Crypto analyst Ibrahim Ajibade says the Render Token is set for further declines. According to analyst Valdrin Tahiri, Solana is in the process of falling below the rising support line that has been in place for 115 days. Another analyst, Gamza Khanzadaev, states that Dogecoin (DOGE) is at risk. Analyst Eli Dambel is assessing whether MATIC will bounce back from critical support.

Render Token set for further price drops?

The altcoin price dropped below $1.63 on April 22. It has increased 12% since then. But despite the recovery, on-chain data is showing a lot of red signals that things are entering an imminent downtrend. The render has struggled to attract the attention of major investors despite the recent price jump from April 22-25. With the daily pull also falling, is the RNDR on the verge of a major price pullback?

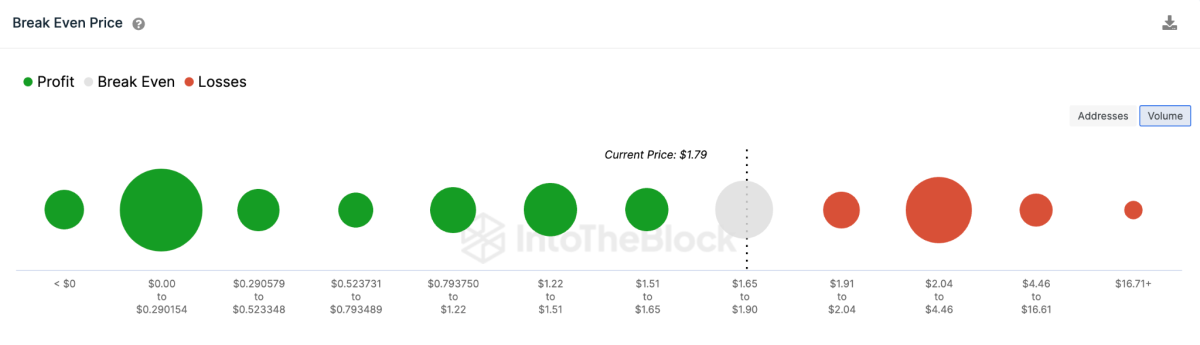

Render bears will likely force a shrink of up to $1.58, according to data from IntoTheBlock’s Break-even Price breakdown. Currently, 1,860 addresses that have purchased 65 million RNDRs are expected to offer some support in the $1.65 breakeven region. If this support folds as expected, the Render price will likely fall to $1.58. However, at this support level, it is possible that bullish pressure from the 1,300 breakeven addresses holding 25 million RNDR will prevent further declines.

RNDR Break-Even price distribution data. April 2023 / Source: IntoTheBlock

RNDR Break-Even price distribution data. April 2023 / Source: IntoTheBlockStill, if the RNDR rises above $1.90, it’s possible for the bulls to debunk this pessimistic narrative. However, as mentioned above, 1,860 addresses holding 65 million coins in this price range are likely to offer some resistance. However, if this resistance level fails to hold, the bulls can expect a rise towards $2.

If Solana price loses this level, a drop is possible.

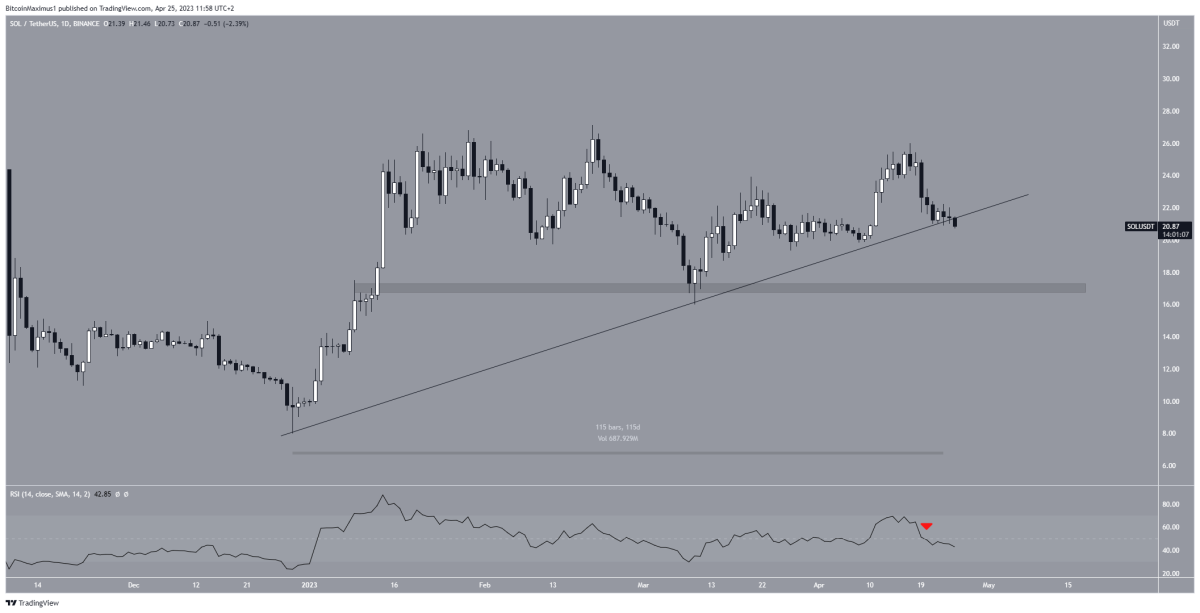

As you follow on Kriptokoin.com, the SOL has increased along an ascending support line since the beginning of the year. While this line hit a year high at $27.12 on February 20, the price is currently in the process of breaking the line down. As the line has been in place for 115 days, a break of the line will mean that the previous upside move has been completed and a correction has begun.

LEFT daily chart / Source: TradingView

LEFT daily chart / Source: TradingViewLEFT, the RSI dips below 50 (red icon), indicating a bearish bias. This supports the continuation of the decline. If the downside continues, the nearest support will be at the average $17.

Has the fix for Solana just begun?

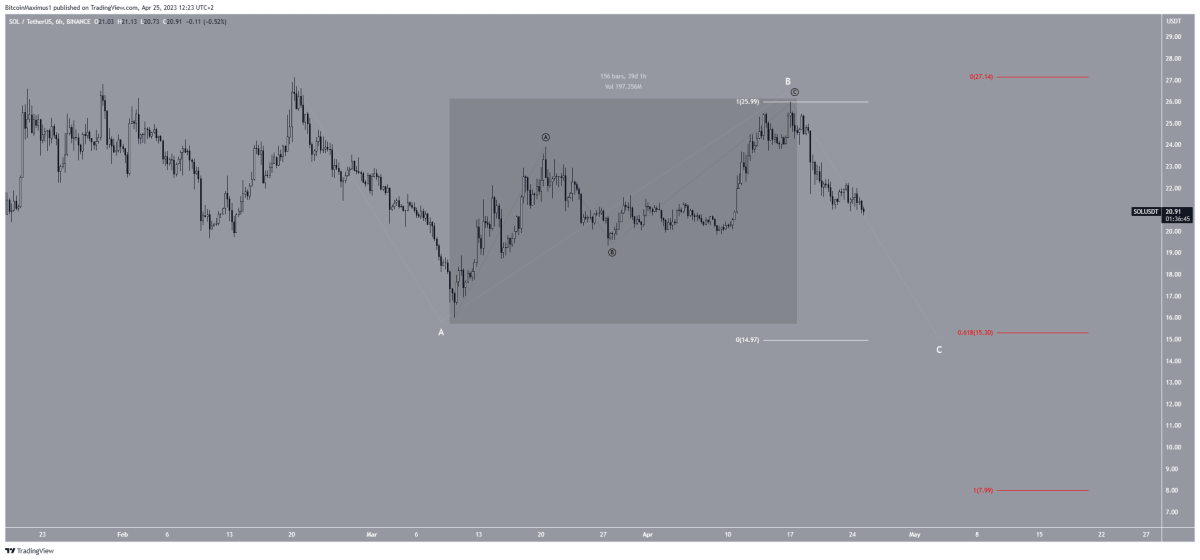

Technical analysis on the short-term six-hour time frame supports the continuation of the downward move. It also gives a bearish Solana price prediction. Wave counting is the main reason why this is the case. The move (highlighted) in March and April looks like the ABC corrective structure (black). Since the move is upwards, Elliott Wave theory states that the dominant trend is probably downwards.

So the drop since the year’s high could be another major ABC (white) corrective structure. Giving the A:C waves a 1:1 ratio would result in a $15 drop. While this is below the previously mentioned horizontal support area, it coincides with the 0.618 Fib retracement support level (red). Fibonacci retracement levels work on the principle that after a significant price change in one direction, the price will retrace or revisit a previous price level before continuing in its original direction. Hence, the region is likely to move as a bottom.

LEFT six hour chart / Source: TradingView

LEFT six hour chart / Source: TradingViewDespite this bearish prediction, SOL breaking above $26 will mean the trend is still up. In this case, it is possible for Solana price to continue increasing towards at least $32.

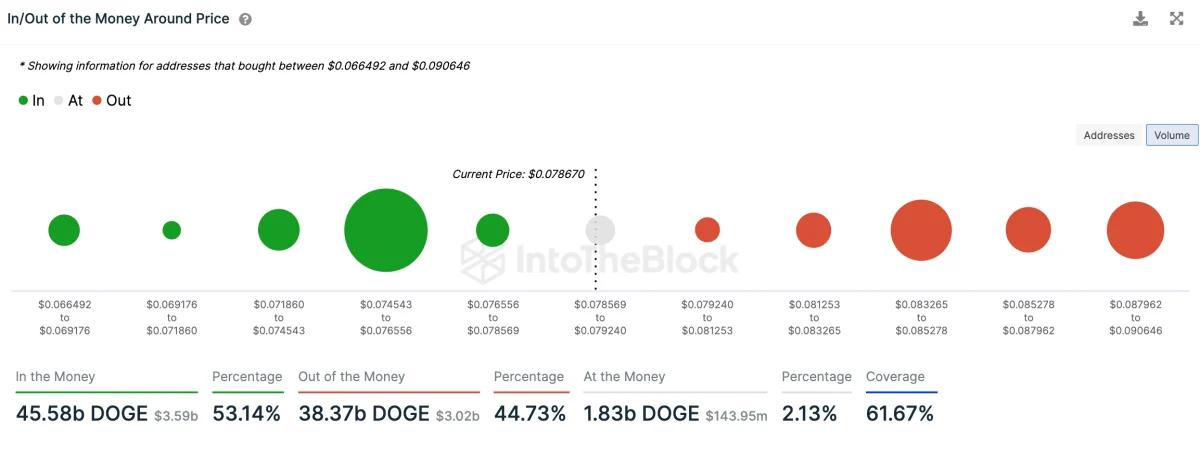

If the price drops to this level, 37 billion DOGE is at risk!

More than 101,270 Dogecoin addresses are at risk of losing their positions if DOGE price drops to $0.745 per token. Data from the crypto intelligence portal IntoTheBlock reflects this. According to the data, more than 37.2 billion DOGEs were purchased between $0.745 and $0.786. This was the largest of the clusters near the current DOGE price of $0.79. Moreover, according to the data, this number accounts for almost half of all DOGE purchases currently in profit. In other words, it represents 74.38 billion DOGE.

Source: IntoTheBlock

Source: IntoTheBlockNearly 40 billion Dogecoins were flooded amid the decline that started at $0.941 per DOGE last Wednesday. This volume spanned over 594,000 addresses. DOGE has since lost nearly 13% in this bearish wave. The explosion of Elon Musk’s Starship superheavy rocket from SpaceX added special drama to the token’s price action.

However, at the moment DOGE is still more of a profit-making crypto than a loss-making crypto. Therefore, the share of addresses in profit in DOGE is 53.72%. This means 2.41 million addresses of the total number. As noted above, this ratio is clearly fragile given that more than half of cryptocurrencies currently in profit could turn red.

Will MATIC pivot from critical support level?

Polygon is in a downtrend forming a third consecutive red candle with lower lows on the daily chart. It fell below its 50-day and 200-day Simple Moving Averages (SMA), which are bearish in the short and long term. MATIC entered a downtrend on April 19, forming a long red candle that closes below the 50-day SMA.

Also, the Relative Strength Index (RSI) is 31.91. Moreover, it is descending into the 30 oversold zone. This means that the price of the asset is under the control of the bears. However, MATIC is approaching the $0.9321 support level, which previously acted as a pivot point on January 1, 2023. When MATIC’s RSI touches this level, it will move into the oversold territory and force the bulls to rebound. A price increase is possible once the altcoin enters the overbought zone. The next level of support is $0.7472. The resistance levels are at $1,026 and $1,1914. Also, the $1 price level has become a psychological resistance point.

MATIC is losing ground on chart / Source: Tradingview

MATIC is losing ground on chart / Source: TradingviewMATIC has formed an ascending triangle on the monthly chart. The next breakout from this pattern will be vital for price action. It traded upwards in February and March 2023 before retracing in April. If the bulls rebound, a return to the upside of the triangle is possible. Also, the Monthly RSI is 53.60 in the neutral zone. However, it is moving downwards, reflecting the bearish trend in April.