possible that this could open the way to $1.05 for a possible rally where the bears will again form a strong defense. Alternatively, if the price breaks from the current level or overhead resistance, it indicates that the bears are active at higher levels. The next break below the 20-day EMA could push the price towards the uptrend line.

Polkadot (DOT)

DOT took support at $5.24 on Dec. This suggests that the bulls are attempting to form a higher low in the near term. However, the bears continue to vigorously defend the 20-day EMA ($5.48).

If the bears pull the price below the uptrend line, a retest of the November 22 low of $5 is possible. This is an important level for the bulls to defend. Because if they fail, DOT is likely to resume its downtrend. DOT is likely to drop to the next support at $4.32 later. The first resistance to watch on the upside is the 20-day EMA. A close above this level indicates that the bearish momentum is weakening. It is possible for the DOT to rally to the 50-day SMA ($5.86) and then to $6.18 later.

Litecoin (LTC)

LTC bounced off the 20-day EMA ($74) on Dec. This shows that the weather continues to be positive. It’s also a sign that traders see dips as buying opportunities.

However, the negative divergence in the RSI indicates that the bullish momentum will weaken. The key support to watch on the downside is the 20-day EMA followed by $70. If this zone is disturbed, it is possible that it will lead to a long purge. Thus, it is possible for LTC to slide to the 50-day SMA ($65). If the price stays above the 20-day EMA, LTC is likely to consolidate between $75 and $85 for a while. Also, a break above $85 opens the way for a possible rally to $104.

Uniswap (UNI)

UNI stays within a symmetrical triangle pattern, indicating indecision between bulls and bears. Buyers bought a dip to the 20-day EMA ($5.97) on Dec. However, they struggle to maintain higher levels.

Price action within a triangle is usually random and volatile. If the 20-day EMA support is broken, UNI is likely to gradually drop to the support line of the triangle. It is possible that this level will attract buyers who will try to protect the support line. If they push the price above $6.55, the short-term advantage is likely to shift in favor of the bulls. UNI is likely to rise to the resistance line of the triangle later on. Buyers will have to break through this hurdle to signal the start of a new uptrend.