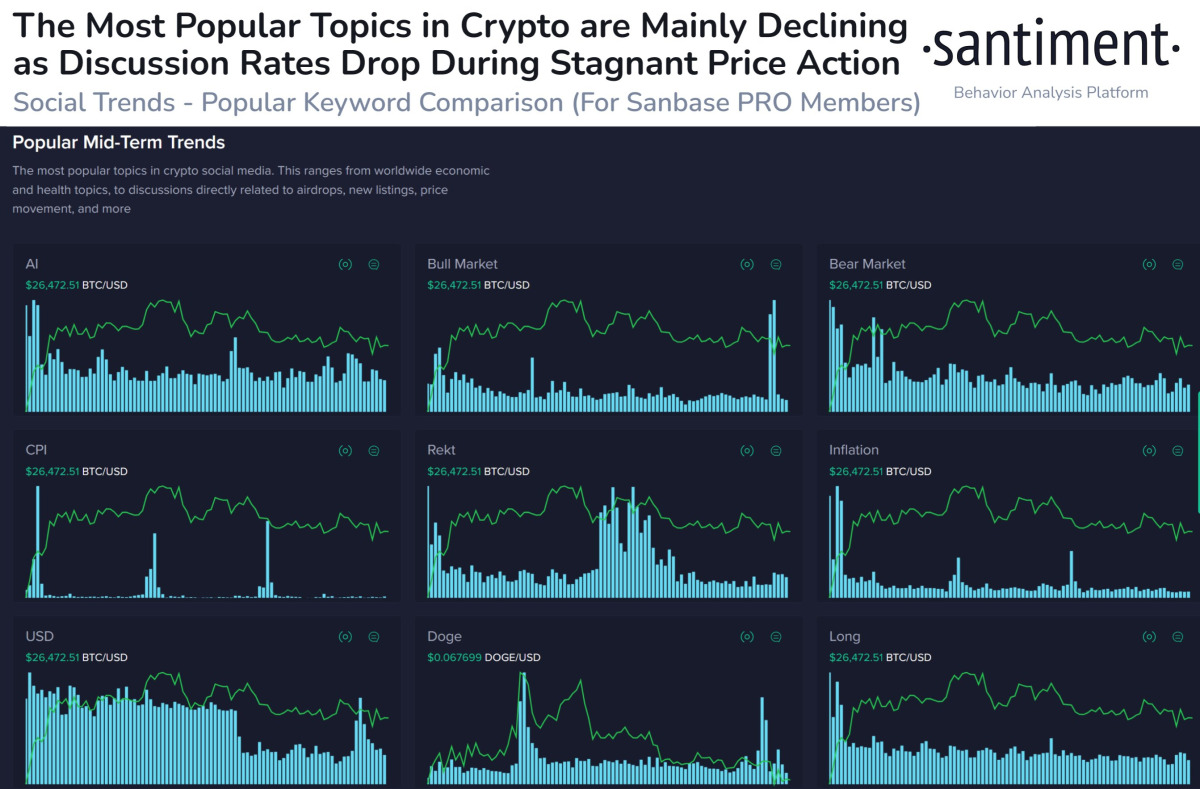

Analytical firm Santiment interpreted the social volume metrics it shared the day before the drop as a ‘bullish signal’. Firm analysts see the rapidly declining interest of crypto investors as the beginning of the accumulation phase.

Social volume metrics signal green for crypto amid market downturn

Santiment reported yesterday that discussions using certain crypto terms on social media platforms are cooling rapidly. She interpreted this trend as an indication that the market may be close to reaching the bottom.

“Crypto discussion rates on Twitter, Telegram, Discord, Reddit and 4Chan are falling as investors show signs of apathy. Look at these dips as a sign that markets are approaching the traditionally bullish accumulation phase,” he wrote.

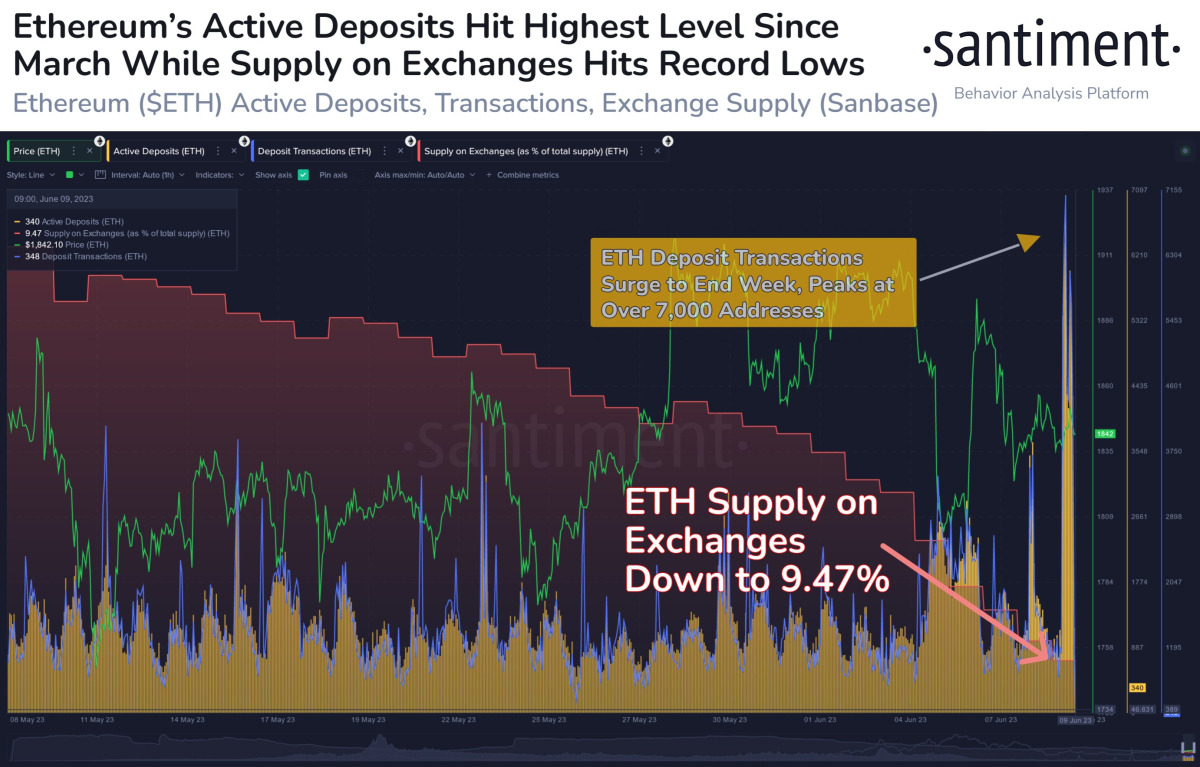

‘Hard times await Ethereum investors’

Santiment then shared that the supply of Ethereum (ETH) on crypto exchanges is approaching record lows. He suggested that this limits the potential for future sales for the leading altcoin. However, he warns that the next few days could be tough for Ethereum as ETH’s deposit transactions skyrocket to close the week.

Ethereum’s supply on exchanges continues to drop to record lows, currently only 9.47%, meaning a lower risk of selling in the future. However, active deposit addresses have hit their highest level since March, meaning this weekend could be volatile.

ETH price is currently down over 5% from the last 24 hours. At the time of writing, it is holding in the $1,730 region.

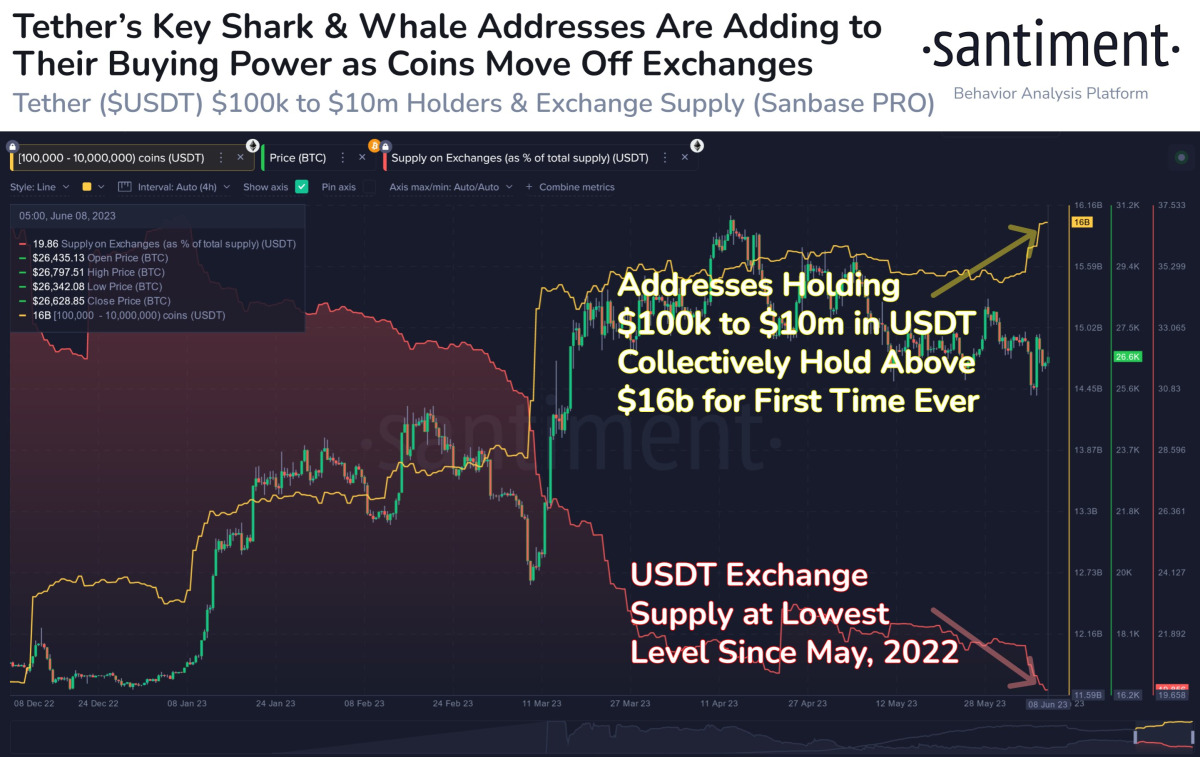

How have crypto whales reacted to the recent drop?

Santiment then studied the activity of Tether (USDT) whales. According to their analysis, USDT whales and sharks have accumulated the largest amount of Tether in history and removed most of the stablecoin from exchanges.

There is an interesting correlation between Tether’s key shark and whale addresses and the amount of cryptocurrency on exchanges. Wallets with $100,000 to $10 million in USDT currently exceed $16 billion, and most of these cryptocurrencies are moving away from exchanges and into cold wallets.

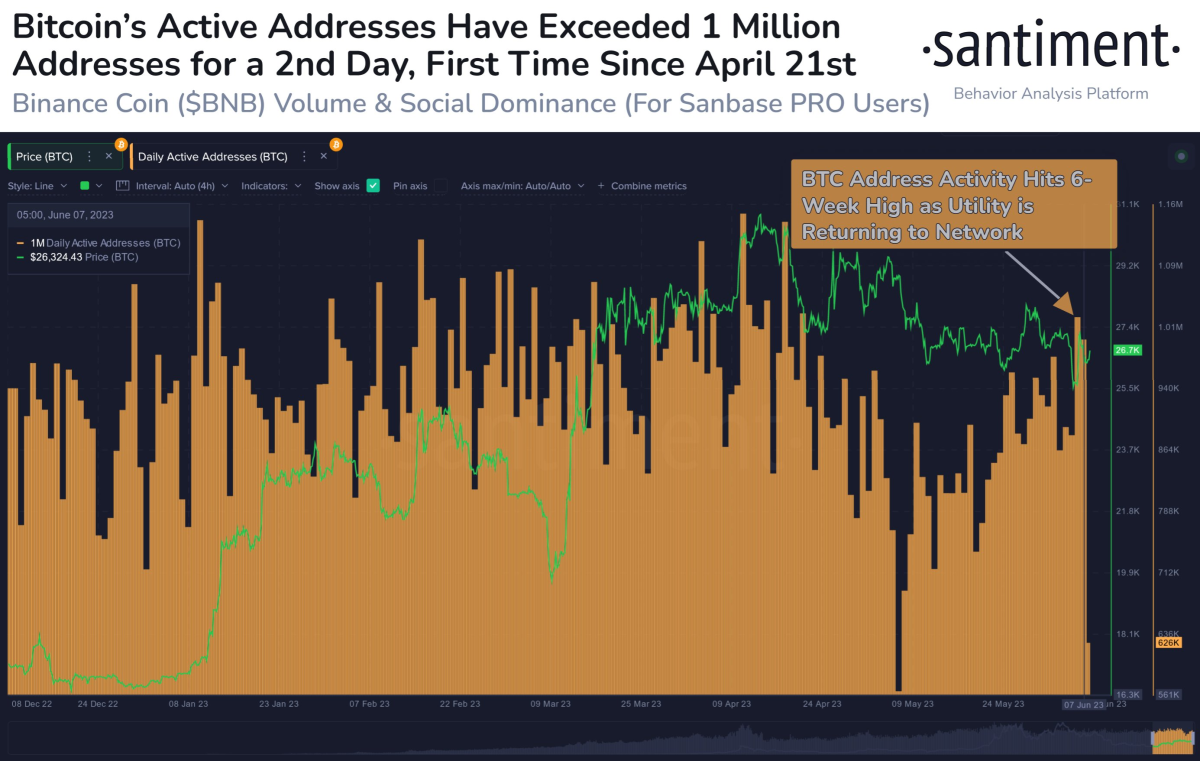

The number of active addresses of the Bitcoin network is increasing

Santiment said that the Bitcoin (BTC) network has seen more active addresses throughout the week. Active addresses show the number of different addresses participating in the BTC transfer on any given day. According to Santiment, increasing active addresses could be seen as a bullish signal, especially when coupled with declining currency deposits as it demonstrates increased cryptocurrency utility without the potential risk of selling. According to the analysis:

With the increase in volatility across the market, the level of usage of Bitcoin has increased quite drastically. The number of unique addresses interacting on the BTC network exceeded one million in each of the last two days for the first time since April 21.

The 52-week moving average is critical, according to Mike McGlone

Finally, Bloomberg senior commodity strategist Mike McGlone stated that Bitcoin may enter a downtrend as it struggles to stay above its 52-week moving average. According to the technical analyst, BTC still faces a bearish risk as the Fed signals to tighten its monetary policy.

Divergent Weakness and #Ethereum's $2,000 Ceiling –

The inability of Ethereum to stay above $2,000 despite a 52-week high in the #Nasdaq 100 Stock Index in 2Q may portend a resistance ceiling for the crypto. The token may depend on the stock index to lift all boats. pic.twitter.com/Q5dBSo4fTo— Mike McGlone (@mikemcglone11) June 8, 2023

McGlone says that Bitcoin’s bearish trend contrasts with the resistance of the stock market. Therefore, he predicts that Bitcoin could return to its 52-week moving average. The senior analyst stated that this reflects the historical pattern of rises and falls in the crypto market. As quoted by Kriptokoin.com, JPMorgan analysts expect Bitcoin to follow the momentum of the gold market in the long run.