Amid the current decline in the market, Ethereum whales are accumulating in two altcoin projects. This interest in whales comes after a series of fundamental developments.

Altcoin whales, Ethereum hoarding continues

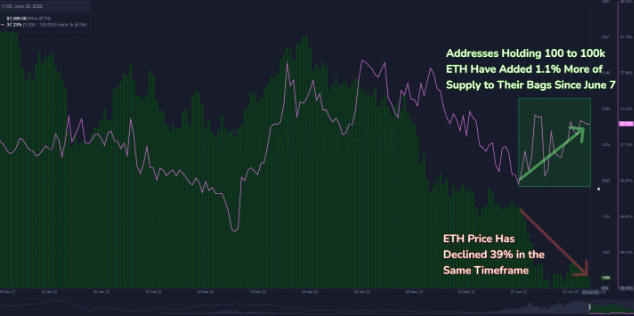

Ethereum whales, which are addresses with 100-100 thousand coins, continue to accumulate ETH. These addresses have collectively added about 1.1% of the Ethereum supply to their bags after the recent price drop of ETH. Looking at the historical data, it seems that this happens when ETH investors expect an increase in ETH. The accumulation of whales came amid dYdX’s decision to leave the Ethereum network.

In related news, crypto derivatives exchange dYdX announced that it will be leaving the Ethereum ecosystem. DYdX is preparing to launch its own Blockchain network in the Cosmos ecosystem. The new Blockchain plans to replace dYdX’s existing platform built on StarkWare, an Ethereum scaling solution platform using ZK-rollup technology that allows for cheap and fast transactions. As Kriptokoin.com, we have discussed the details in this article.

On-chain data reveals growing whale appetite for Polygon MATIC

Polygon MATIC outperformed most altcoins during the recent market sell-off. It managed to reach $0.50 by 60% from the low of $0.32 on June 18. Prior to this latest price rally, there was a huge surge in whales’ wallets, significant currency outflows, followed by high activity among MATIC holders.

The balance indicator by altcoins classifies and divides addresses according to the cryptocurrency it holds. It is used to analyze the historical change in circulating supply. In this case, we can follow the evolution of MATIC over time from 100 million to 1 billion.

As can be seen from the indicators, an accumulation phase started after a sharp drop in equilibrium. This is seen in the red box above. Wallets currently holding between 100 million and 1 billion tokens make up 30% of the total MATIC supply. This ratio equates to 2.96 billion MATIC, currently worth $2.48 billion.

MATIC accumulation of whales according to historical data

The same previous stage of accumulation had occurred in late November before a 30% increase in price. In the following weeks, the whales began to sell their MATIC savings consistently at the ATH level. This last 9% accumulation rally is the largest since the one seen in November last year. A similar behavior can be noticed right now, with big rallies being followed by small time selling.

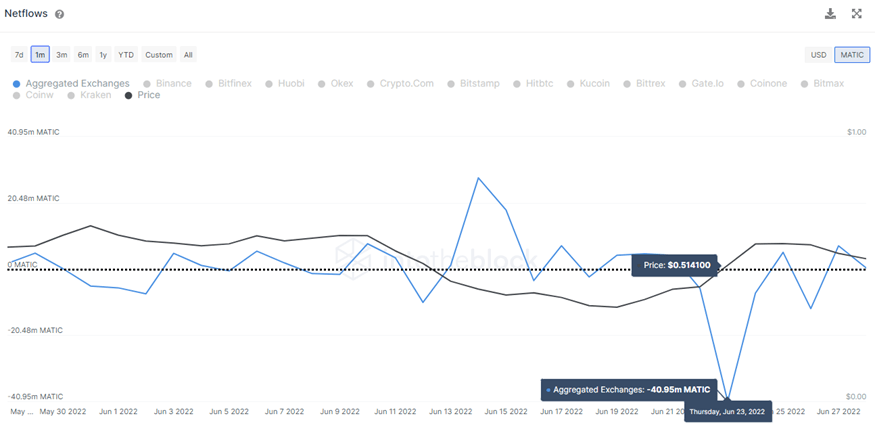

At the same time, we see that MATIC is leaving the exchanges. This model is compatible with the MATIC accumulation of whales. For this metric, IntoTheBlock collects the addresses of the largest centralized exchanges. In this way, it measures the net volume flowing into the exchanges by subtracting the inflow volume from the outflow volume.

The Net Flow indicator highlights the trends of traders going in and out of exchanges. Therefore, Net Flows are negative when withdrawing a larger volume from exchanges. This can be seen as a sign of accumulation. What’s more, it could be geared towards buybacks after major declines.

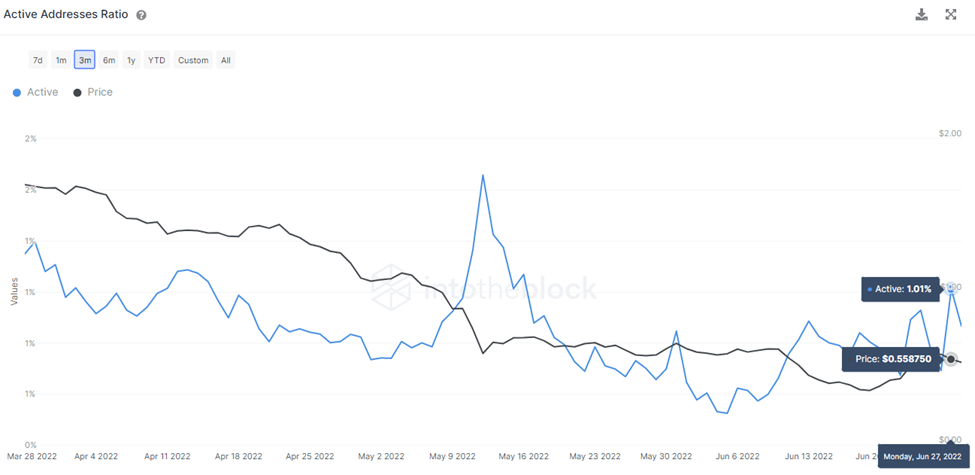

The following indicator shows the daily percentage of addresses with balance sending transactions. As shown above, the percentage of addresses reaching 1.01% recently marks the second highest point in a 3-month period. The highest point is due to the collapse of the Terra ecosystem on May 13. This indicator helps to further show the user’s interest rate fluctuation during a change in market conditions.

What does this data mean for altcoin

Overall, signs of progress and demand in Polygon continue to grow despite short-term volatility and market conditions. Some argue that this request may be linked to Meta launching upcoming NFTs on Instagram on top of the Polygon network.